U.S. March Empire State survey weak, Import and Export Prices picking up in early 2024

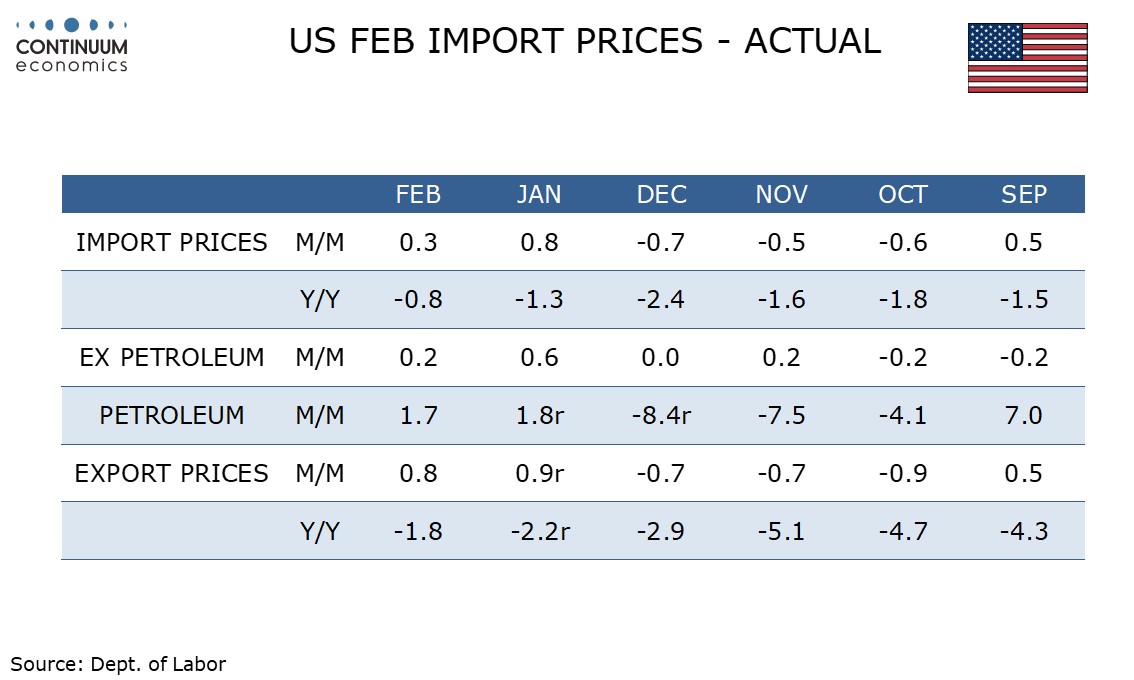

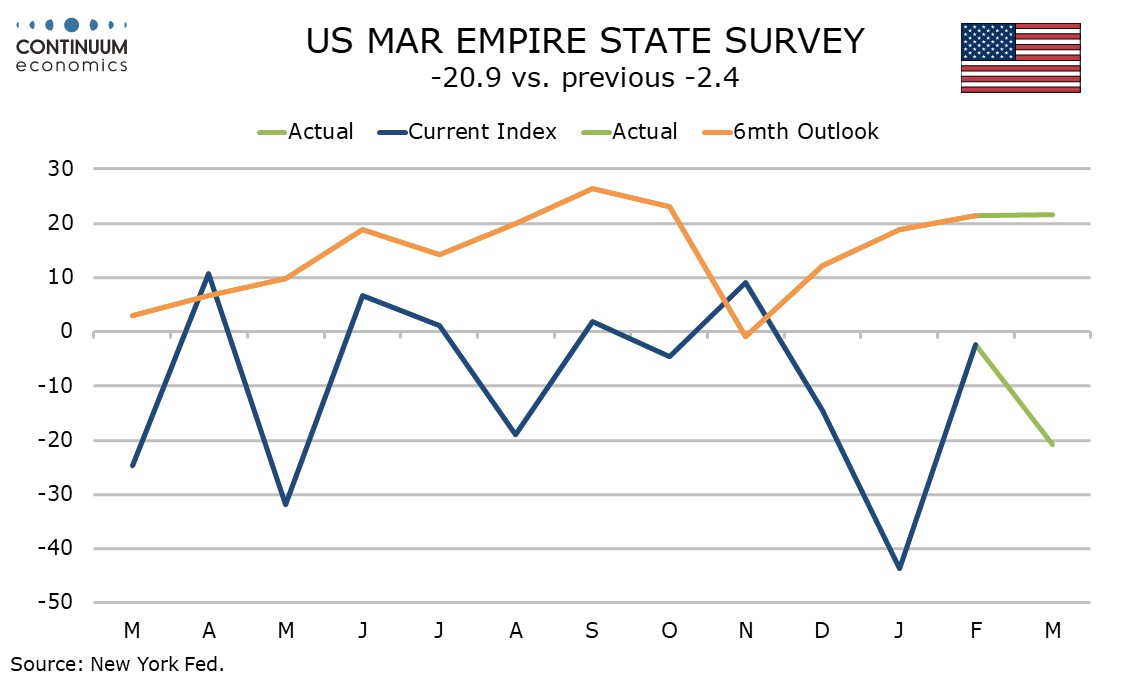

March’s Empire Sate manufacturing index of -20.9 is very weak and down from -2.4 in February. This index is however more volatile than most manufacturing surveys and does not tell us much about what other surveys will show. Separately February import prices have shown a second straight rise, of 0.3%, and like CPI and PPI have started 2024 stronger than they finished 2023.

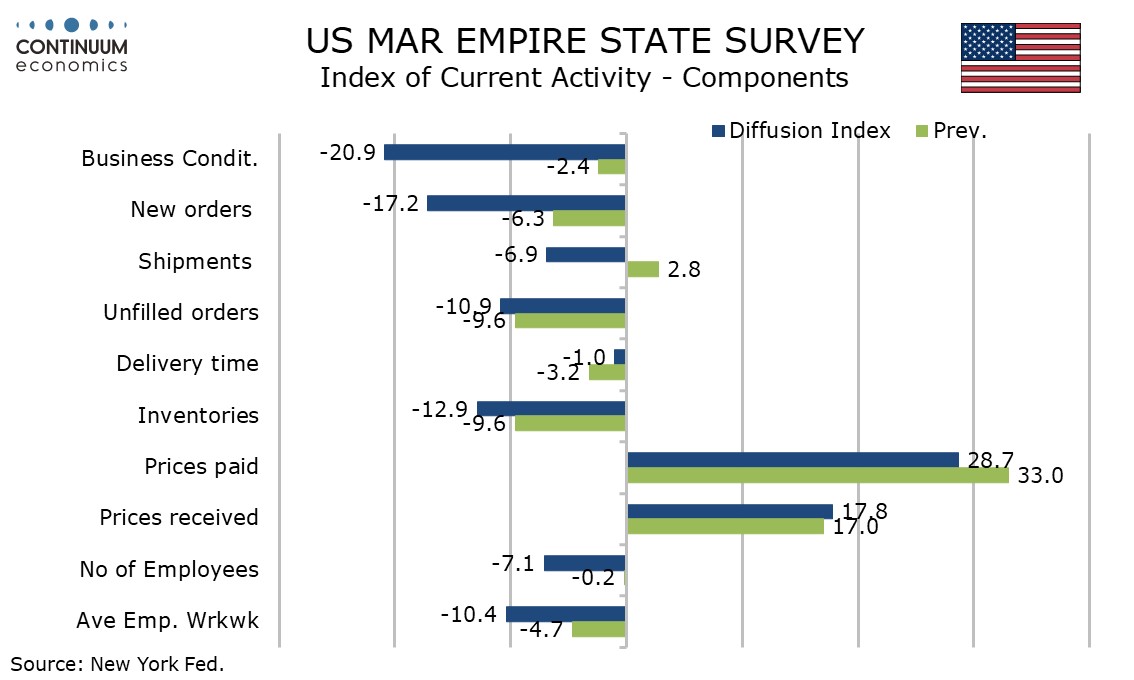

The Empire State details are weak across the board in the current month detail apart from the price indices which have not changed much. 6 month expectations however remain positive, at 21.6 from 21.5, with the components showing a similar message. 6 month price details are also slightly firmer.

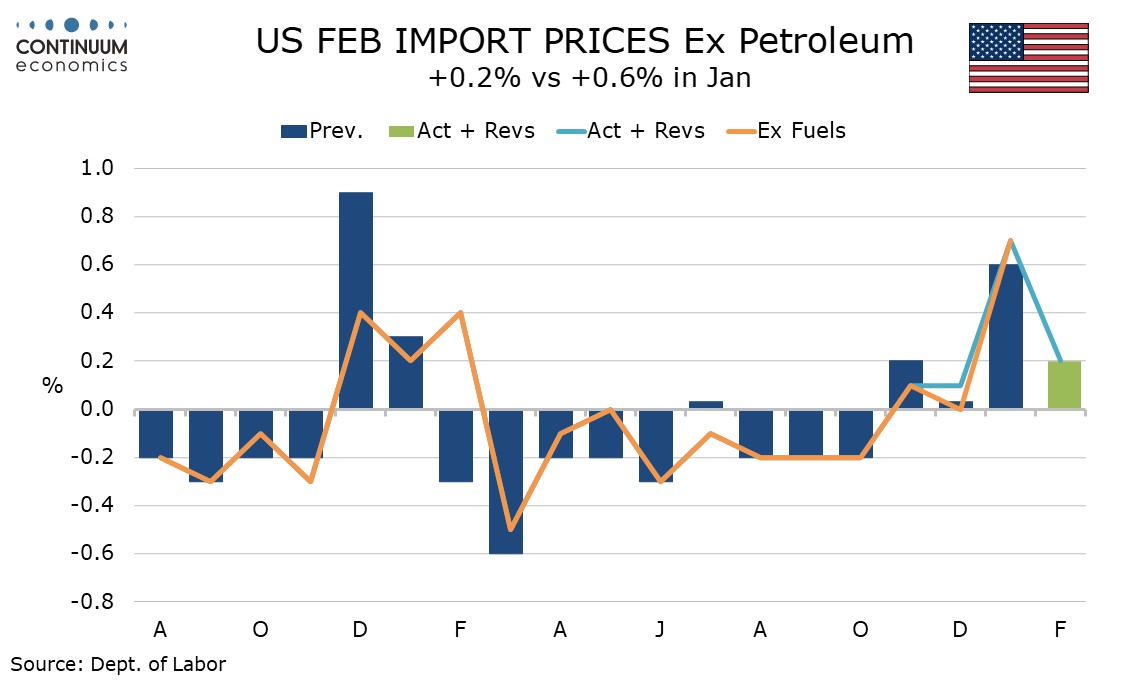

Import prices fell in each month of Q4 but ruse by 0.8% in January and 0.3% in February. Ex petroleum import prices trended lower through most of 2023 before rising by 0.2% in November. After a flat December a 0.6% rise in January was followed by a 0.2% gain in February.