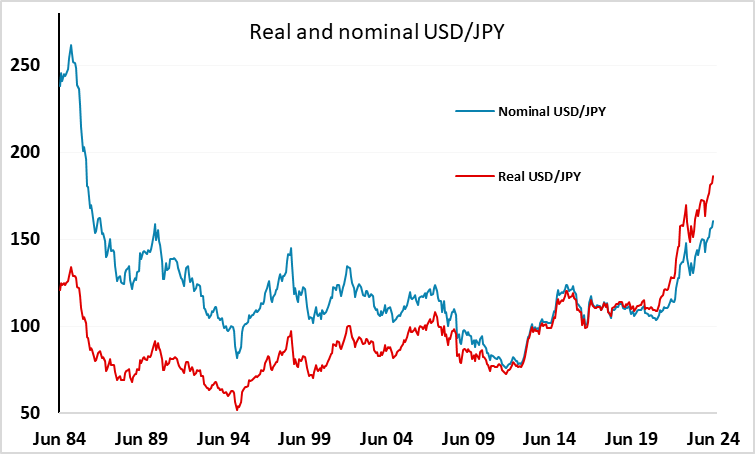

JPY flows: USD/JPY to new 38 year highs, all time highs in real terms

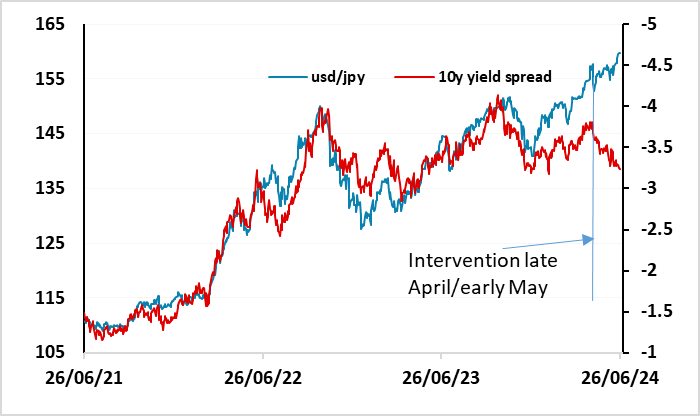

USD/JPY continues to move sharply higher, without any obvious news. Stops have no doubt been taken out at the previous highs, and we are now at the highest level since December 1986. Of course, in real terms this massively understates the weakness of the JPY, as relatively low Japanese inflation means that we are already at all time real terms USD/JPY highs (see chart). The BoJ cannot allow this to continue unchecked, so the question is when rather than if they will intervene, and what the impact is likely to be. After the last intervention, USD/JPY fell sharply but has recovered to new highs even though the rise in yield spreads that drove the JPY weakness in recent years has been partially reversed in the last month. This may mean that JPY bears are unafraid of BoJ action. But when the market is this one way, with the JPY falling even when there are yield moves in the JPY’s favour, the BoJ is likely to want to make the next intervention stick. They might well be happy to just stabilise the market below 160, but we can’t envisage them allowing levels above 160 to persist.

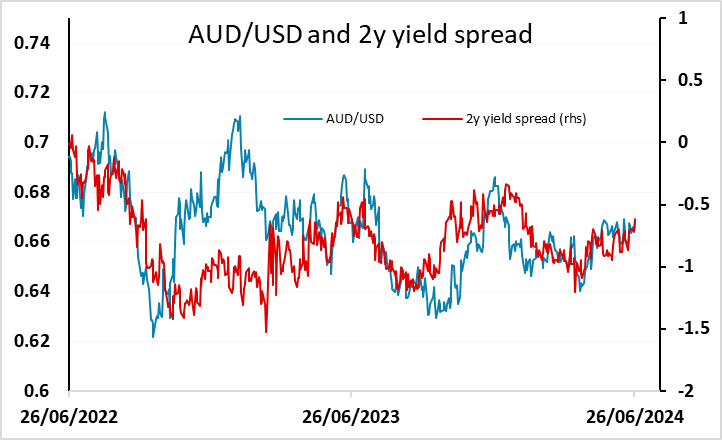

A quiet start to what looks like a quiet day, with very little on the calendar to trigger FX movement. The AUD has been the best performer overnight after CPI came in stronger than expected in May, pushing up towards the top of the range at 0.67. The market has now shifted away from seeing some risk of the RBA easing this year to seeing some risk of tightening, and the rise in AUD yields supports a test of the highs. However, more general USD weakness may be required for a proper break, and this looks unlikely to be seen in a day with little on the calendar.

Otherwise, JPY weakness continues to be the main theme, with JPY bears perhaps encouraged by the lack of new verbal intervention from the BoJ. But current levels are clearly dangerous. USD/JPY is above the level seen when the BoJ intervened in NZ hours in early May, and since then yield spreads have moved substantially in the JPY’s favour. The BoJ aren’t going to allow a sustained move above 160, but would prefer and organic decline in USD/JPY. The conditions are in place for this, but a BoJ shove may be needed to break technical levels and trigger unwinding of momentum trades.

usd/j