This week's five highlights

FOMC Dots and economic forecasts marginally more hawkish

BoJ Bring Interest Rate To Zero

SNB Surprise with 25bps Rate Cut

BoE's Easing Bias Continues

RBA Holds as Expected

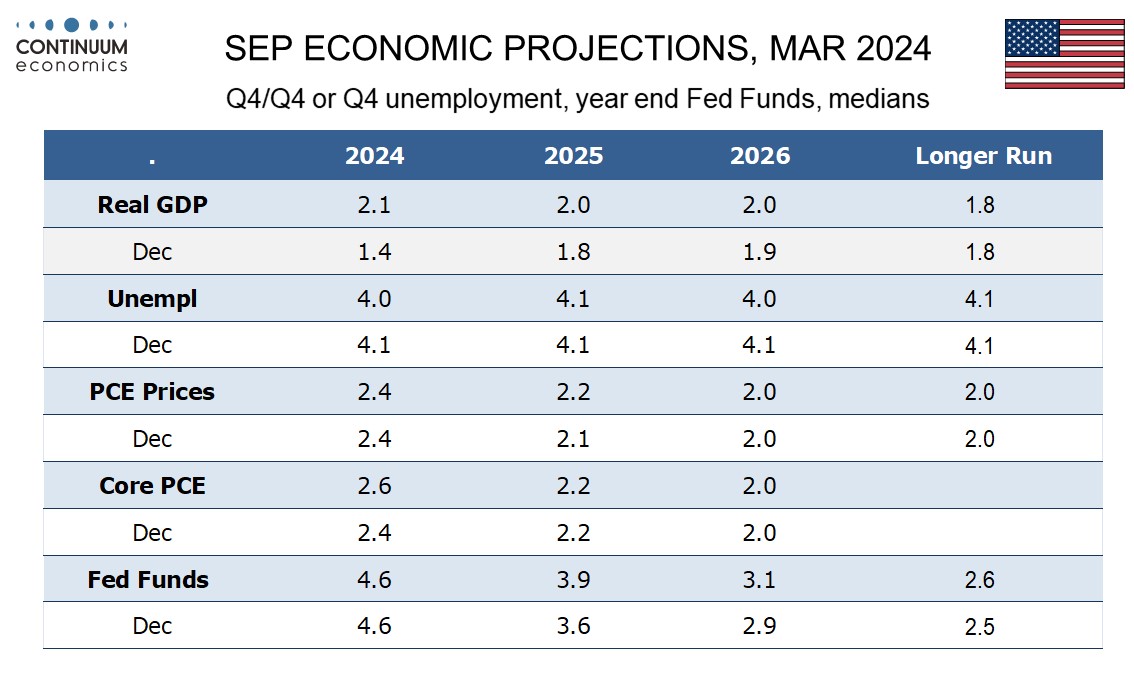

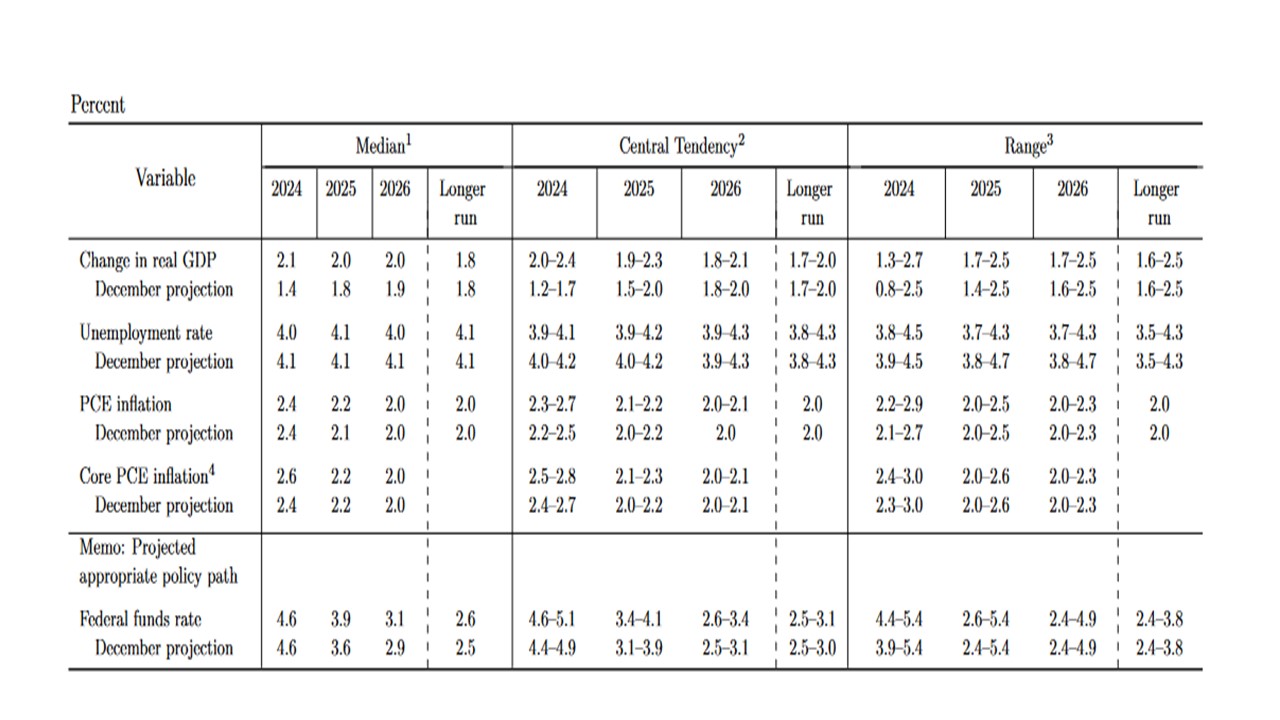

The FOMC has left rates unchanged as expected and continues to state it needs greater confidence that inflation is moving to 2.0% before easing. The dots are slightly more hawkish despite 2024 still seen having 75bps of easing, with 2025 now seen having only 75bps rather than 100bps. Economic forecasts have been fine-tuned higher too. The upward revisions to GDP are quite significant, 2024 to 2.1% Q4/Q4 from 1.4%, with both 2025 and 2026 also seen at 2.0% despite long-run potential still being seen at 1.8%. Unemployment for Q4 of 2024 and 2026 has been revised down 4.0% from 4.1% though 2025 remains at the long-run rate of 4.1%. The Q4 2024 core PCE price index is seen at 2.6% rather than 2.4% presumably in response to strong January and (for CPI) February data, but he path forward seems similar, 2025 still seen at 2.2% and 2026 on target at 2.0%.

The March FOMC leaves the impression that the Fed still feels that they will reduce the scale of restrictive monetary policy and the upward revision to 2024 GDP and core PCE medians are not significant. On balance, July is the most likely meeting, followed by two further cuts in Q4. We see a further 100bps of cuts in 2025, as our 2024 and 2025 GDP forecasts are below the Fed. Though the 2025 median dots is now for 75bps of cuts, FOMC members are skewed to the downside and the uncertainty impacts the 2025 and 2026 views more. Finally, Powell guidance that QT will slow fairly soon suggest a decision at the May or June meeting.

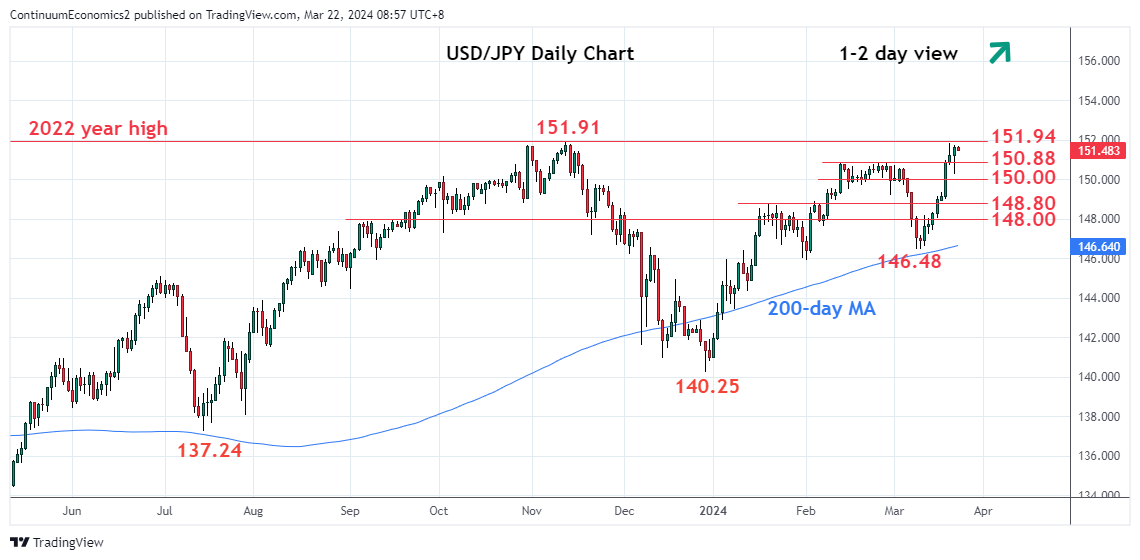

In the March 18-19 meeting, the BoJ has moved short term interest rate to the 0-0.1% range from -0.1-0% and removed Yield Curve Control. They acknowledged the 2% inflation target can be sustainably reached with current inflation and wage dynamics. ETFs and REITs purchases will be discontinued where corporate bonds' purchase will be phased out in a year. While yield curve control is officially removed, BoJ announced they will be purchasing roughly the same amount of JGB and will intervene if yield spike.

The move aligns with BoJ's take towards trend inflation and wage. The BoJ has been waiting for results of wage negotiation before policy changes as inflation is expected to remain above 2% in fiscal 2024, with CPI ex fresh food and energy expected to be stubbornly at 1.9% in fiscal 2025, as per BoJ' January outlook forecast. The first round of wage negotiation showed a bigger increase than 2023 with most securing around 5% total pay increase. The overall pay growth will likely surface in early April after the other two rounds of negotiation for small to medium enterprises. From BoJ's eyes, the stronger than expected wage growth will filter into Japan's inflation sustainably. The change in wage and price setting behavior will fuel trend inflation in a medium run. With all three items of CPI above target, BoJ deem it would be a window to exit negative rates before major central banks are expected to ease later in the year.

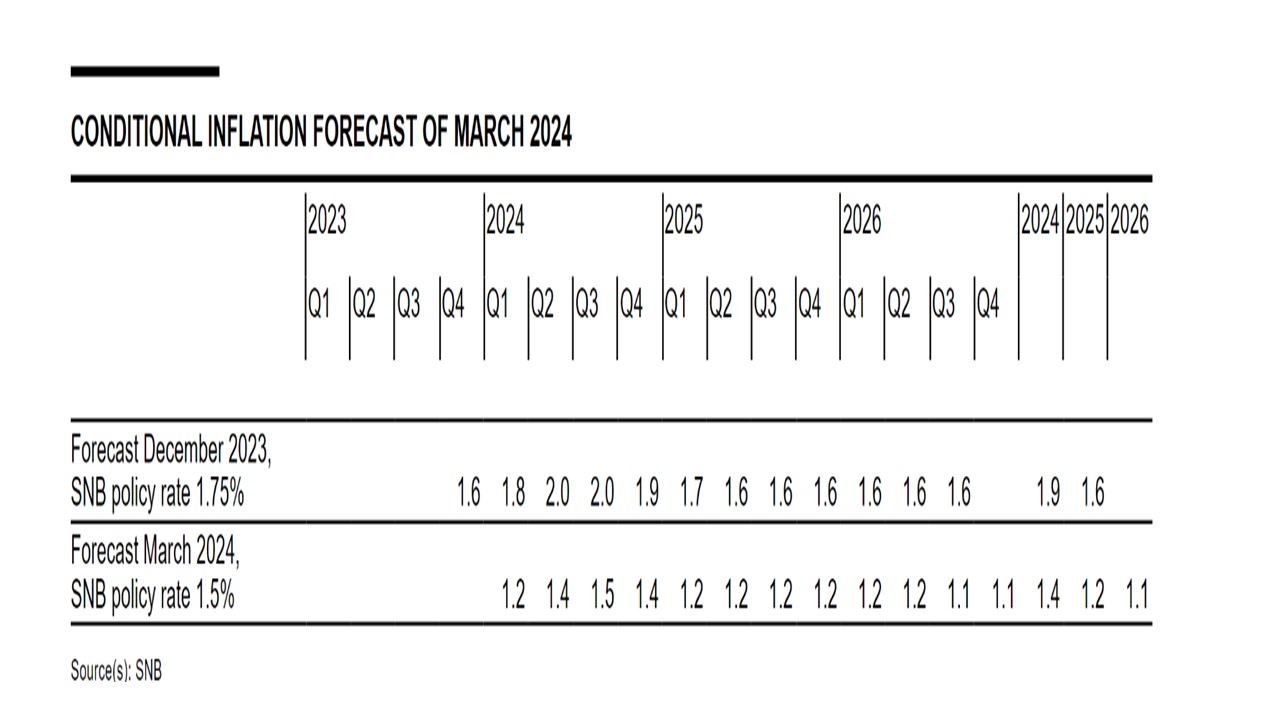

The SNB became the first DM central bank to cut rates with a 25bps reduction to 1.50%, which reflects an even larger forecast inflation undershoot and to counterbalance the strong Swiss Franc (CHF). The inflation forecasts for 2024 and 2025 were significantly lowered even with the new 1.50% policy rate, which suggests that a further cut is highly likely in both June and September. A December cut is possible, but will depend on the September inflation forecast and how the CHF is performing.

The March SNB statement and inflation forecasts provides some interesting insights

· The inflation forecast (Figure 1) has been reduced in 2024 due to incoming lower than expected CPI, while the SNB also noted that mortgage lending has been soft. They expect the Swiss economy to grow by 1% this year (which we largely echo) and the statement also noted downside risks from the global economy turning out to be softer than expected. For 2025 and 2026, the inflation projection was also lowered, as the SNB now expects less 2 round effects from the previous pick-up in inflation.

· This significant reduction in the inflation forecast is based on the new 1.50% policy rate, which helps to back the earlier than expected cut from the SNB. Additionally, the SNB statement made clear that the easing was also partially to counterbalance the tightening of financial conditions from the real appreciation of the CHF. The SNB also appears to remain keen to intervene and sell CHF to restrain the CHF, but want the FX market to understand that it can move quicker than other central banks on interest rate reductions as well.

· A further 25bps cut in June and September is now our forecast, as the new inflation forecast is too low for SNB comfort. Additionally, the SNB statement noted that other central banks are still likely to reduce the degree of restriction and this likely means an expectation that the ECB will start easing in June. SNB needs to cut to keep pace with the ECB and avoid CHF upward pressure. A cut in December is also possible, but would depend on the September inflation forecast and the performance of the CHF.

· It is noteworthy that the SNB has not only become the first DM central bank to cut conventionally but having dropped formally in December plans of further FX sales, it is now seemingly doing the opposite to a degree that is seeing its balance sheet re-expand as it intervenes to curb CHF strength.

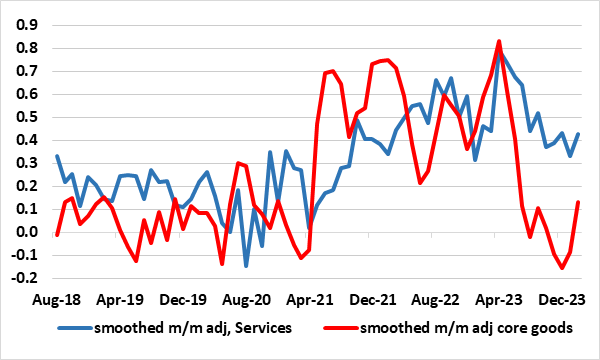

Figure: Services Inflation Down But Not Out?

Source: ONS, CE, smoothed is 3 mth moving average

Although no shock that the BoE vote to keep policy on hold this month, there was some surprise that all hawkish dissents ended, with the one MPC member instead still again calling for a cut. But despite recent CPI underlying falls, the majority continue to focus on assessing how ‘persistent’ are price pressures. Thus the MPC still suggested policy would need to remain restrictive for sufficiently long to return inflation to the 2% target but was also more open in accepting that the stance of monetary policy could remain restrictive even if Bank Rate were to be reduced. Indeed, an implicit easing bias was evident in the Committee still keep under review for how long Bank Rate should be maintained at its current level. Clearly, a fuller policy review will take place with an updated Monetary Policy Report at the May 9 MPC meeting. We think this will pave the way for the first cut in June and for around a total 75 bp of cuts this year and even more in 2025.

As was widely expected, the BoE kept policy on hold for a fifth successive meeting this month and again hinted that policy could be eased but stressed more evidence was needed before this could happen. But clearly the BoE accepts that even with signs it belies that the real economy is on the mend that price pressures are nevertheless still easing. It noted that CPI inflation fell to 3.4% in February, a result that was a little below the expectation in the February Monetary Policy Report. It was perhaps little less concerned about services price inflation. It has declined but while it remains elevated, at 6.1% in February, it noted that higher-frequency measures of core services inflation, such as the three-month on three-month annualised rate, had fallen to around 4½%. Such more coincident indicators are something we have been flagging for some time and while there are some signs such disinflation may have stalled we think more likely that weakness in demand will take a further toll. In this regard we echo BoE thinking in that ‘most indicators of short-term inflation expectations have continued to ease’.

In fact there is a question of just how much services inflation has to fall as, historically, it has exceeded (core) goods inflation as is the case at present. Indeed, as Figure 1 suggests, even current adjusted services inflation is not far from the pre-pandemic rates. The question is whether some of the MPC (ie the hawks) are thinking that the UK faces a new normal in which goods and services inflation have to equate.

The RBA has kept the cash rate on hold at 4.35% as per our forecast. The current inflation picture does not support any change of monetary policy from the RBA with the latest CPI showing a 3.4% y/y growth.The key forward guidance statement of "Whether further tightening of monetary policy is required to ensure that inflation returns to target in a reasonable timeframe will depend upon the data and the evolving assessment of risks." has been changed to "The path of interest rates that will best ensure that inflation returns to target in a reasonable timeframe remains uncertain and the Board is not ruling anything in or out.". The wordings may mean the same, RBA being data dependent, but the change in rhetoric seems to suggest that RBA would also consider easing if they see CPI to be returning to target range. RBA is forecasting inflation to be back in target range in mid 2025.

The decision is in line with RBA's rhetoric of being data dependent and patient in assessing the effect of cumulative hikes while keeping a close eye on inflation dynamics. The Q4 CPI showed a 4.1% y/y growth, slowing from 5.4% in Q3 and missed estimates at 4.3% and the latest February CPI bangs in estimate at 3.4% y/y, still above RBA's inflation target but align with their forecast . RBA will prefer not to further tighten because the Australian economy will be growing slower in 2024 and the room for RBA to tighten without significantly hindering economic growth remains minimal. The household balance sheet are restricted by mortgage cost and inflationary living pressure, while business are facing the tightest financial conditions in months, alongside peaking labor market even as the Australian economic growth being stronger than market consensus. Preliminary data suggest that domestic demand will weaken significantly in Q1 2024, further weighing on RBA's decision to tighten more. The RBA did not change their inflation forecast and seems to be content with the trajectory of inflation by seeing 2-3 percent in 2025. We maintained our forecast of terminal rate to be 4.35% before seeing two 25bps easing in H2 2024 .