U.S. Initial Claims, GDP revisions, Durables and Trade - No major surprises

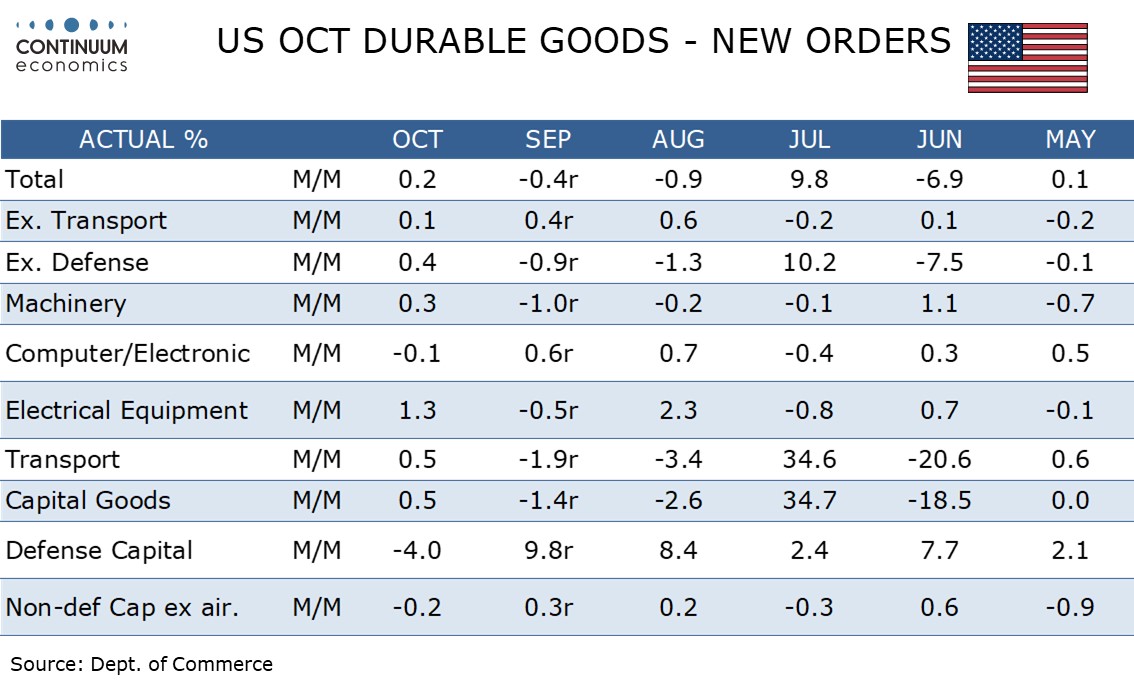

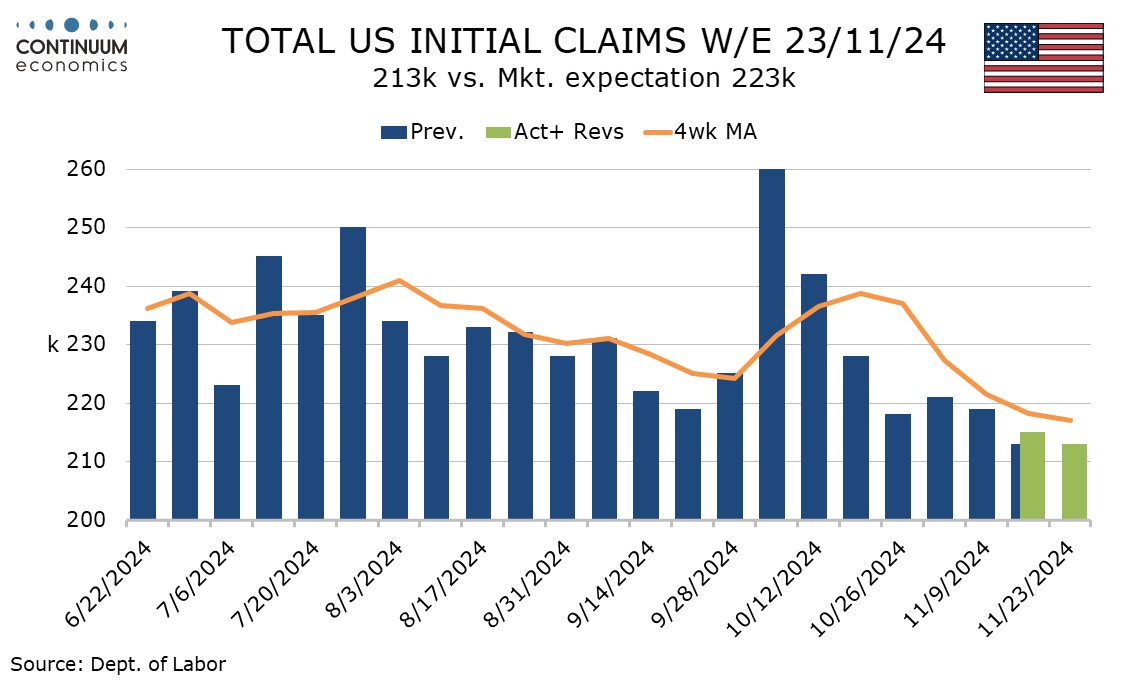

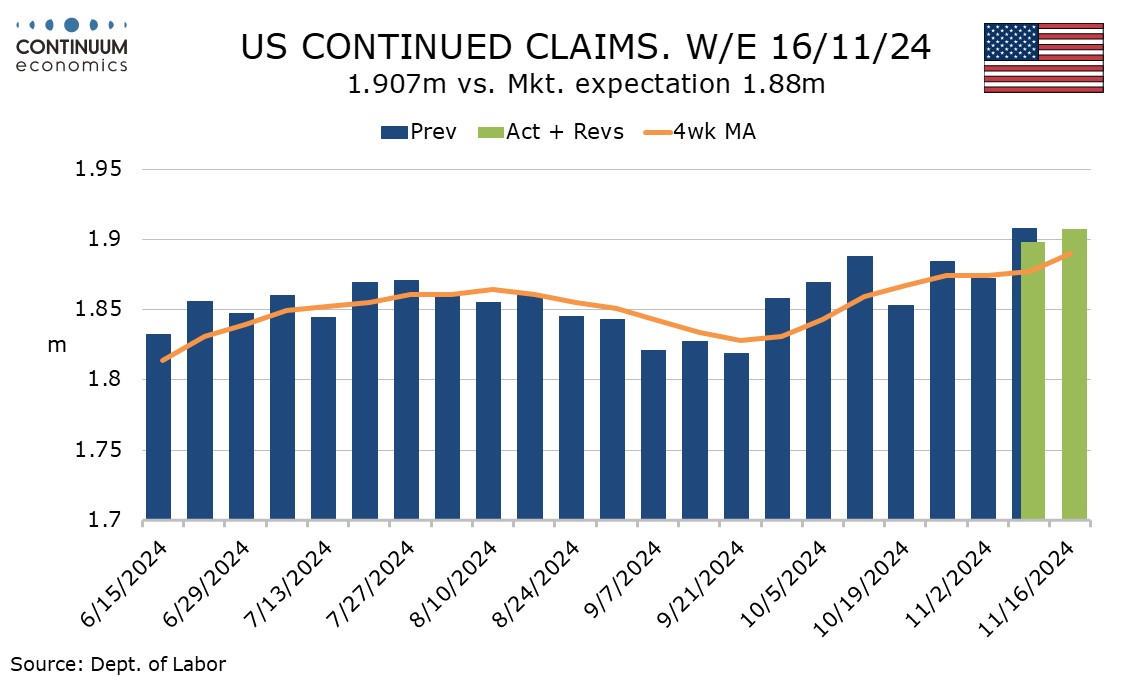

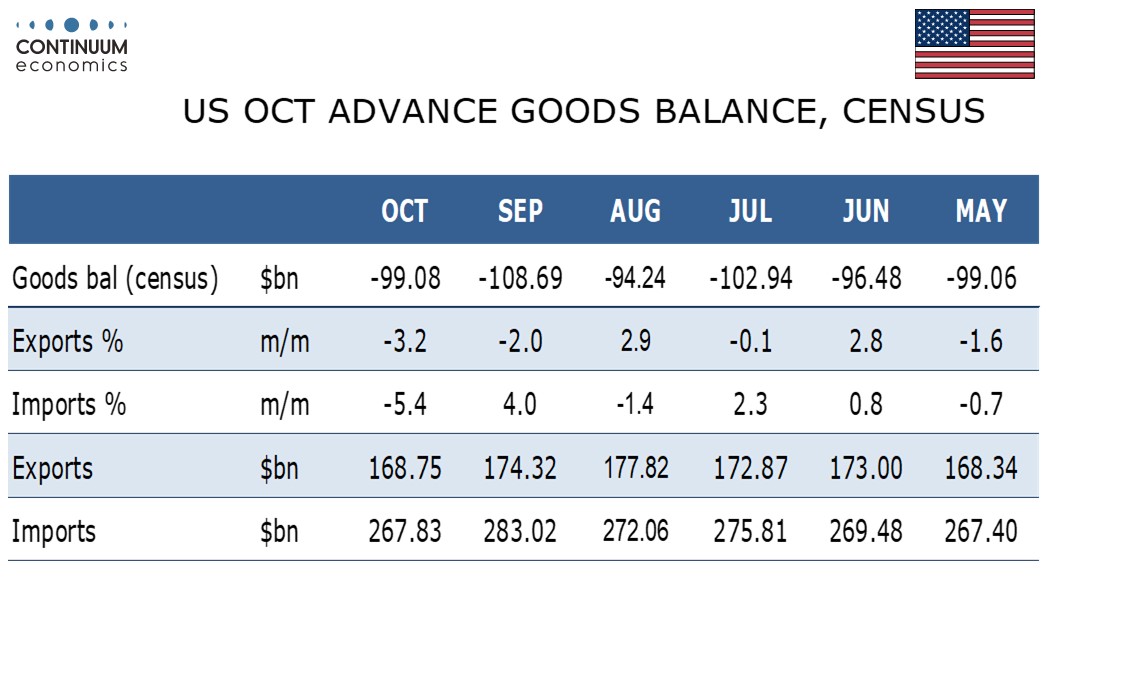

There are no major surprises in the latest round of data. Initial claims remain low but continued claims remain high, Q3 GDP was unrevised at 2.8%. October durable goods maintain a marginally positive trend, up 0.2% overall and 0.1% ex transport. October’s advance goods trade deficit corrected lower but may bounce in coming months ahead of expected tariffs.

Initial claims at 213k are down because last week was revised up to 215k from 213k. The level is the lowest since April and the 4-week average has more than fully erased a bounce seen after the recent hurricanes.

Continued claims however continue to trend higher, rising to 1.907m from 1.898m, with the level the highest since November 2021. This suggest that while layoffs are low, jobs are becoming harder to find.

October’s advance goods trade deficit of $99.078bn is down from $108.674bn in September but above August’s $94.327bn. The data shows weakness in both exports, -3.2% after a 2.0% September decline, and imports, -5.4% after a 4.0% September increase. A brief strike in Northeast ports probably depressed both totals. Imports may pick up in November and particularly December in an attempt to beat proposed tariffs.

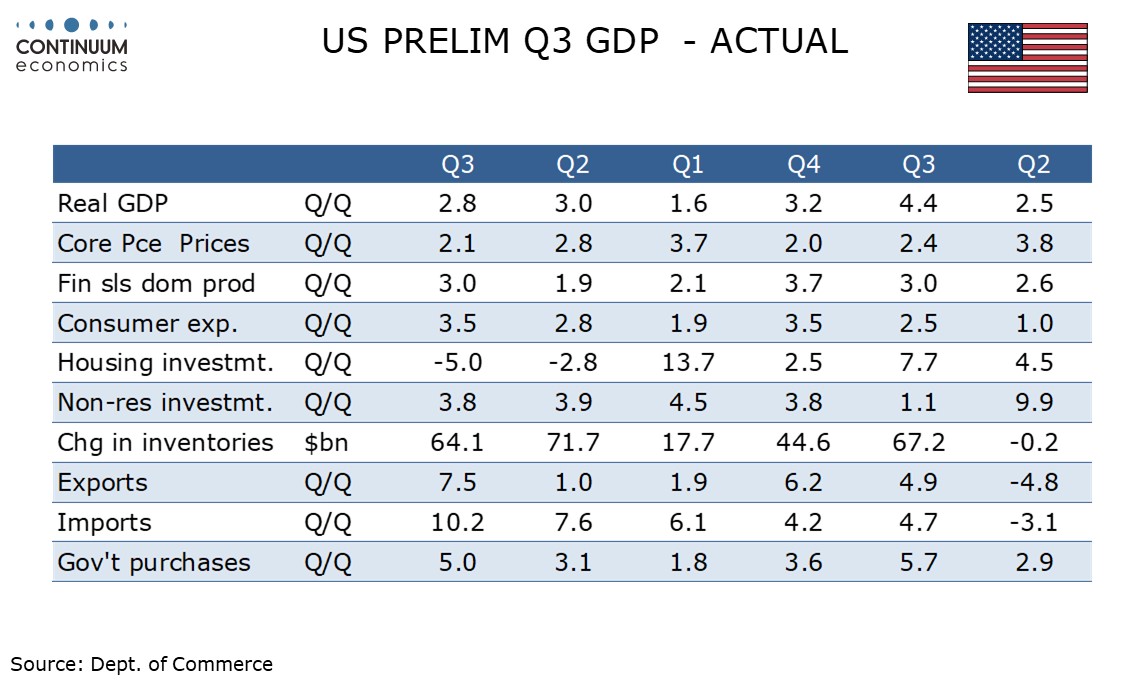

The unrevised 2.8% GDP increase keeps the pace healthy, with the detail showing consumer spending a little less strong at 3.5% from 3.7% but fixed investment and inventories revised higher. The first estimate for Q3 Gross Domestic Income showed a 2.2% increase, slightly slower than GDP. A downward revision to core PCE prices to 2.1% from 2.2% was minimal before rounding.

The durable goods orders trend remains marginally positive with the 0.1% rise ex transport the third straight gain, though the 0.2% rise overall and the 0.4% rise ex defense were both following tow straight decline. Non-defense capital orders ex aircraft, a key indicator for business investment, disappointed, but October’s 0.2% decline follows a 0.3% September increase.