JPY flows: JPY still weak

USD/JPY makes new high in early Europe and near term trend remains weak although there is still scope for a longer term recovery

USD/JPY stabilised overnight, but the high at 153 reached on Wednesday has been breached in early European trade. Comments overnight from Takuji Aida, an economist advising the policy circle of Japan's likely new premier Sanae Takaichi, suggested the government is comfortable with a weak JPY. He said the yen's current weakness benefits the economy and the hit to households from rising import costs can be offset by aggressive fiscal spending. Such comments suggest intervention to stem JPY weakness is unlikely, and will help to encourage JPY bears.

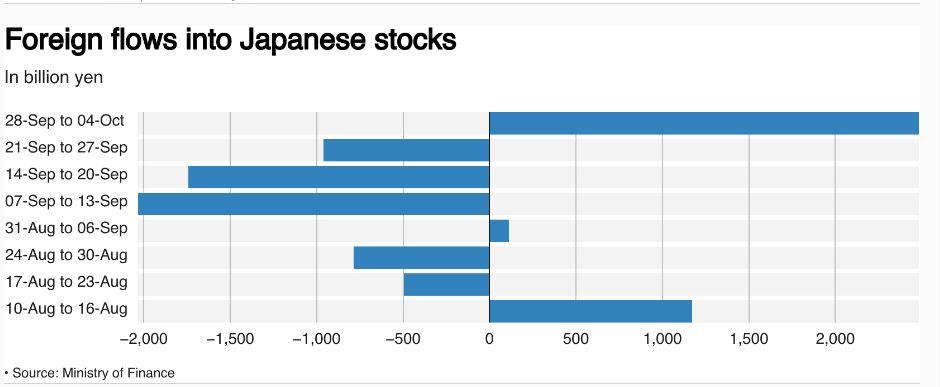

However, while the government can institute easy fiscal policy, it cannot prevent BoJ tightening in response. While Takaichi may be a fan of Abenomics, BoJ governor Ueda is his own man, and has indicated an intention to raise rates if growth and inflation pick up as projected. Takaichi’s policies if anything are likely to lead to stronger growth and inflation than previously anticipated, so rate hikes remain on the table, albeit probably not in October, although if the JPY remains weak an October move can not be ruled out. Expectation of stronger growth is reflected in strong foreign buying of Japanese equities in the latest week, which itself should be JPY supportive. All in all, we may see some near term stabilisation in the JPY, and there is still scope for a longer term recovery, but the current weakness remains hard to oppose without some action or comments from the authorities to support the currency.