Published: 2024-09-18T13:16:15.000Z

Preview: Due September 19 - U.S. August Existing Home Sales - Slippage to resume

7

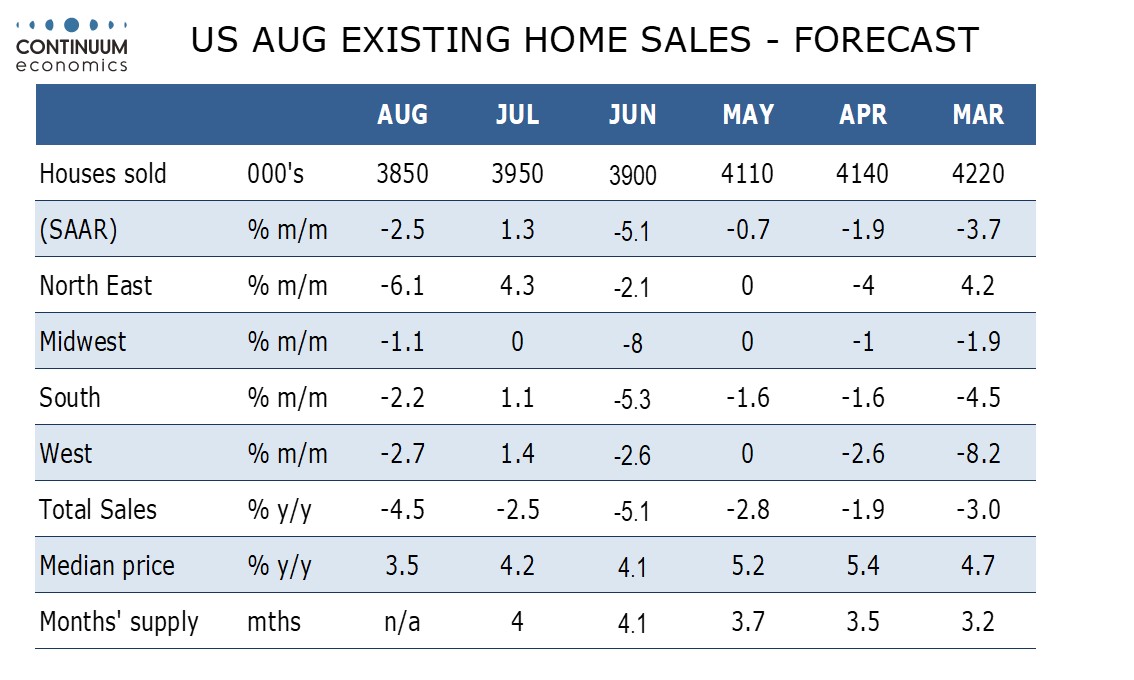

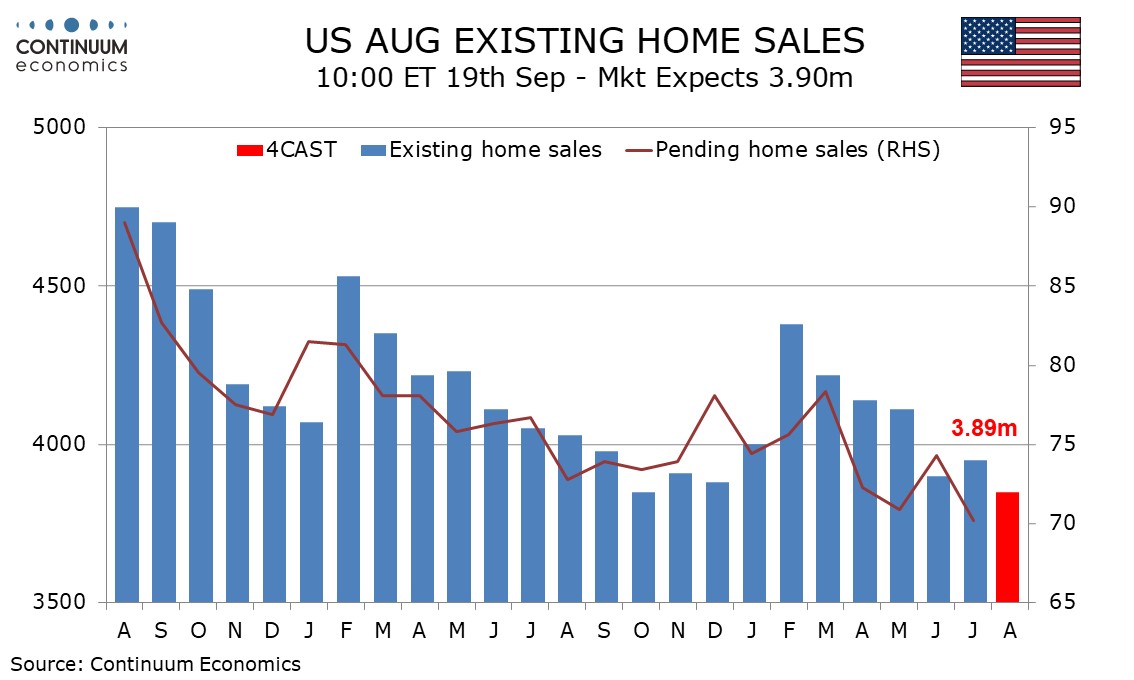

We expect a 2.5% decline in August existing home sales outcome to 3.85m, resuming a negative trend after a 1.3% July rise corrected a steep 5.1% decline in June. August’s level would be the weakest since a matching low in October 2023.

While new home sales surprised on the upside in July, pending home sales, which are designed to predict existing home sales, saw renewed weakness, while August’s NAHB homebuilders’ index continued to slip, even if there was some improvement in 6-month expectations, probably supported by growing hopes for Fed easing. August slippage in existing home sales is likely to be broad based by region.

We expect the median price to fall by 1.0% on the month, matching July’s decline, which followed five straight monthly gains. The monthly movement is largely seasonal though we expect yr/yr growth to slip, to 3.5% from 4.2%. This would be the lowest since November 2023.