USD flows: USD staying soft as confidence declines further

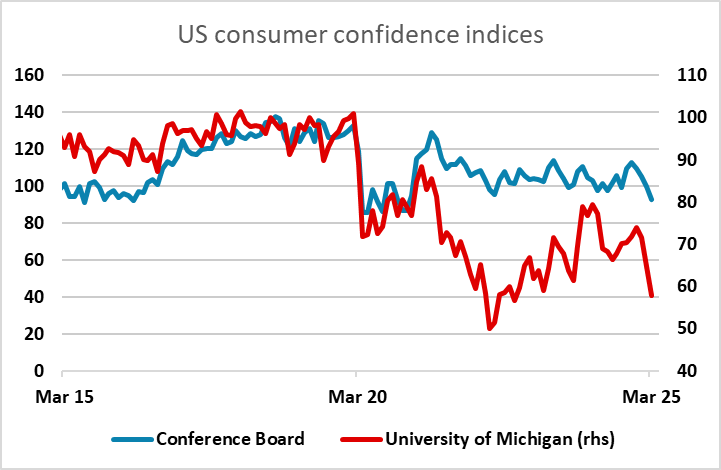

USD weaker in early US and the lower than expected Conference Board consumer confidence index should sustain the weaker tone.

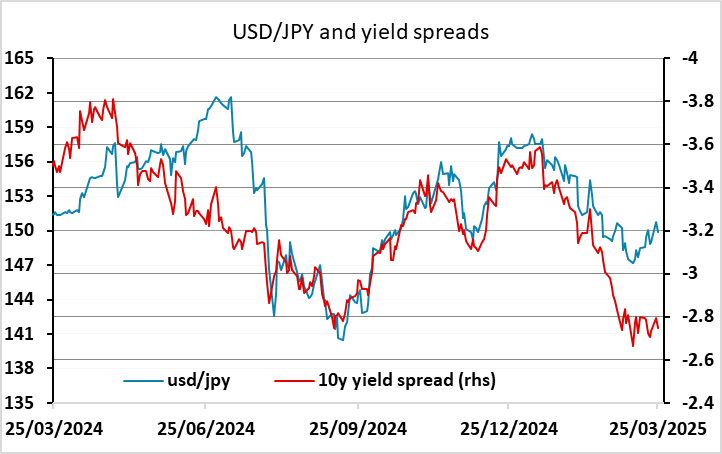

The US Conference Board consumer confidence index has fallen to its lowest since the pandemic affected January 2021. Excluding the pandemic the index is the lowest since May 2016. With the Richmond Fed index also softer than expected, the data should maintain the softer USD tone seen since the start of European trading this morning. There are still a lot of uncertainties about the economic outlook with the impact of tariffs and tax and spending decisions all still unclear. While the direct fiscal impact of the DOGE spending cuts is unlikely to be large, it may be having a significant effect via consumer confidence. Unless the tariff increases are abandoned, we continue to see the current equity market levels as extended and see USD/JPY in particular as overstretched above 150.