Preview: Due August 5 - U.S. July ISM Services - Unlikely to match strong S&P Services PMI

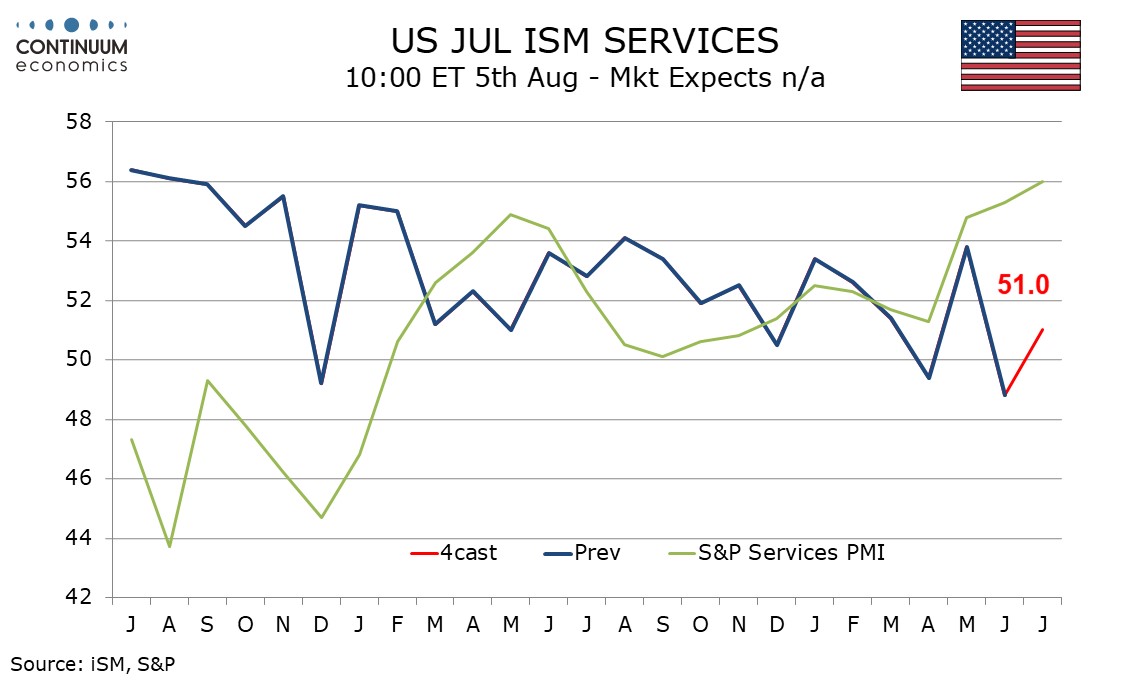

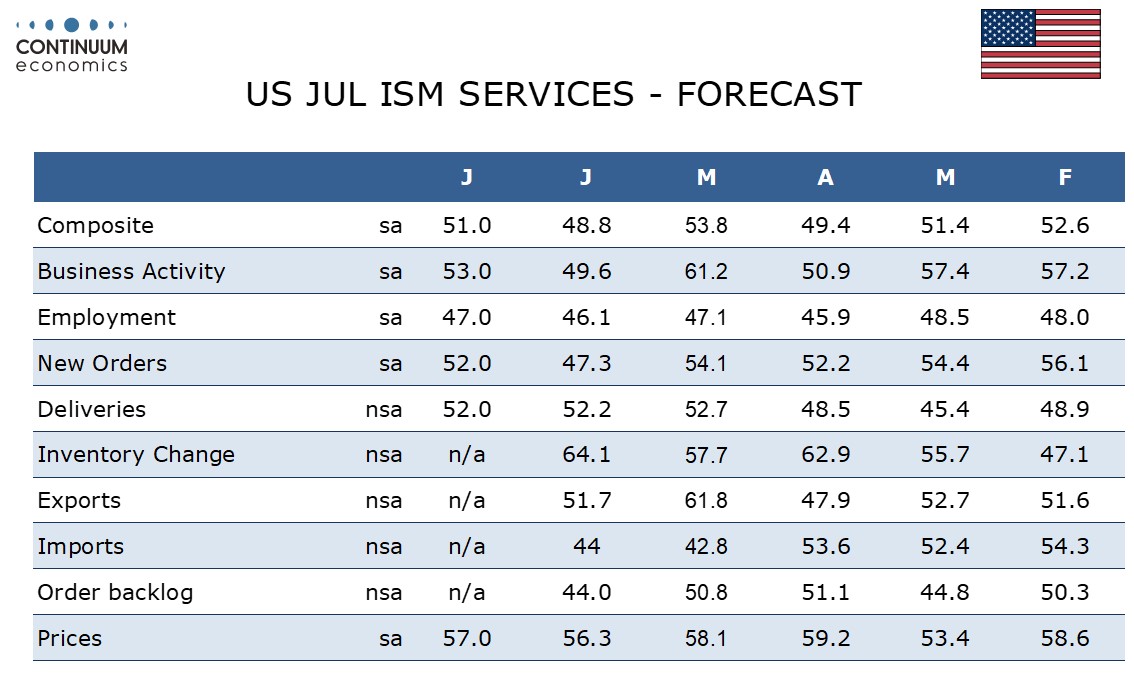

We expect July’s ISM services index to correct higher to 51.0 after slipping to 48.2, its lowest since the pandemic in May 2020. However the index will remain a lot weaker than the S and P services PMI, which in July saw a third straight rise to 56.0, to its highest since March 2022.

The ISM services index does not have a good relationship with that of the S and P. In fact the ISM index has been trending marginally lower, albeit with plenty of volatility, over the last two years while the S and P index has been trending higher. We believe the S and P index is more sensitive to bond yields and interest rate expectations, helping to explain its recent outperformance. Regional Fed service sector surveys have mostly remained subdued.