This week's five highlights

War in Gaza and MENA Country Risk

Trump's Reelection and U.S. T-Yields

U.S. Q4 GDP delivers another strong quarter

Bank of Canada Drops Tightening Bias

BoJ's Ueda Hinting April Move

Country risk in Middle East and North Africa is impacted by the ongoing war in Gaza, though we feel that the war will likely come to an end in the coming months. The war in Gaza will likely drag onto the spring, when Hamas military capacity will be structurally broken though perhaps not eliminated. Attention will then switch to the post war environment where Israel’s initial ideas focus on a continued Israeli military presence; no settlers and a multinational rebuilding fund. What is unclear is who would have political control, which could slow or stop the rebuilding and recovery process. The West Bank has also seen an outbreak of violence on both sides, which will likely sour the relationship between Israel and Palestinian authority that partially governs the West Bank.

Moreover, though the EU will back an Arab/EM push for a post war two state initiative and the formation of a Palestinian state, the U.S. will not want to make any commitments until after the November 2024 elections. In 2025, U.S. opposition to the two state idea could continue, which would deflect pressure on Israel – domestic Israel politics argue it could be years before this is accepted by an Israeli government. All of this means that ongoing instability in the region centered on Gaza. However, Iran appears to want to avoid major escalation, as this could suck the U.S. back into the region and curtail the pivot towards Asia. Intermittent trouble can be seen from Houthi attacks on Red Sea shipping, but this is likely to become less frequent when the war ends.

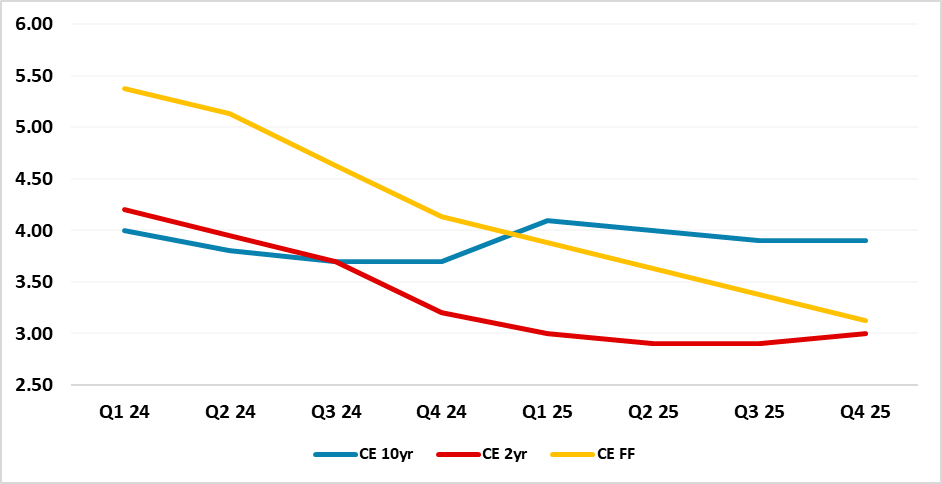

Expectations are firming that Donald Trump will win the Republican nomination, but the presidential election race is currently 50/50. If Trump were reelected as U.S. president, what would it mean for U.S. Treasuries? There would be a very full agenda for financial markets in 2025 if Trump were reelected. For U.S. Treasuries, the key issues would be the budget deficit and rule of law (plus associated rating agencies downgrades) and whether Trump would be effective in pressuring the Fed into faster and deeper rate cuts. This promises turbulence for U.S. Treasuries, but it would also likely accelerate the ongoing swing to a positive shape yield curve in the 10-2yr area of the curve that we see occurring .

Though Nikki Haley enjoyed a healthy showing in New Hampshire, political analysts remain of the view that Donald Trump is on course to be nominated as the Republican contender. However, moderate and centrist Republican voters are wavering on whether they will vote for Trump or simply not vote. The outcome of numerous court cases for Trump is also a swing factor for moderate and centrist voters, as a formal prosecution could decide the election. However, President Biden also faces the risk that some Democratic voters could decide not to vote, given concerns over U.S. support for Israel in Gaza and immigration/cost of living concerns. An independent candidate could also take votes from Biden and Trump. This far out a Biden/Trump presidential election looks 50/50.

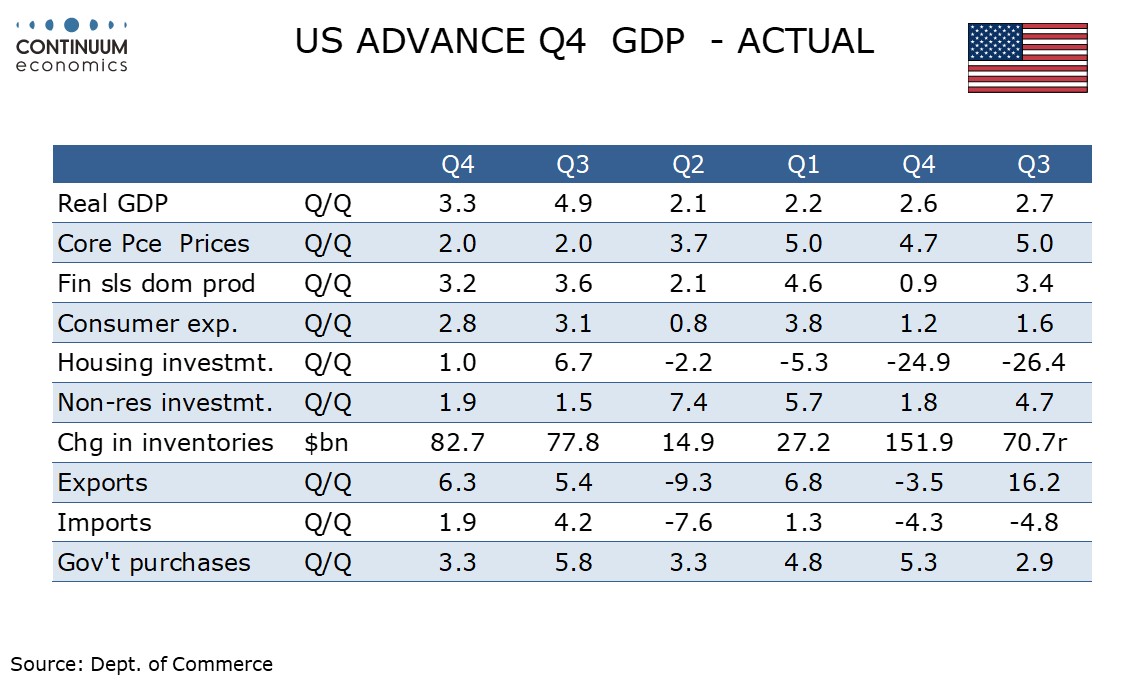

Q4 GDP with a 3.3% rise has come in significantly stronger than expectations and sufficiently so to cause surprise at the FOMC, remaining above long term potential even if slower than Q3’s 4.9%. Initial claims at 214k have corrected last week’s exceptionally low 189k but taking the two numbers together the labor market appears to have seen some improvement in recent weeks. While the GDP data looks strong core PCE prices saw a second straight increase of 2.0% annualized, consistent with the Fed’s 2.0% target if sustained for two more quarters, though this outcome is in line with market expectations. The overall GDP price index at 1.5% was softer than expected however, with overall PCE prices at 1.7% and lower export prices a further restraint.

While inventories unexpectedly did not correct a Q3 acceleration, final sales (GDP less inventories) were strong at 3.2% and the strength here was broad based. Exports at 6.5% outpaced imports at 1.9% with final sales to domestic purchasers (GDP less inventories and net exports) up by 2.7%. Consumer spending rose by 2.8% marginally outpacing a 2.5% increase in real disposable income with retail outpacing a 2.4% rise in services. Fixed investment was relatively subdued at 1.7% though all major components saw modest increases, with housing relatively weak at 1.1%. Government at 3.5% completes a solid breakdown even with defense easing from a very strong Q3. A narrower December trade deficit and stronger than expected gains in December retail and wholesale inventories contributed to the GDP strength. Unchanged durable goods orders were weaker than expected and consistent with a relatively subdued business investment picture but ex transport saw a stronger than expected rise of 0.6%

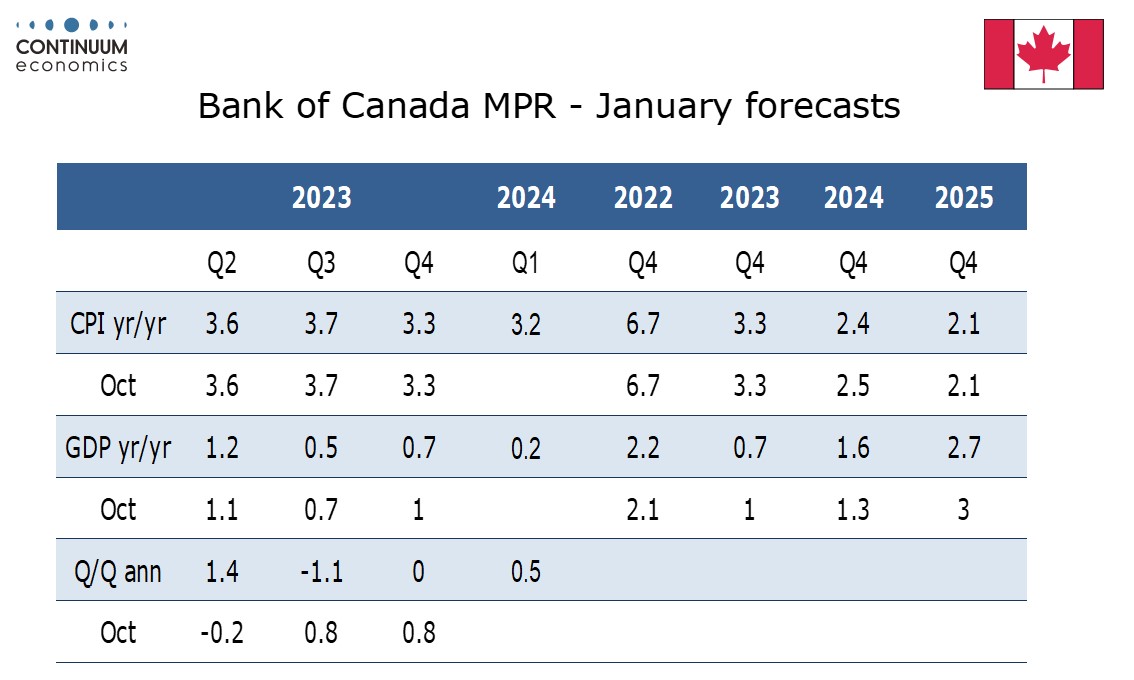

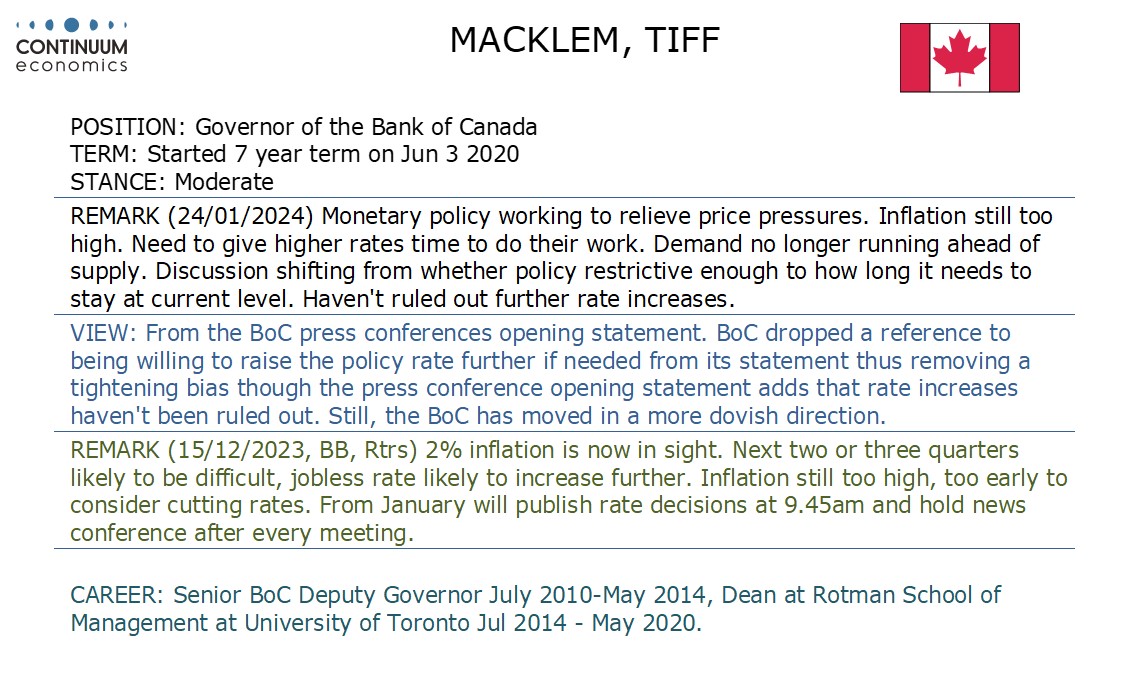

The Bank of Canada left rates at 5.0% as expected though the statement took a clearly more dovish tone, dropping a tightening bias though still expressing concern over persistently high inflation. Easing does not appear imminent but we now expect it to start in Q2 rather than Q3. The statement made several dovish adjustments, most significantly dropping a reference to being prepared to tighten further if needed. The statement was negative on global growth, noting unexpected strength in the United States but expecting it to slow, and weakness in Europe and China. Canada’s economy is seen as having stalled with Q4 2023 seen flat (weaker than we expect) though 2024 has been revised up to 1.6% Q4/Q4 from 1.3% with growth seen strengthening gradually from the middle of 2024. In December the BoC stated the economy was no longer seeing excess demand. Now it sees the economy operating in modest excess supply.

Despite the statement noting oil prices being $10/barrel lower than assumed in October the BoC made no significant adjustment to its inflation forecasts. Despite seeing an easing of labor market conditions it notes that wages are still rising by 4-5%. The BoC does see slowing demand reducing pressures in a broader number of inflation components with shelter being the biggest contributor to above target inflation, but states it wants to see further and sustained easing in core inflation. Inflation is seen remaining near 3% in the first half of this year before gradually easing to the 2% target in 2025, though its forecast for that year remains at 2.1% Q4/Q4.

In his opening statement Governor Tiff Macklem gave a twofold message. Monetary policy is working to reduce inflationary pressures and the BoC needs to give higher rates time to work. However discussion is shifting from whether rates are restrictive enough to how long policy needs to remain at this level.

In the February meeting, the BoJ did not change monetary policy nor forward guidance with their rationale being labor cash earning not supporting a 2% sustainable inflation target. And in fact, the latest November headline labor cash earning is only showing a 0.2% growth, which aligns with BoJ's decision to wait for spring wage negotiation to confirm wage - inflation dynamics. The BoJ kept forward guidance "The Bank will continue with Quantitative and Qualitative Monetary Easing (QQE) with Yield Curve Control, aiming to achieve the price stability target, as long as it is necessary for maintaining that target in a stable manner. It will continue expanding the monetary base until the year-on-year rate of increase in the observed CPI (all items less fresh food) exceeds 2 percent and stays above the target in a stable manner. ", the text within the statement has stated "The year-on-year rate of increase in the CPI (all items less fresh food) is likely to be above 2 percent through fiscal 2024", which seems to suggest BoJ do see an exit of ultra-loose monetary policy but is waiting for wage growth to further pick up, which is to be confirmed in spring. Despite the BoJ revised fiscal 2024 less fresh food CPI to 2.4% from 2.8%, it remains above 2% and does not change our monetary policy forecast.

While there is no fireworks in the BoJ statement, Ueda's press conference are more informational. His rhetoric in "Likelihood of achieving 2% inflation" turn to "gradually rising" and suggest their "confidence has grown in achievement of price target". He is signalling there is more confidence in wage growth in as more big firms had decided to hike wage this year. The focus of BoJ remain on wage/inflation dynamics as they see current above target inflation not sustainable until wage growth further pick up towards 2%. BoJ is looking for evidence that such wage inflation would be supporting consumption and thus the Japanese economy. It also aligns with BoJ's current forecast of above 2% less fresh food CPI, which is the CPI referred to in the statement's forward guidance. Specifically, Ueda hinted that the next move in policy will be in April as they suggest they will have more data at April meeting compared to March. Moreover, Ueda restated that even if real wages are negative, a policy change is possible.