EUR, AUD flows: EUR supported by French GDP, AUD soft

EUR benefits from better than expected French Q3 GDP, but other Eurozone data awaited. AUD still under pressure but should find support on a 0.65 handle

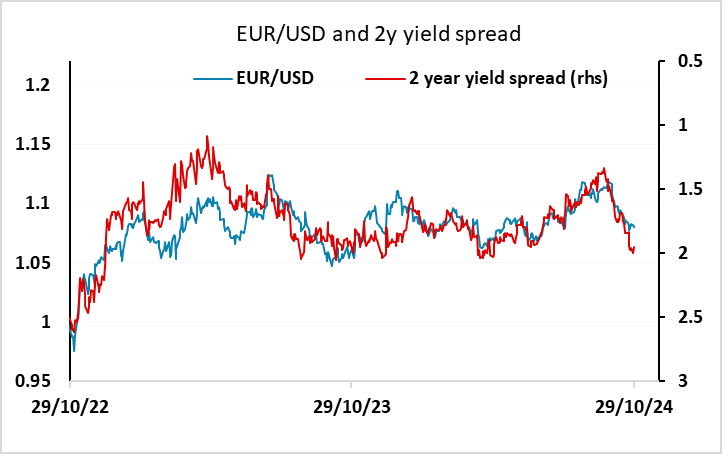

EUR/USD has started the data a little firmer on the back of the slightly stronger than expected French Q3 GDP data, which showed a 0.4% q/q rise against the 0.3% consensus. The other major Eurozone countries are all due to release preliminary Q3 GDP by 09:00 GMT, with the consensus looking for a 0.2% rise. The French data obviously gives a positive head start, but Germany has been the weakest of the majors of late, and could still drag the aggregate Eurozone number (release 10:00 GMT) down to or below consensus. As it stands, EUR/USD continues to look somewhat too high given the rise in front end US yields of late, so strong data may be required to sustain it above 1.08.

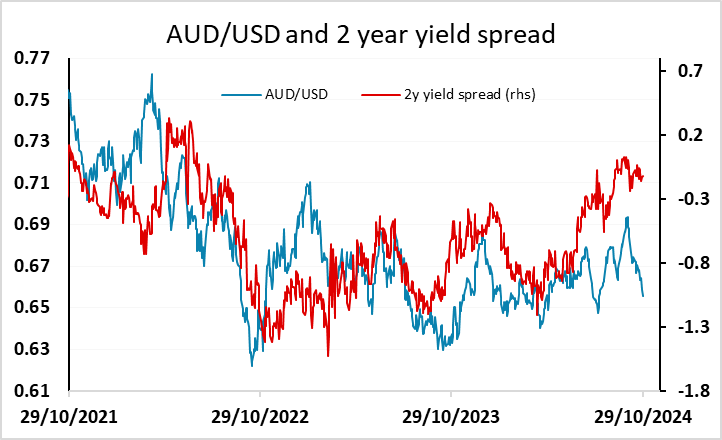

Elsewhere, the AUD continued to weaken overnight, falling back after the Q3 CPI data, though it has recovered somewhat in late Asia. The CPI data wasn’t particularly remarkable, since despite a slightly weaker than expected headline, the core measures were if anything above consensus. Yield spreads reman very favourable, but the AUD continues to be dragged lower by the correction lower in Chinese equities after the stimulus inspired surge. Even so, there is strong technical support on the 0.65 handle and we see upside risks.