USD flows: USD firmer on Fed and geopolitics

Mildly more hawkish fed and talk of US strike on Iran USD supportive

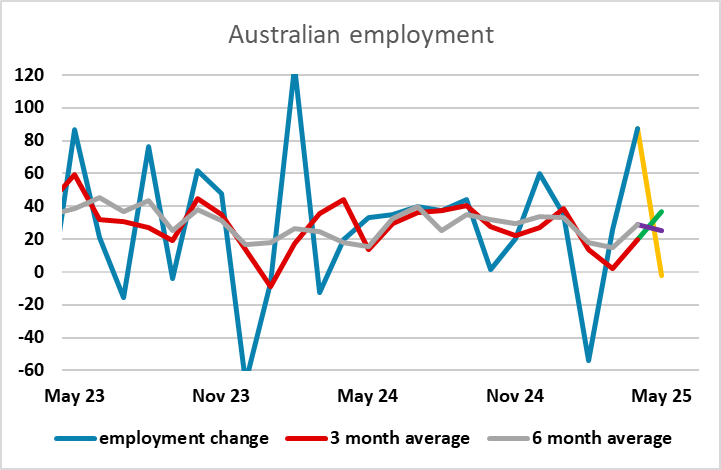

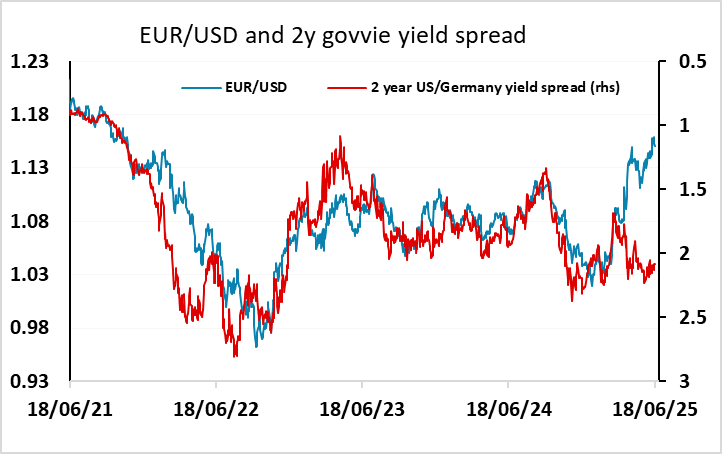

Focus today in Europe is on the SNB and BoE meetings, with the SNB perhaps the most interesting (see FX Daily Strategy). Overnight the USD has advanced modestly helped by a slightly more hawkish Fed which delivered modestly higher dots and indicated that uncertainty had diminished, and a Powell press conference in which he sounded in no hurry to ease. There is also talk of a potential US strike on Iran at the weekend, which Trump is reportedly considering, and this has also helped support the USD and weighed on equities. As long as geopolitical concerns are the prime focus, and tariff risks are pushed into the background, the USD seems likely to benefit, with European currencies generally looking vulnerable after recent strong gains. The AUD has also softened overnight, in part due to a weaker than expected employment report, although the underlying employment trend still looks stable, and we still see 0.64 as representing strong support.