Published: 2025-01-29T14:17:59.000Z

USD flows: Little reaction to huge trade deficit, but clearly USD negative

2

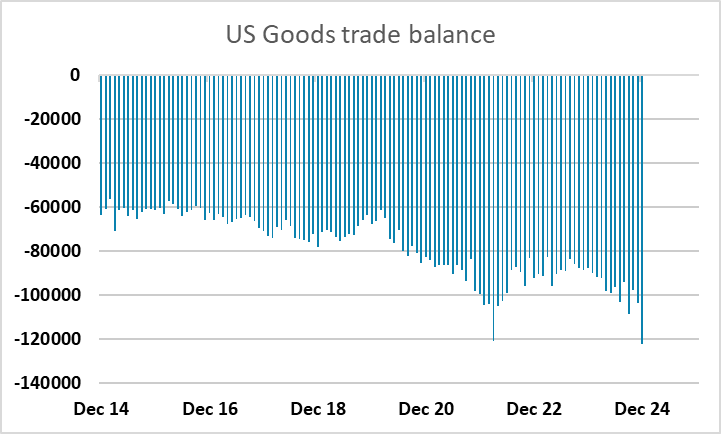

US goods trade deficit second largest in history. Along with weak inentory data will cut around 1% off Q4 GDP tomorrow, so should be USD negative.

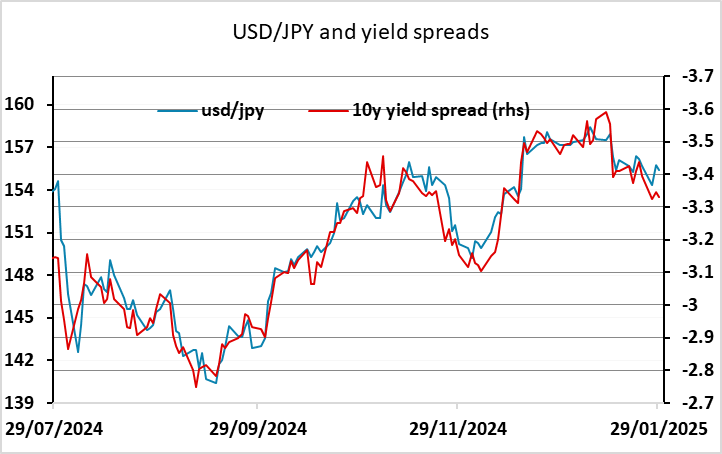

The market seems to have largely ignored today’s US trade and inventory data, but it is very significant for Q4 GDP released tomorrow, probably knocking around 1% off previous forecasts for Q4. The goods trade deficit is the second largest in history, which in itself is an argument for a weaker USD. There is likely to be some reluctance to adjust positioning ahead of the FOMC later, but the USD has been firm today and people expecting a more hawkish Fed later may in any case be disappointed. We would most clearly favour USD/JPY lower, as it continues to trade below levels associated with current yield spreads, but also see scope for EUR/USD to bounce back above 1.04.