Published: 2023-12-20T15:21:49.000Z

US December Consumer Confidence and November Existing Home Sales rise as mortgage rates slip

Senior Economist , North America

-

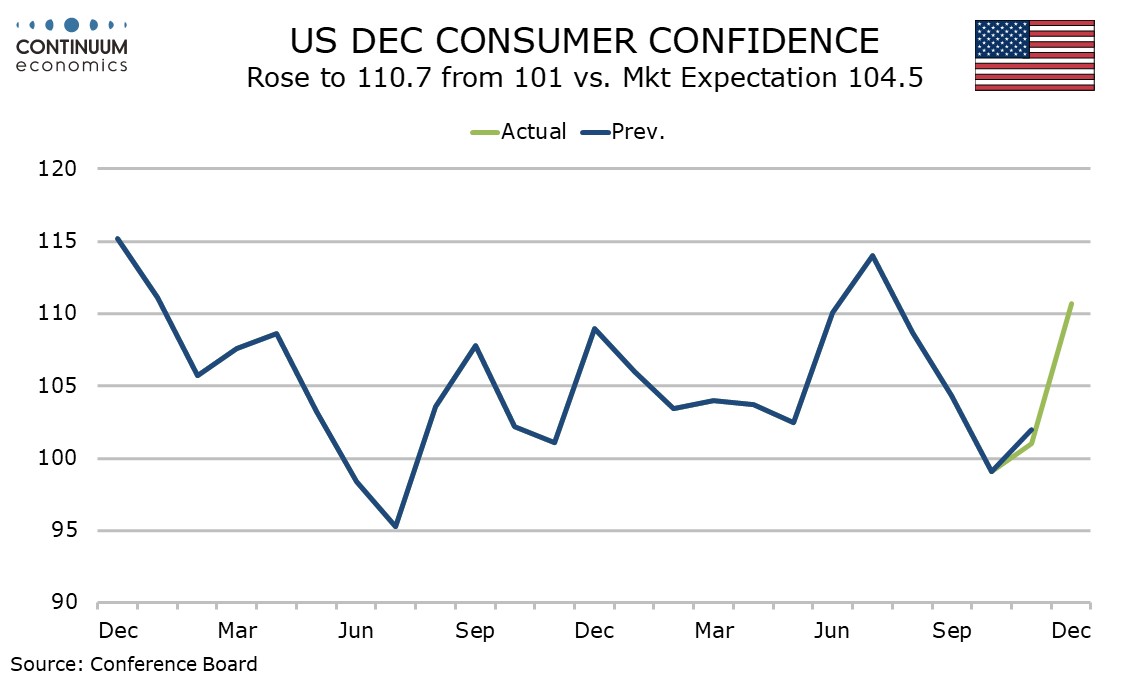

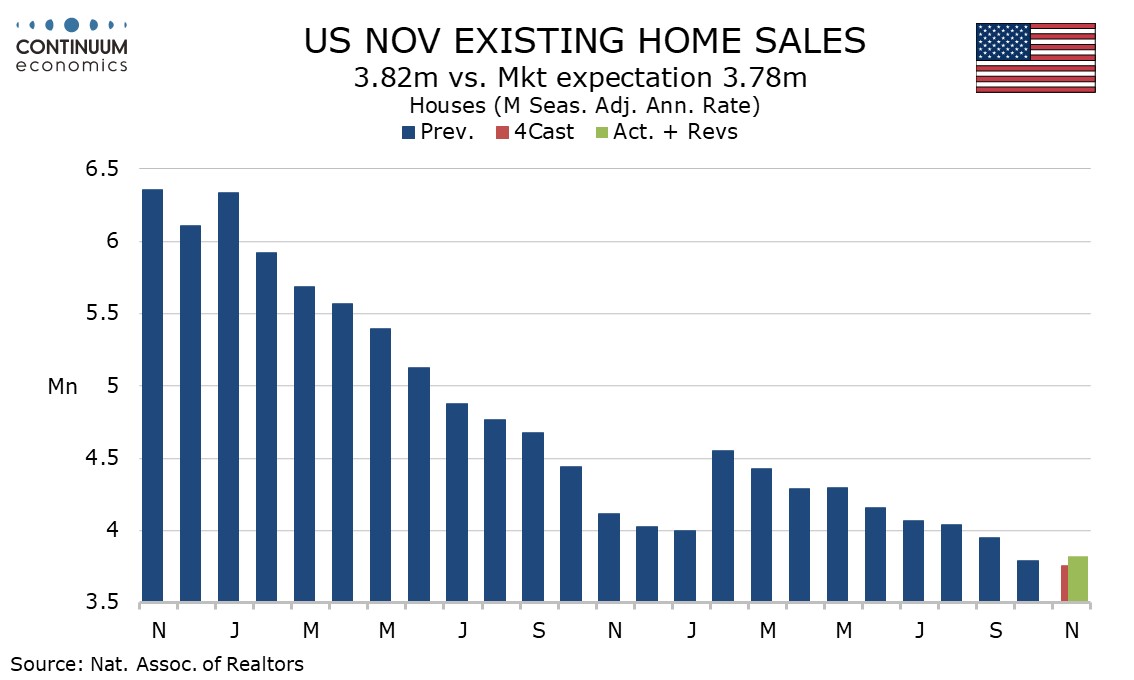

December consumer confidence in rising to 110.7 from 101.0 and November existing home sales with a 0.8% rise to 3.82m are both stronger than expected. The improved tone of financial markets, in particular lower UST yields and mortgage rates, will have provided support.

The consumer confidence reading is the highest since July and follows a rise in the preliminary December Michigan CSI index. Both the present situation, to 148.5 from 136.5, and expectations, to 85.6 from 77.4, contributed to the gains.

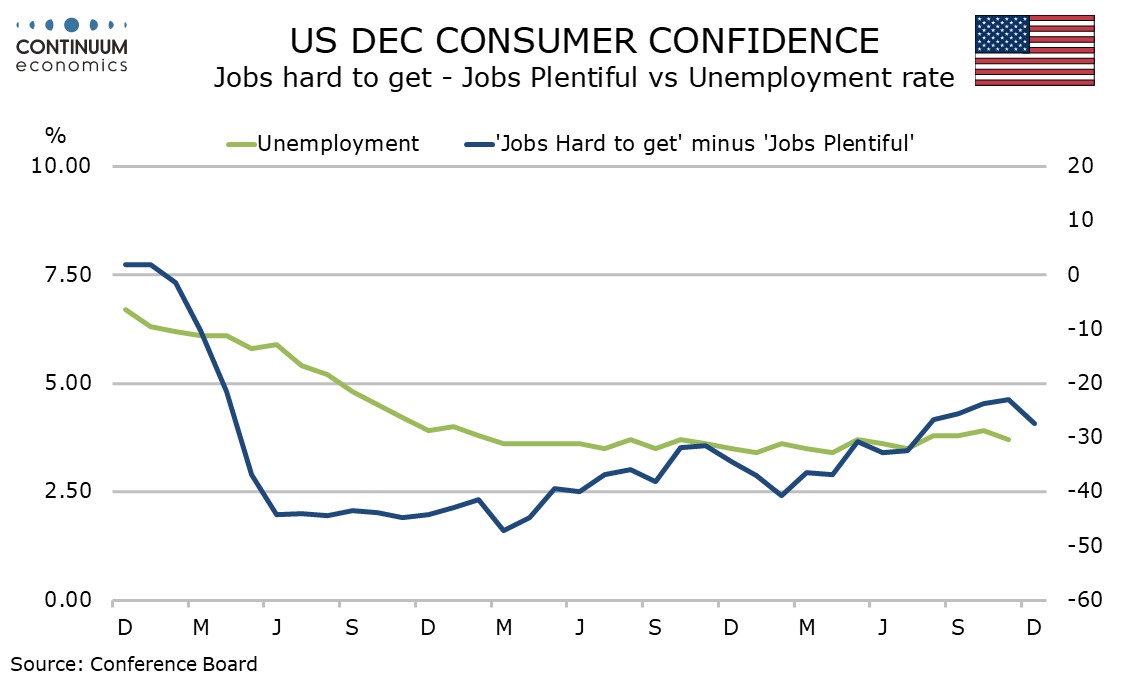

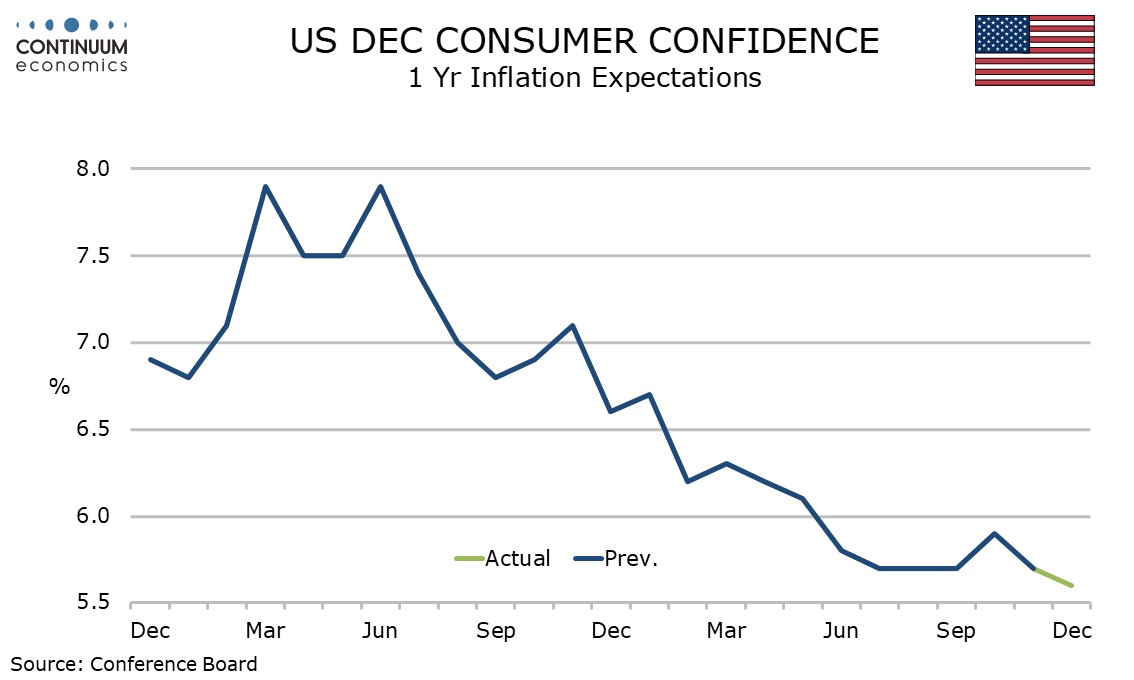

Perceptions of employment showed a significant improvement, those seeing jobs as plentiful exceeding those seeing them as hard to get by 27.5%, up from 23.0% in November and the strongest since July. The one-year inflation expectation edged lower, to 5.6% from 5.7%, the lowest since October 2020 though still above pre-pandemic levels which were near 4.5%.

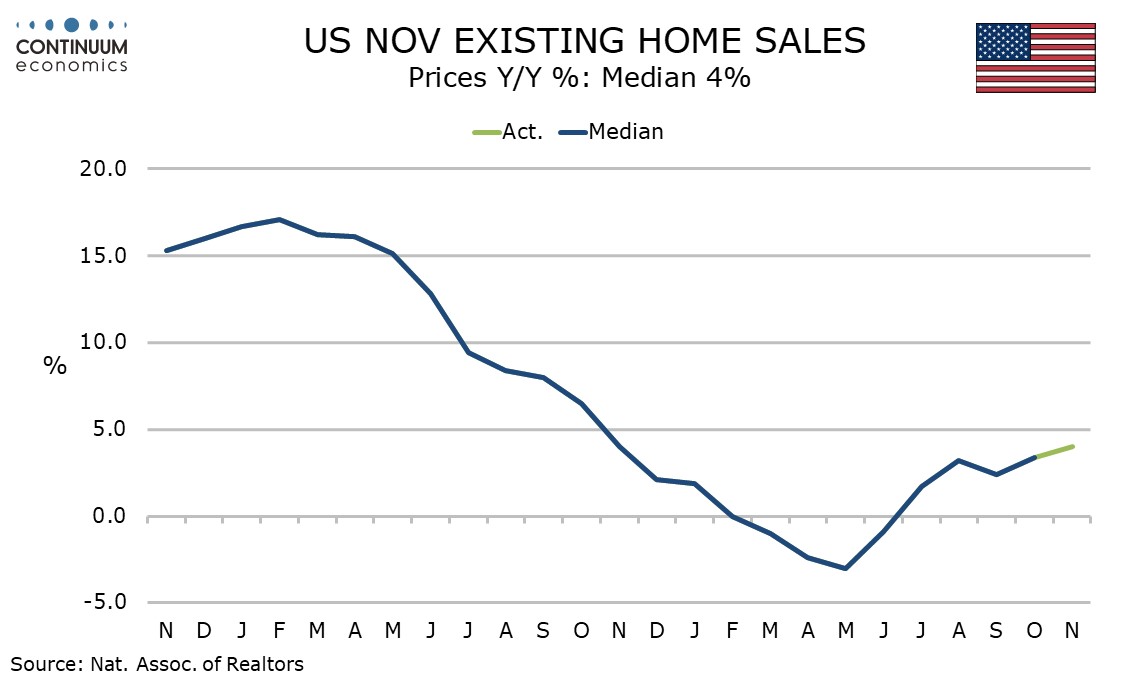

The existing home sales increase is modest but is the first since May and the strongest since February. Housing sector surveys have recently been edging off recent lows as mortgage rates move off recent highs.

The median price fell by 1.0% on the month but this is in part seasonal. Yr/yr growth increased to 4.0% from 3.4%, extending the acceleration from May’s low of -3.0%.