This week's five highlights

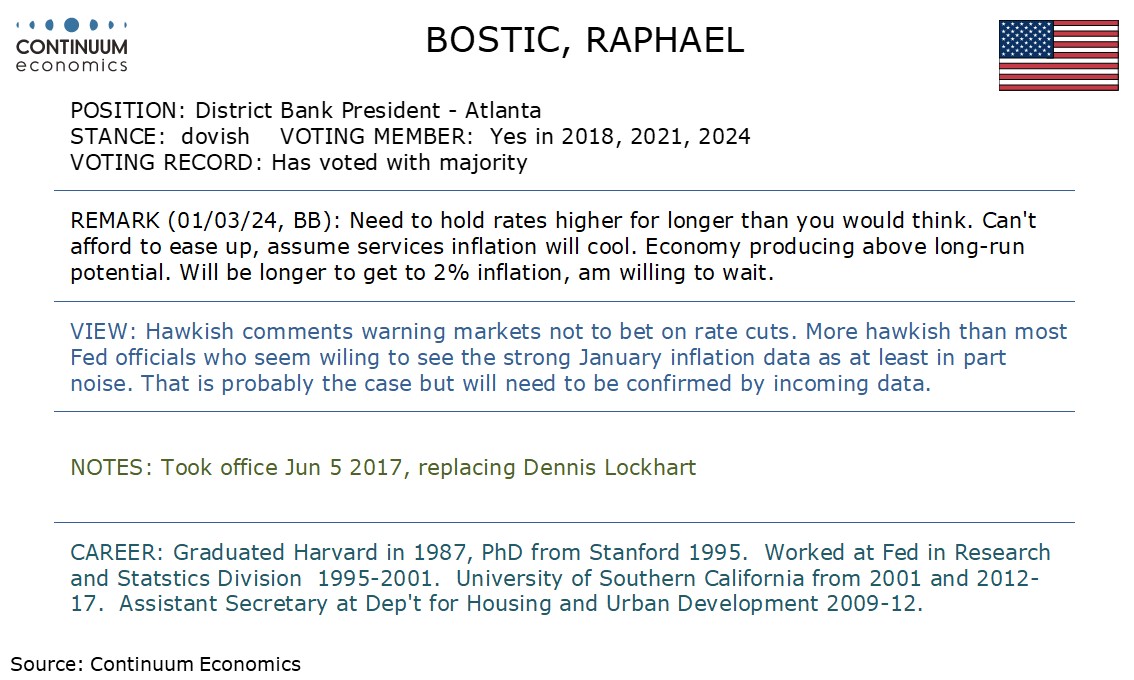

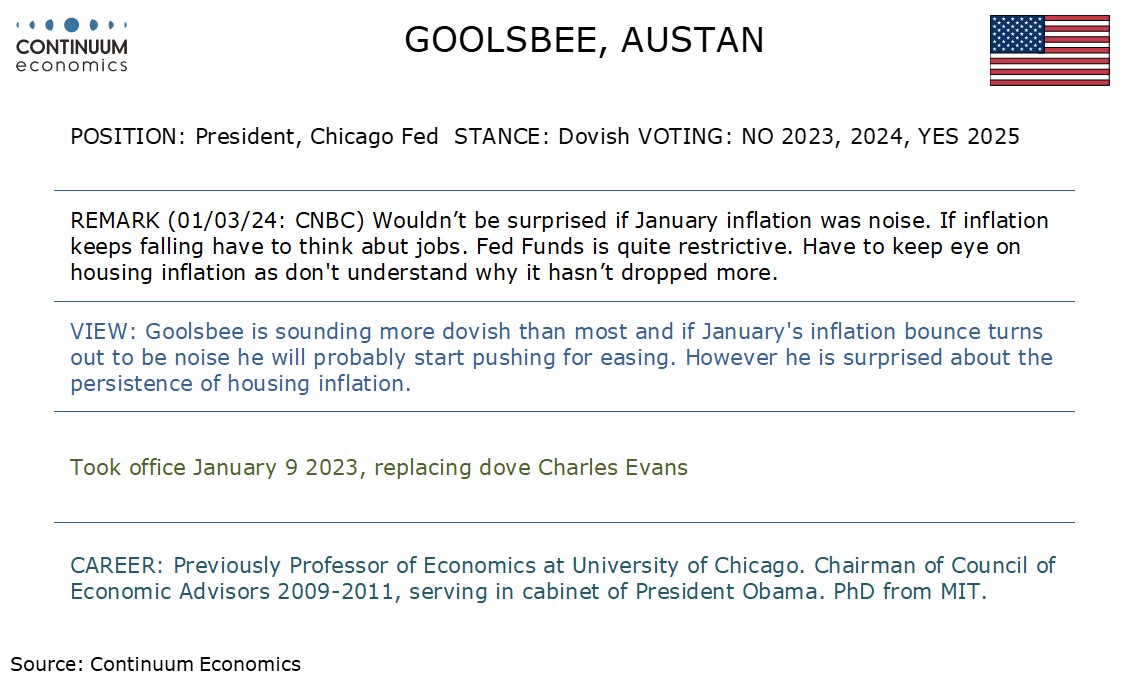

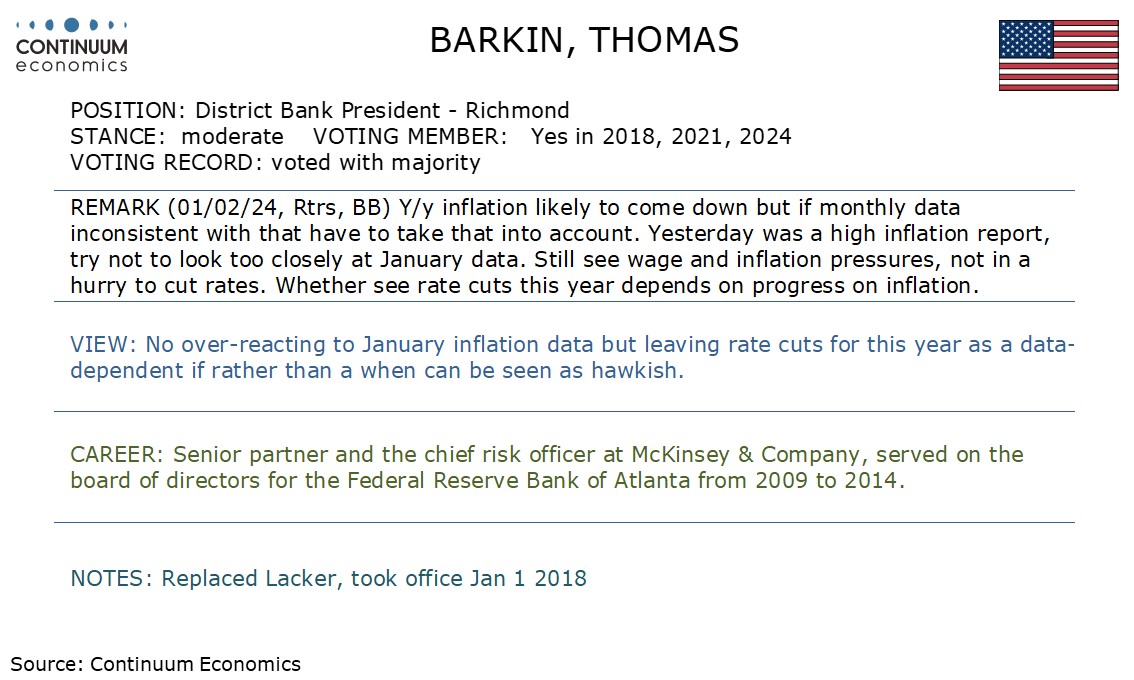

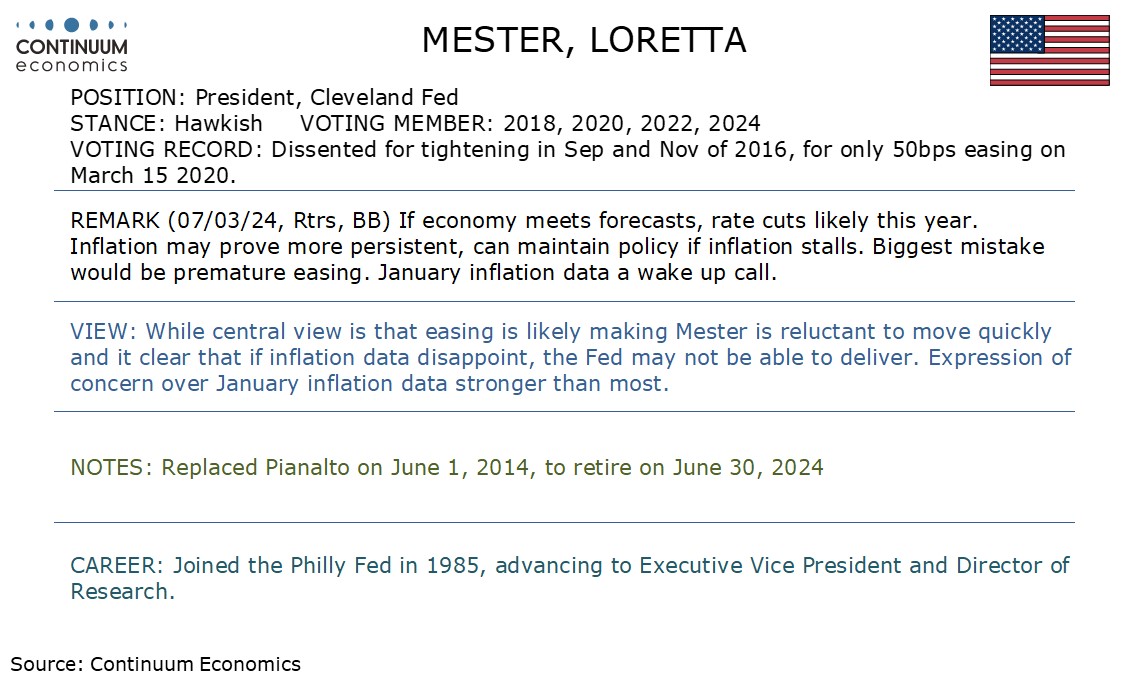

Fed Speakers Capture market Spotlight

Overshadowing U.S. Data

Bank of Canada Keeps Markets Waiting

ECB Bowing to Markets?

BoJ Signals Policy Changes Soon

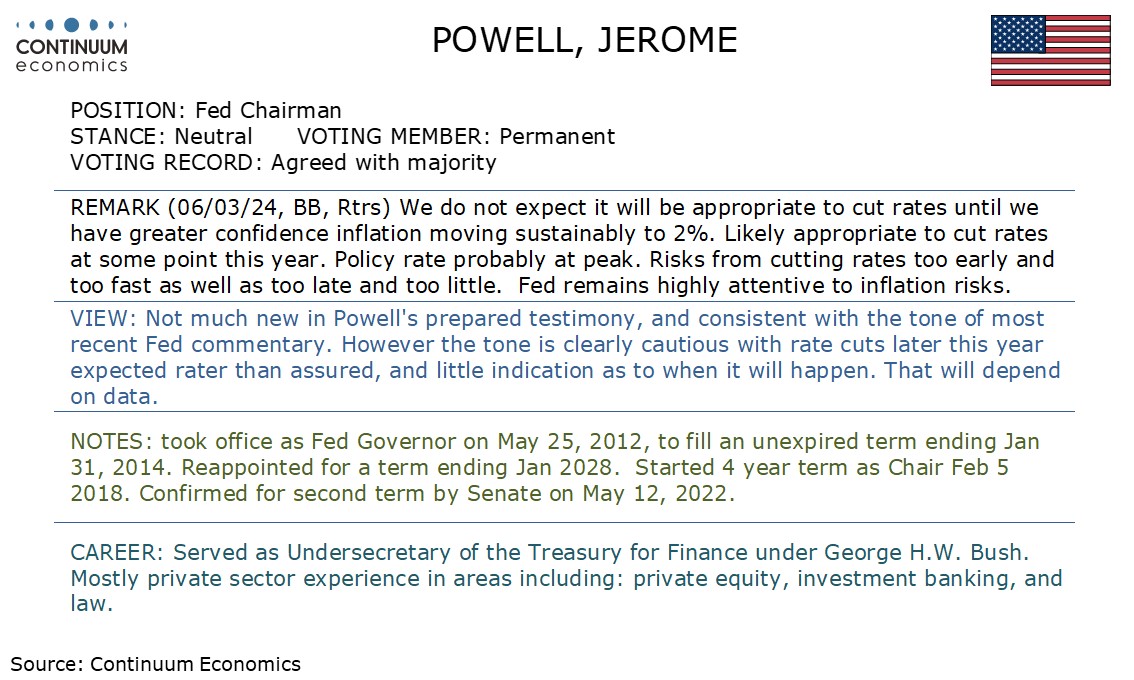

While these speakers may hold different view towrds rate in the coming year, it is visual that most of them has been tilted towards potential easing when data supports.

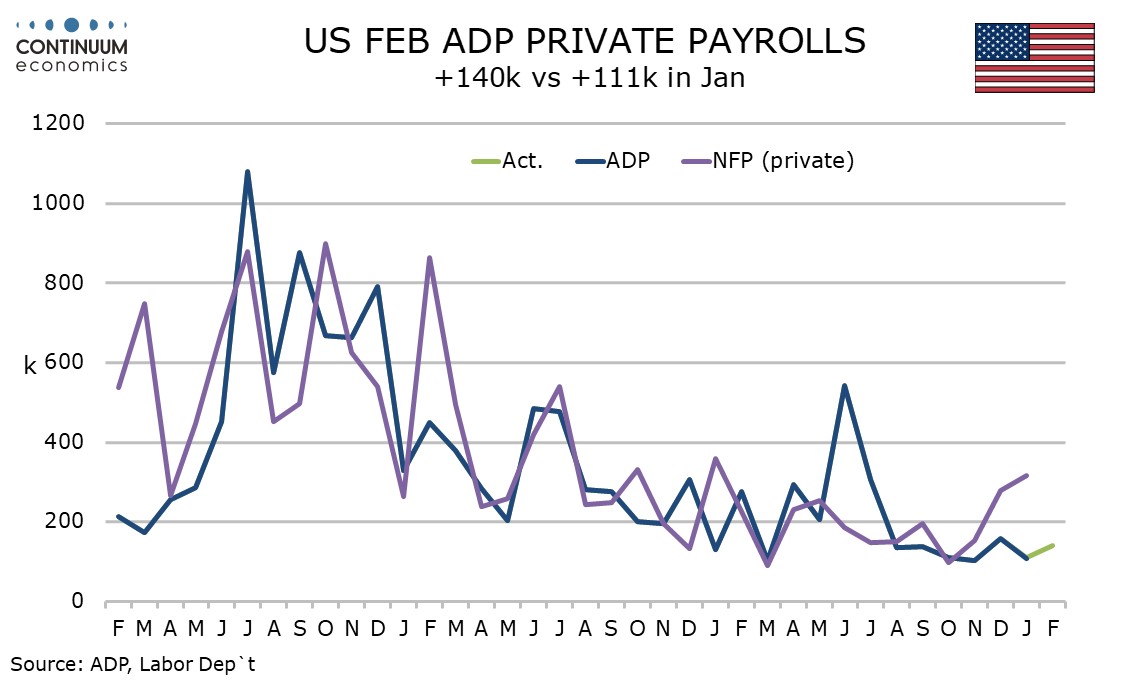

ADP’s February ADP estimate for private sector employment growth of 140k is close to if a little softer than market expectations, slightly above recent ADP trend but well below the last two non-farm payrolls. The data does not tell us much about Friday’s non-farm payroll, for which we expect a 200k rise (160k in the private sector). ADP details show moderate gains in most components, leisure and hospitality at 41k being the strongest, while construction at 28k was also fairly strong. There were no significant negatives.

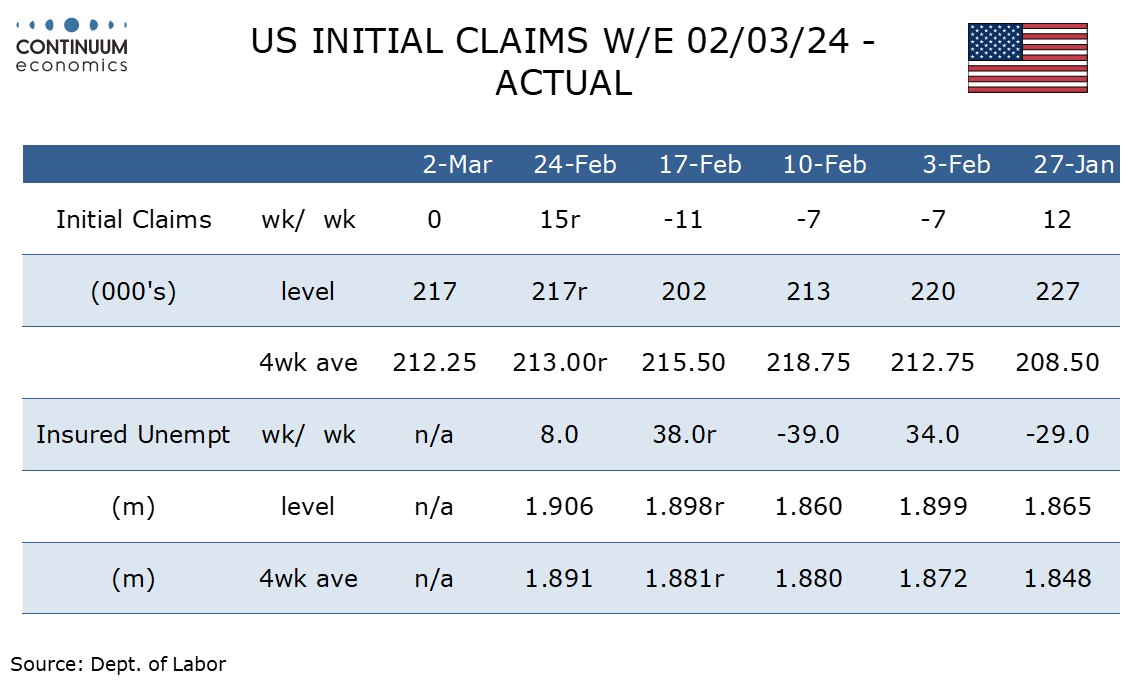

The initial claims picture remains stable and consistent with a tight labor market, unchanged at 217k with the preceding week revised marginally higher from 215k. A wider than expected January trade deficit of $67.4bn from $64.2bn however presents some downside risk to Q1 GDP. The continued claims picture also looks stable, 1.906m in the latest week up from 1.898m which was revised from 1.905m, meaning little net change. February’s payroll was surveyed two weeks before this week’s initial claims data and one week before that for continued claims.

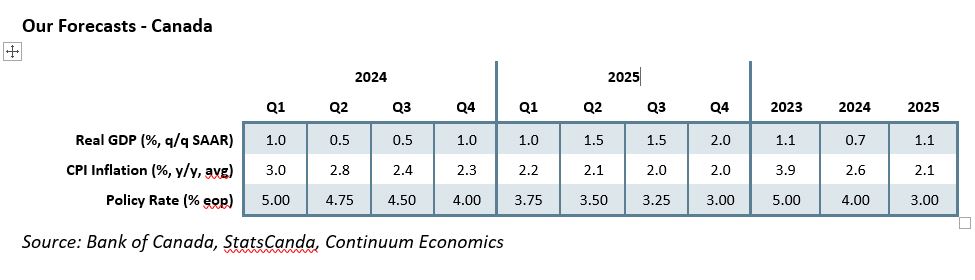

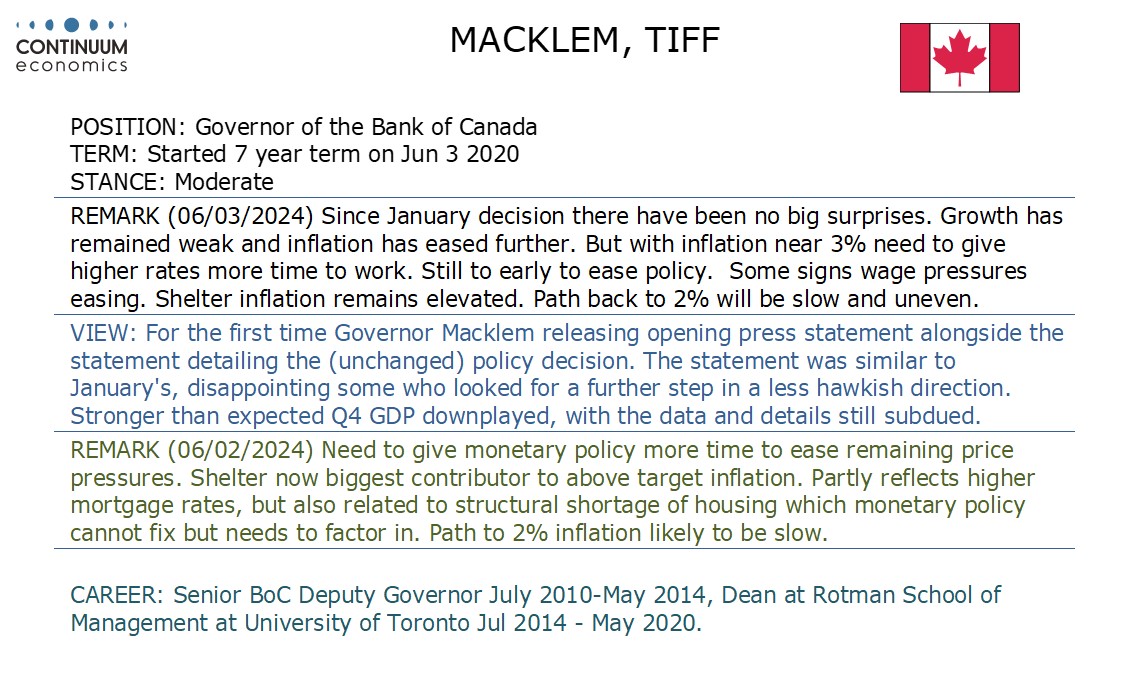

The Bank of Canada left both rates (at 5.0%) and its forward guidance unchanged in its latest statement. A rate cut at the next meeting in April now looks unlikely, and while we continue to project a move in June it is now a close call between June and July for when the BoC starts to cut rates.

This meeting saw the BoC release its press conference opening statement alongside the policy statement, and there was more detail in the former than the latter. Governor Tiff Macklem stated that there were no big surprises since the last statement in January. Q4 GDP at 1.0% annualized did exceed a flat projection made in January but Macklem described it as weak and below potential, while the statement noted that the gain was dependent on a large rise in exports. January CPI at 2.9% yr/yr was below the BoC’s Q1 forecast of 3.2% on lower goods inflation but the statement sees yr/yr and 3 month measures of core inflation as running in a 3.0-3.5% range and expects the pace to remain near 3% during the first half of 2024 before gradually easing. The statement reiterated January’s concern about persistence in underlying inflation and wants to see further and sustained easing in core inflation. Macklem stated that shelter inflation remains elevated and mote broadly underlying price pressures persist. Macklem stated it is still too early to consider lowering the policy rate.

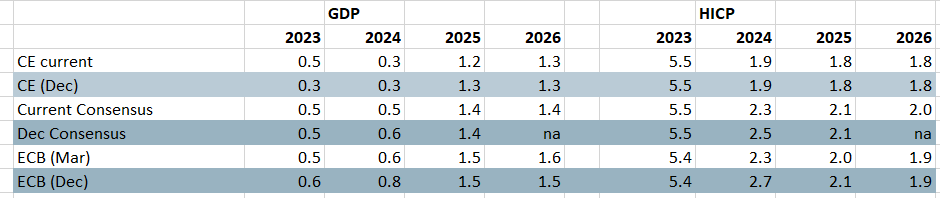

Figure: ECB Forecasts in Perspective

Source: Bloomberg, ECB, Continuum Economics

With the ECB staff updated forecasts pointing to headline inflation below target somewhat earlier, now in H2 2025 and then through 2026, and the core rate at target on the basis of market rate pricing of future official rates two years hence some 150 bp below current levels, this implies a tacit Council endorsement of that rate profile. The rejigged rhetoric probable reflects what are still divisions within the Council but where the doves may be getting the upper hand as inflation surprises on the downside. We continue to envisage rate cuts if 75-100 bp this year starting in June with something similar though 2025. Indeed, President Lagarde’s comments were consistent with June moves, provided no upside surprises are seen.

As the Figure highlights, the ECB made negligible changes to the real economy outlook. The changes to inflation outlook were also not marked but, more importantly, also much more meaningful. Indeed, HICP inflation forecasts have largely been revised down, in particular for 2024 which mainly reflects a lower contribution from energy prices but where the target is now undershot two quarters earlier (ie from H2 next year) and stays below through 2026 (Figure 2). As notable, the core inflation projections (excluding energy and food) have also been revised down and average 2.6% for 2024, 2.1% for 2025 and 2.0% for 2026, the first time that the core has been consistent with target in the current cycle.

This has come alongside hardly any changes in the real economy outlook, with the ECB pointing to the economy picking up and growing above trend at 1.5% in 2025 and 1.6% in 2026, supported initially by consumption and later also by investment. We think this is optimistic. But the point is that the ECB still accepts that even this real economy outlook delivers price stability, if not a slight target undershoot and this on the basis of that economic outlook encompassing official rates cuts of some 150 bp over the course of the next two years or so. The ECB projections use official rates roughly averaging 2.4% in both 2025 and 2026 (based on market based assumptions). In other words, the ECB is at least implicitly endorsing market rate thinking.

The BoJ has signaled monetary policy changes soon with March on the cards after headline labor cash earning reached 2% in the January report and early result from the spring wage negotiation has suggested wage hike will be even larger than last year. Combined with an expected rebound in National CPI (previewed by Tokyo CPI), the BoJ may find a window for them to move their monetary policy as data allows them. Our central forecast remain a change in forward guidance in the March meeting, followed by a hike to bring interest rate to 0% in April and removal of YCC. Yet, we may not know until "leaks" one day ahead of the March meeting.

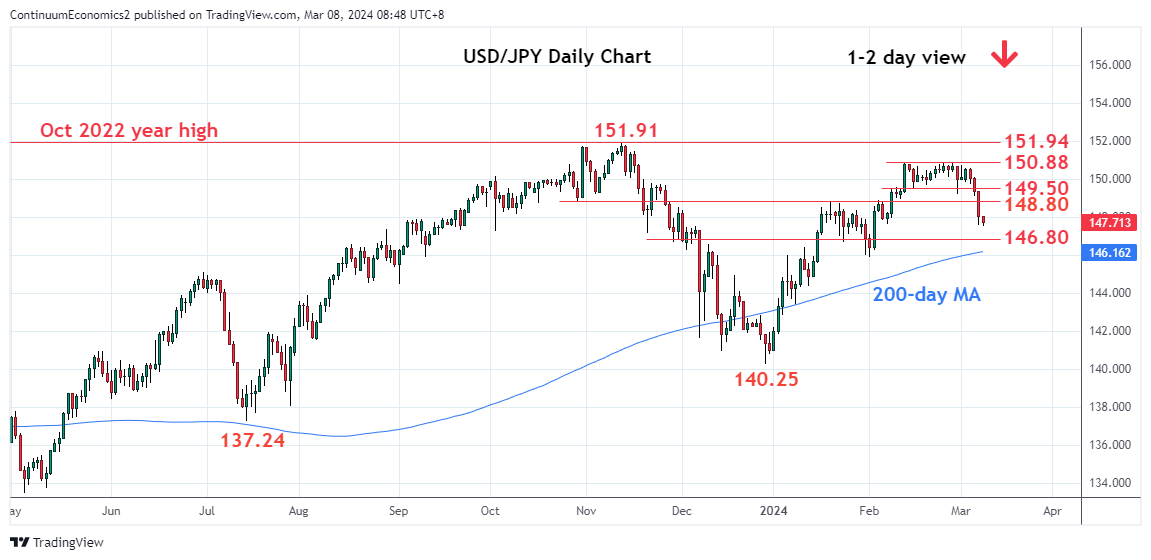

On the chart, further extend sharp losses to reach the 148.00/147.60 area where selling pressure has given way to consolidation as prices unwind the oversold intraday studies. However, the downside still not firm and lower will see room to the 147.00 level then the 146.80, 38.2% Fibonacci level. Lower still will open up the February low at 145.89. Meanwhile, resistance is lowered to the 148.80/149.00 area and this should now cap corrective bounce and sustain the bearish pressure from the 150.88, February YTD high.