Preview: Due December 15 - Canada November CPI - Slightly firmer but not on the key core rates

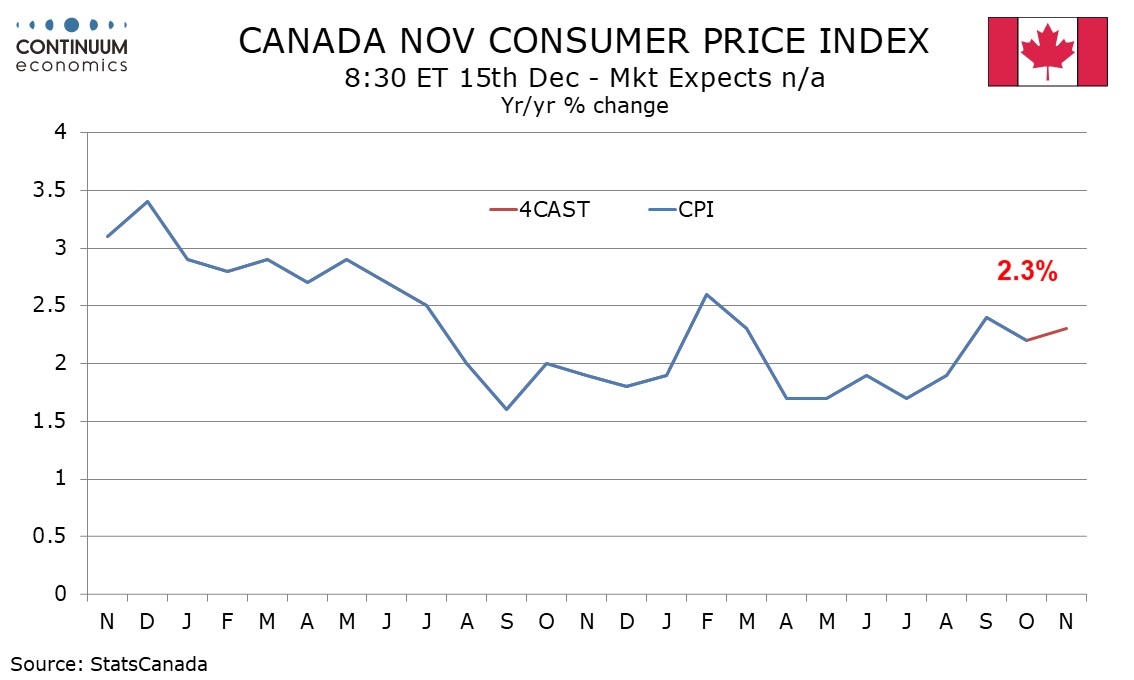

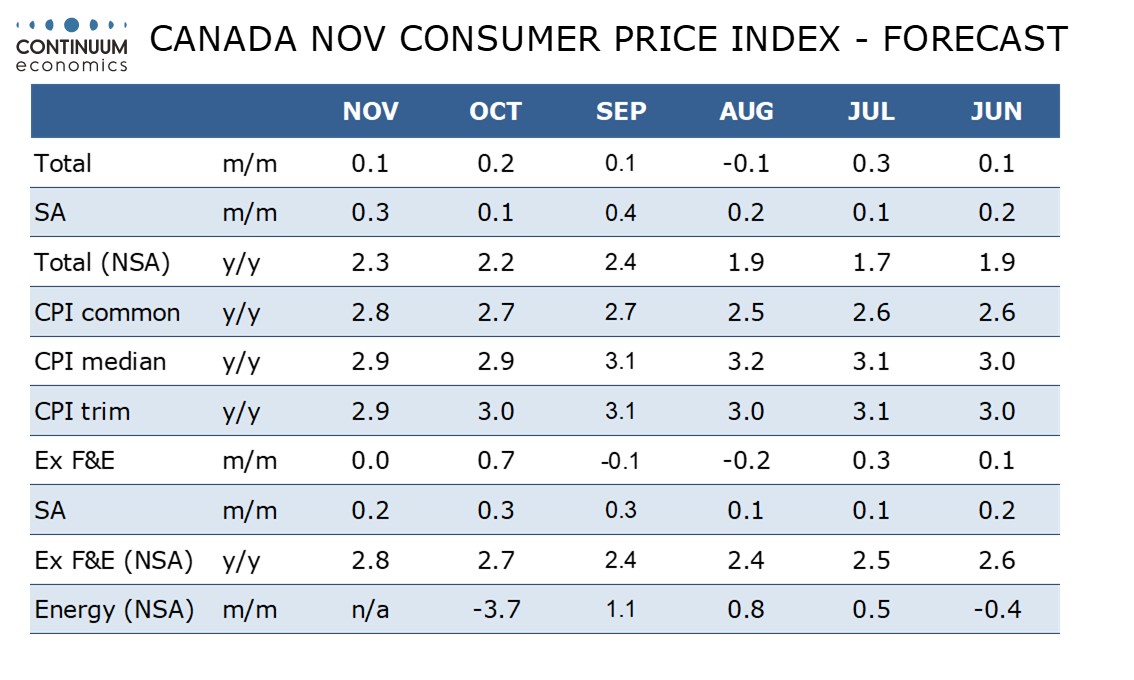

We expect November’s Canadian CPI to increase to 2.3% yr/yr from 2.2% in October, suggesting Q4 is likely to exceed a Bank of Canada forecast of 2.0% made in October. However, risk on the Bank of Canada’s core rates leans to the downside.

On the month we expect seasonally adjusted gains of 0.3% overall, lifted by gasoline, and 0.2% ex food and energy, the latter following two straight gains of 0.3% that came after two straight gains of 0.1%, Strength in October’s shelter component is unlikely to be repeated.

Unadjusted we expect overall CPI to rise by 0.1% with ex food and energy unchanged. With a soft November 2024 dropping out, we expect the yr/yr ex food and energy rate to increase to 2.8% from 2.7%. Overall CPI remains restrained by around 0.7% due to April’s abolition of a carbon tax.

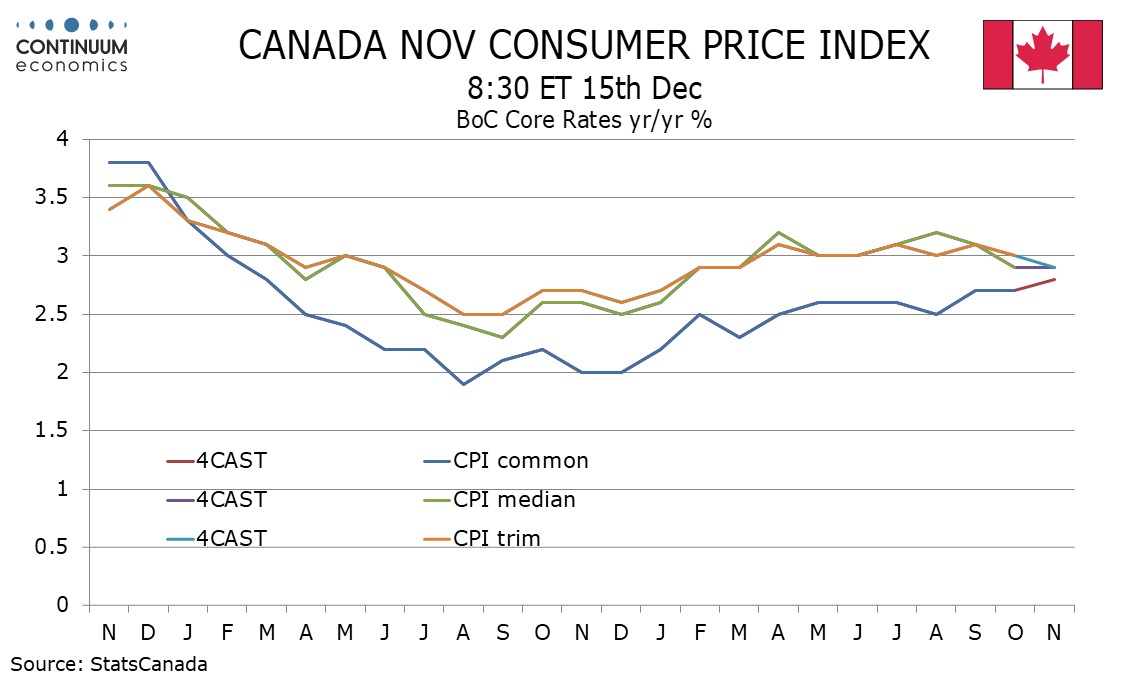

The ex food and energy rate is not one of the BoC’s three core rates. Here we expect CPI-Common to increase to 2.8% from 2.7%, but CPI-Median, which we expect to remain at 2.9%, and CPI-Trim, which we expect to slow to 2.9% from 3.0%, have less of an issue with year ago weakness dropping out. CPI-Median and CPI-Trim are more important to the Bank of Canada than CPI-Common.