Published: 2024-04-23T15:50:11.000Z

Preview: Due May 1 - U.S. April ISM Manufacturing - Holding just above neutral

Senior Economist , North America

3

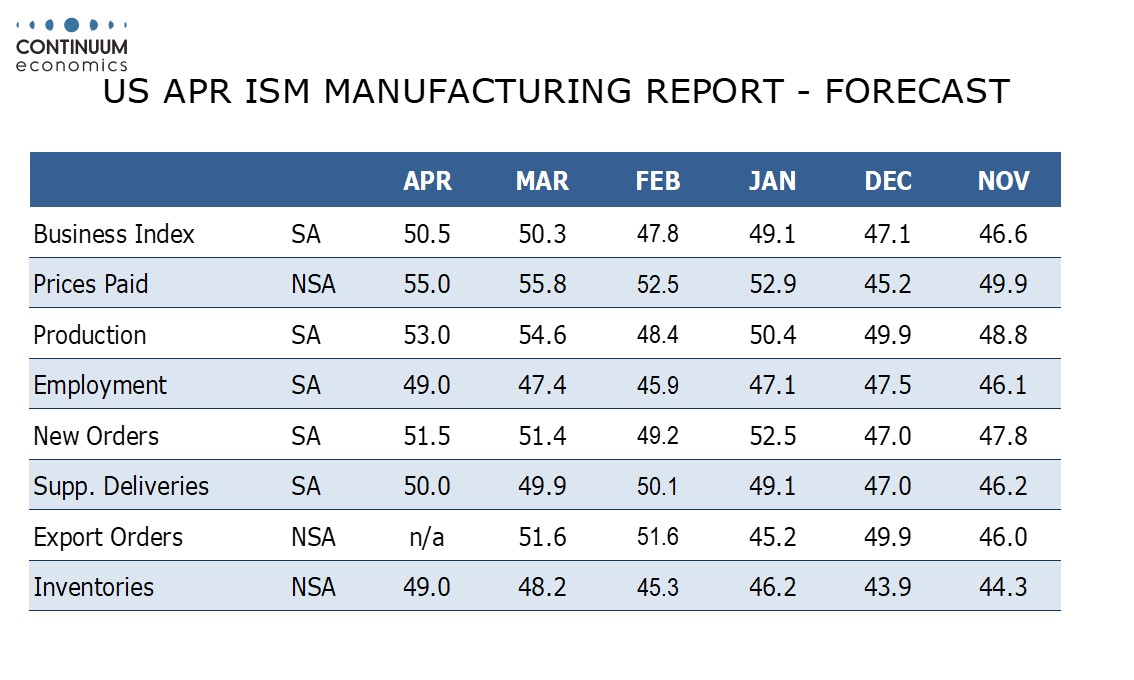

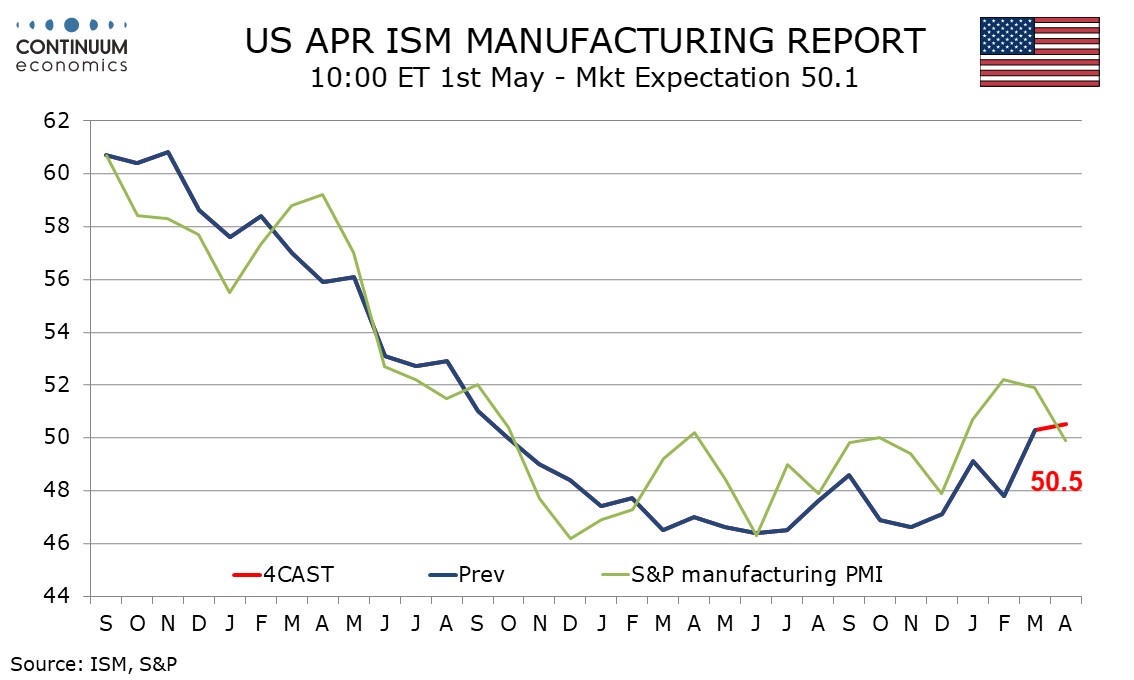

We expect an April ISM manufacturing index of 50.5, marginally improved from March’s 50.3 which was the strongest reading since September 2022.

The improvement from February’s weaker 47.8 was assisted by more favorable seasonal adjustments while February’s dip from January’s 49.1 was largely due to tougher seasonal adjustments. April’s seasonal adjustments are similar to March’s, implying little change in the index.

ISM downside risks are greatest in production after a stronger 54.6 reading in March. We expect new orders and deliveries to be little changed at 51.5 and 50.0 respectively but some improvement in employment and inventories, both of which were below 50 in March. Prices paid do not contribute to the composite. Here we expect a correction lower to 55.0 after March at 55.8 saw its highest reading since July 2022.