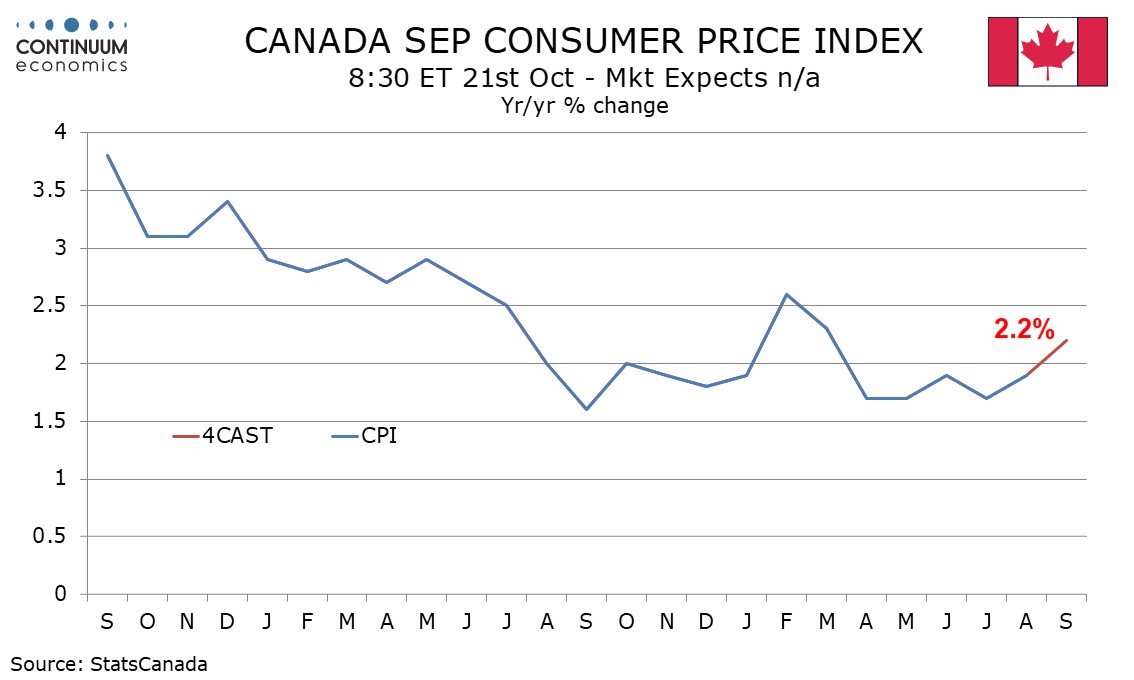

Preview: Due October 21 - Canada September CPI - Higher as year ago weakness drops out

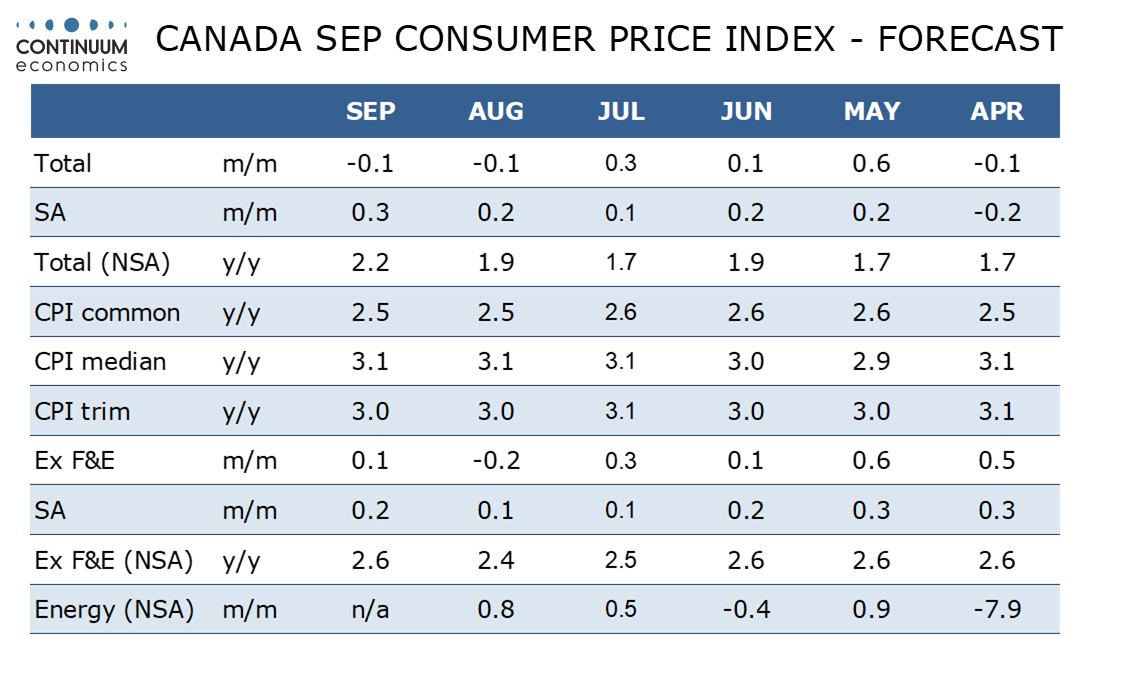

We expect September Canadian CPI to pick up to 2.2% yr/yr from 1.9%, in part on year ago weakness dropping out. The Bank of Canada’s core rates are likely to remain stable, and above the 2.0% target. The yr/yr headline rate will remain restrained by around 0.7% due to April’s abolition of the carbon tax.

On the month the data is likely to look soft before seasonal adjustment, with a 0.1% decline overall and a 0.1% increase ex food and energy rate unchanged. However seasonally adjusted we expect stronger gains, overall CPI at 0.3% and ex food and energy at 0.2%.

This would still leave the seasonally adjusted ex food and energy picture looking quite subdued, though a third straight 0.1% increase may be difficult to achieve. Gasoline prices are likely to fall before seasonal adjustment5, but see a second straight positive contribution to the seasonally adjusted CPI. We expect the yr/yr ex food and energy rate to rise to 2.6% from 2.4%.

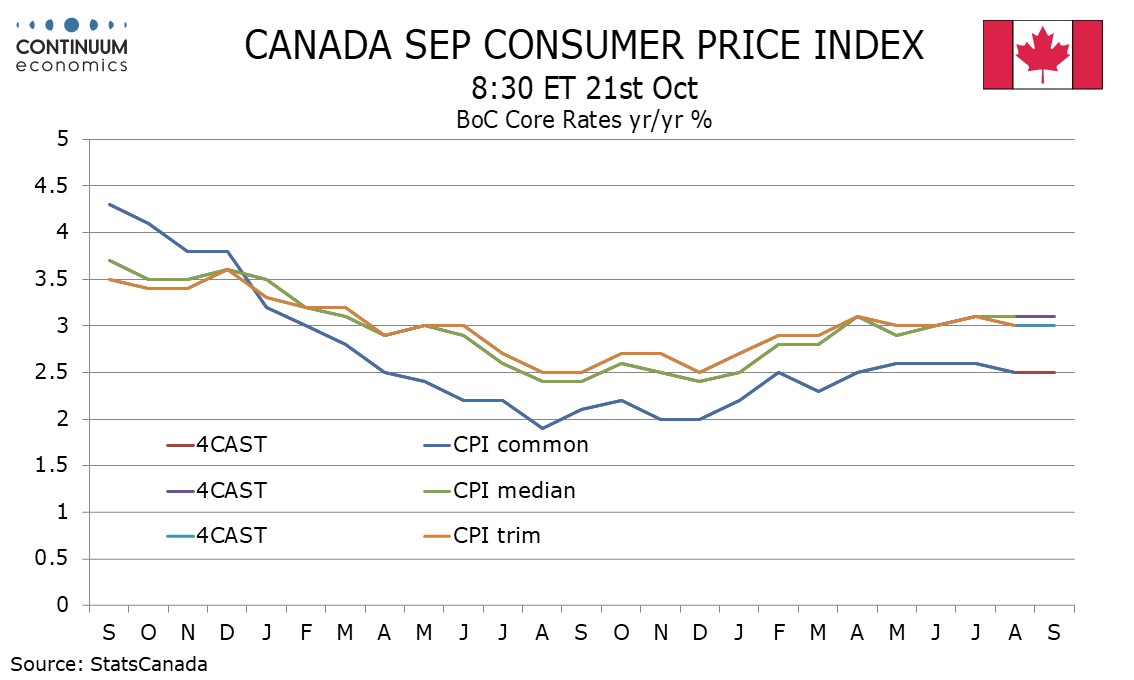

The ex food and energy rate and the BoC’s three core rates are less impacted by the end of the carbon tax than the overall pace. We expect the core rates to remain stable, with CPI-Common at 2.5%, CPI-Median at 3.1%, and CPI-Trim at 3.0%. Risk however leans to the upside given year ago weakness.