SEK, EUR flows: SEK firmer after higher CPI, EUR steady after recovery in German orders

Swedish CPI rises sharply, German orders recover but trend remains uncertain

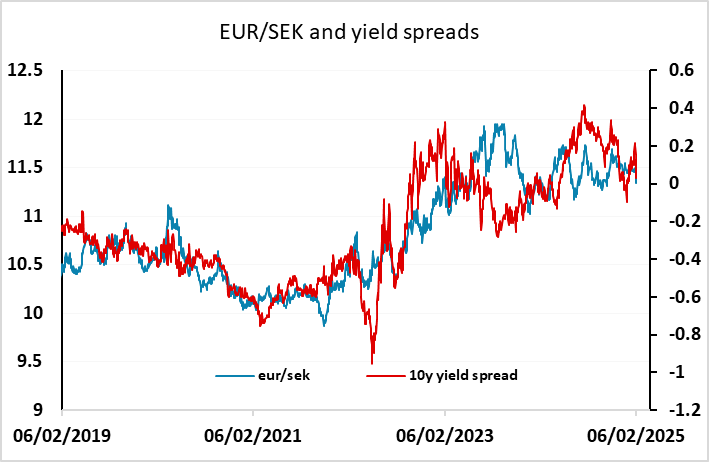

Thursday kicks off with two much stronger than expected data prints in Europe. Swedish CPI inflation rose sharply to 1.0% y/y headline from 0.8%, and 2.2% y/y from 1.5% on the targeted CPIF measure, against market consensus of 0.5% and 1.6% respectively. This should kill any hopes of a near term rate cut from the Riksbank, and may mean we have seen the last rate cut of the cycle. As it was, the market was only pricing in one more cut, and that is no longer fully priced in, with 2 year Swedish yields up 9bps after the data. EUR/SEK has only fallen modestly to 11.33 from an open at 11.35, but there is scope for more downside to 11.30, even though the starting point was a little expensive relative to yield spreads.

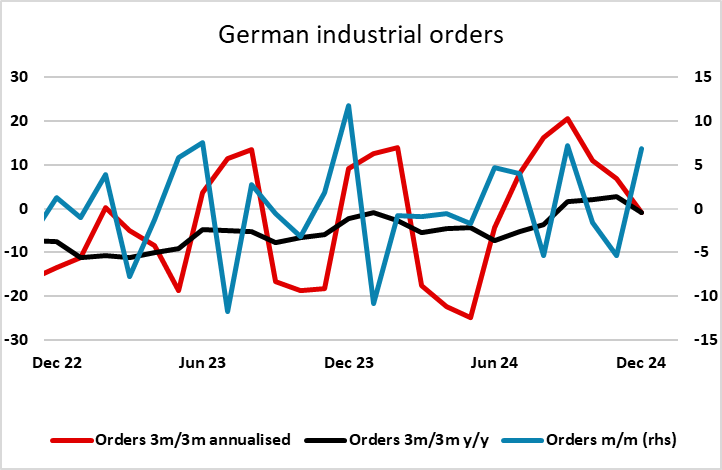

We have also seen much stronger than expected December German factory orders, but these are very volatile, and followed a much weaker than expected November. The December numbers prevented a sharp weakening in the trend, but the average of the last two months is still well below the October levels, so a better January number is still required to suggest the improving trend seen towards the end of last year is continuing. There has been no initial impact on the EUR.