Published: 2026-01-06T14:50:09.000Z

Preview: Due January 7 - U.S. December ISM Services - Headline and prices paid to slow

4

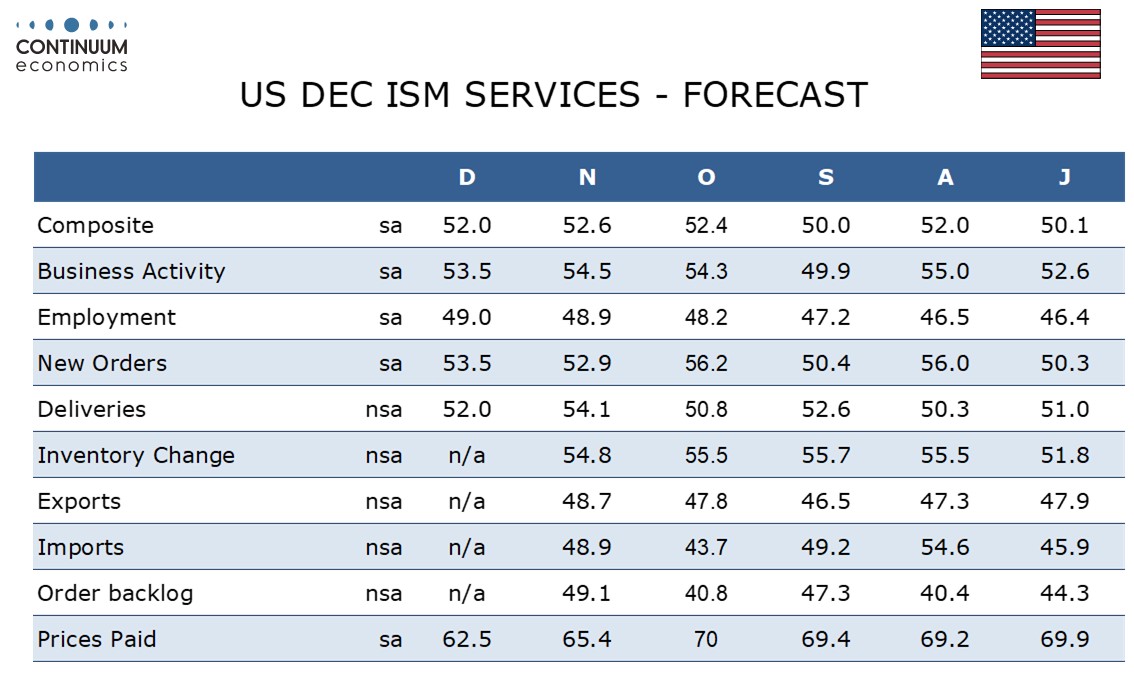

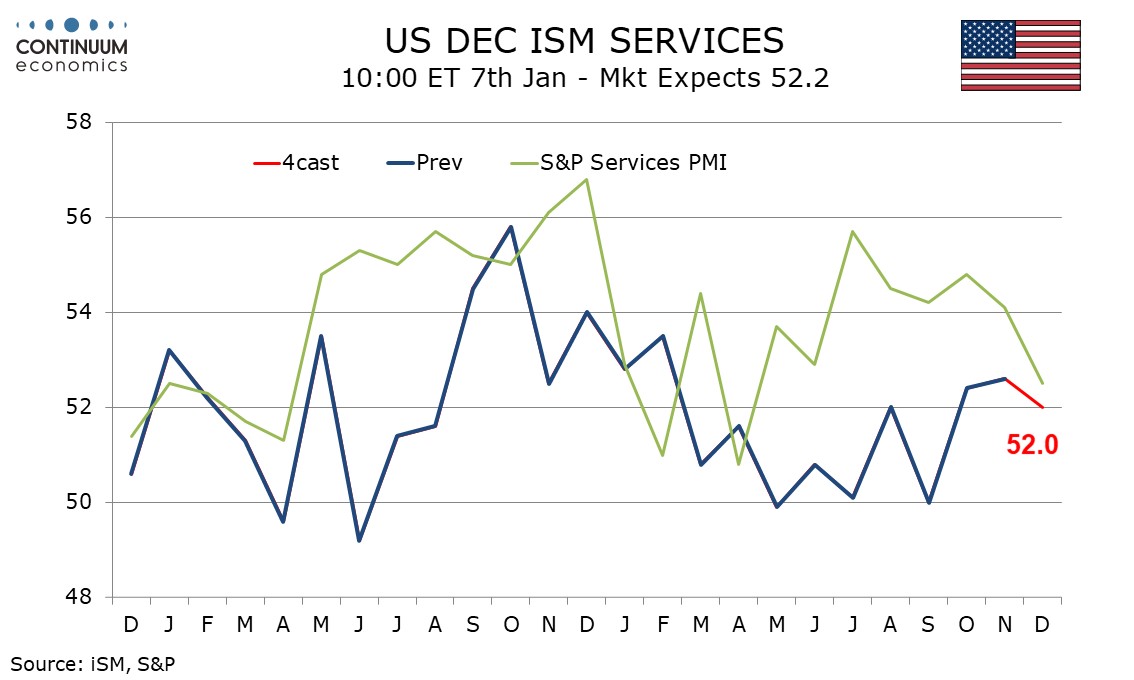

We expect December’s ISM services index to slip to 52.0 from November’s 9-month high of 52.6. A weaker December S and P services PMI suggests downside risk with its revised level of 52.5 from 52.9 now marginally below November’s ISM services index. Regional Fed service sector surveys are mostly still negative, if little changed from November.

The S and P’s service index was flattered in November by a strong rise in delivery times to 54.1 from 50.8 and we expect a correction back to 52.0 in December. We see both business activity and new orders at 53.5, the firmer down from 54.5 but the latter up from 52.9. We expect a marginal rise in employment to 49.0 from 48.9 to complete the breakdown of the composite.

Prices paid do not contribute to the composite and here we expect a fall to 62.5 from 65.4, extending a slowing from October’s reading of 70.0 that was the highest since October 2022. A second straight fall would suggest inflationary pressures from tariffs are peaking.