EUR, JPY, CAD, USD flows: German CPI near consensus. USD strength extends on tariffs, end of month, but...

German CPI close to consensus, EUR/USD to hold near 1.04. USD strength on tariffs and end of month can extend to end of day fixings, but JPY decline looks overdone

State CPIs suggest national German CPI will be close to consensus. NRW, Bavaria and Saxony are all seeing a 0.1% decline in the y/y rate in February, but the others are showing either no change or a rise, and the consensus for the national number is for the y/y rate to remain unchanged at 2.3%, although the HICP version is seen declining to 2.7% from 2.8%. German yields are not much changed after falling earlier in the session, and EUR/USD remains close to 1.04.

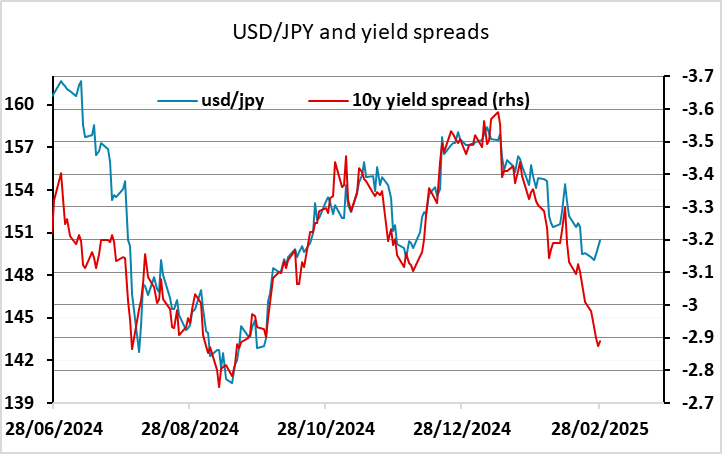

The USD has been generally stronger in the last 24 hours, some of which may relate to end of month rebalancing flows, some to the renewed threat of tariffs on Canada and Mexico being introduced next week, which has certainly impacted USD/CAD. If end of month flows are involved the firmer USD tone should continue until at least the 16:00 GMT fixing. Certainly, other than end of month flows or some technical corrective pressures, it’s hard to see a reason for the JPY weakness this morning. While the Tokyo CPI data overnight was a touch weaker than expected, yield spreads continue to point to potential for sharp JPY gains, and weaker equities and tariff concerns should benefit the JPY, albeit more on the crosses than against the USD, at least initially. There is scope for the USD/JPY correction to extend to the 151 area, but we would expect JPY buyers to emerge there.