Preview: Due June 4 - U.S. May ISM Services - Slowing in trend to persist

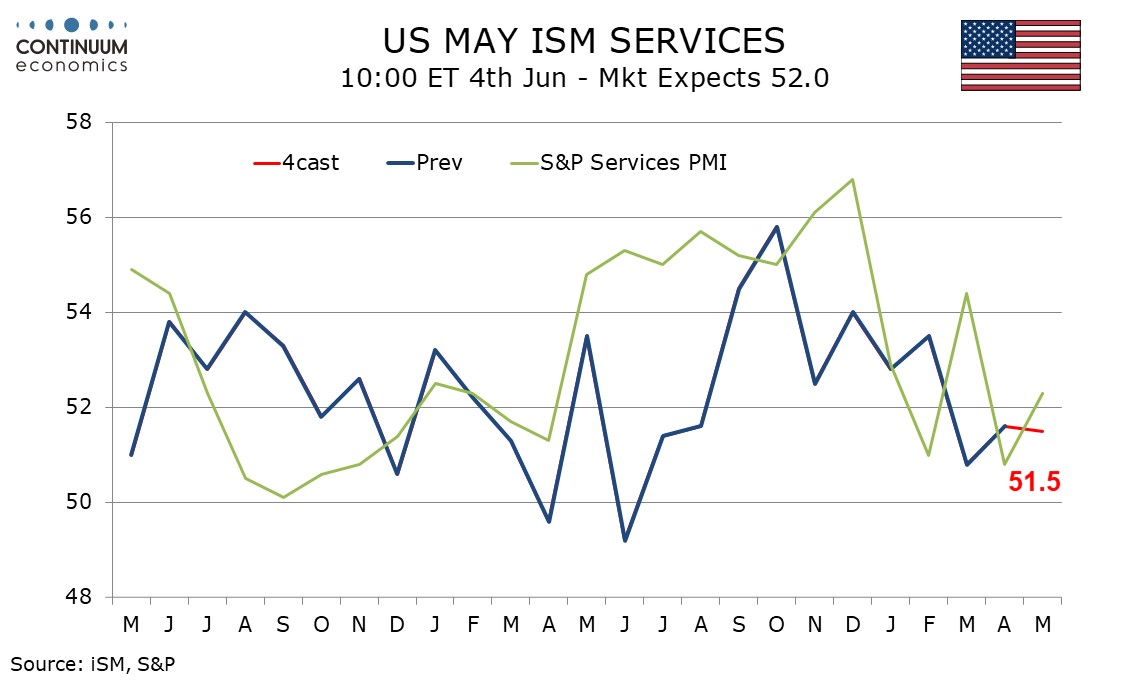

We expect a May ISM services index of 51.5, almost unchanged from April’s 51.6 that saw a modest recovery from a weaker though still marginally positive 50.8 in March. Underlying trend has slowed in recent months.

While May’s S and P services PMI did correct higher after a weaker April, it too has slowed significantly in recent months and is not a reliable guide to the ISM services index. Most Fed regional service sector surveys remained negative in May, though the Kansas City Fed services index did see a bounce.

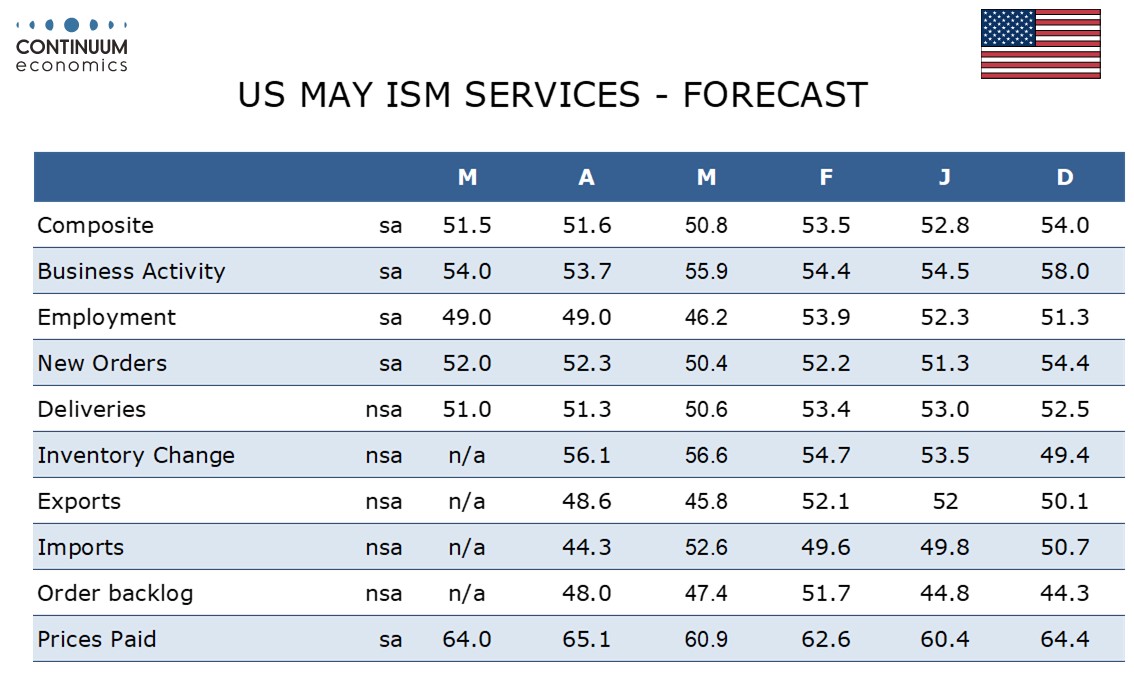

We do not expect much change in any of the four components that make up the ISM services composite in May. Tougher seasonal adjustments may restrain new orders. We expect a modest rise in business activity, a modest slowing in deliveries and stable employment slightly below neutral.

Prices paid do not contribute to the composite and here we expect a modest correction lower to 64.0 from April’s 65.1, which was the highest reading since January 2023, probably fueled by tariffs.