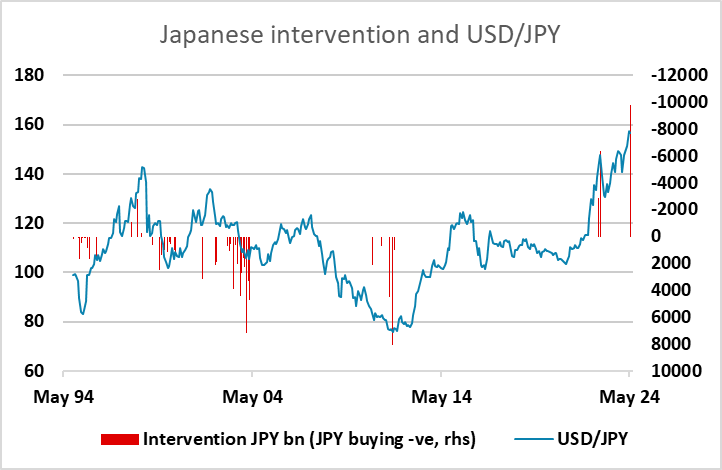

JPY flows: MoF announced record JPY buying intervention

The Japanese authorities bought JPY 9.788 trn in the April 26-May 29 period

Japan spent JPY 9.788 trn (around USD 62bn) on intervention in the period between April 26 and May 29, the largest JPY buying operation they have ever conducted in a month. This is also larger than the largest JPY selling operation in October 2011, which amounted to JPY 8.07trn, although in USD terms this was a larger operation as the JPY has more than halved in value against the USD over the period. Thus far, of course, the intervention has been quite ineffective, as USD/JPY is back at the intervention levels, but it does suggest the Japanese authorities are quite serious about the operation. The intervention represents a small proportion of Japans FX reserves, which were at USD1.136 trn at the end of April.

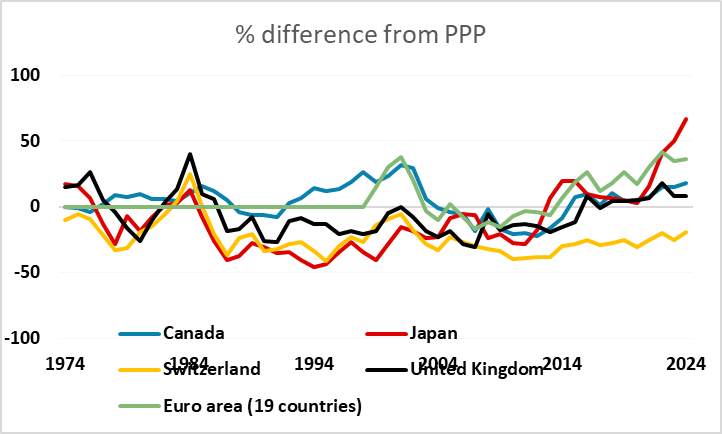

USD/JPY has edged a little lower after the data was released, but remains very close to the levels the Japanese authorities intervened. The weakness of the JPY now is much more extreme than its strength in October 2011 when they made their record JPY selling intervention. Then, USD/JPY was around 30% below Purchasing Power Parity against the USD. Now, it is around 66% above it. Such weakness is historically unprecedented, not just for the JPY, but for any major currency, so we doubt the Japanese authorities will allow it to extend.