This week's five highlights

U.S. January Core PCE prices match Core CPI

USD/JPY The Moment of Truth

RBNZ Sees No Hikes in Sight

German Inflation Drop But Services Still Resilient

China Authorities Views and Policy Changes

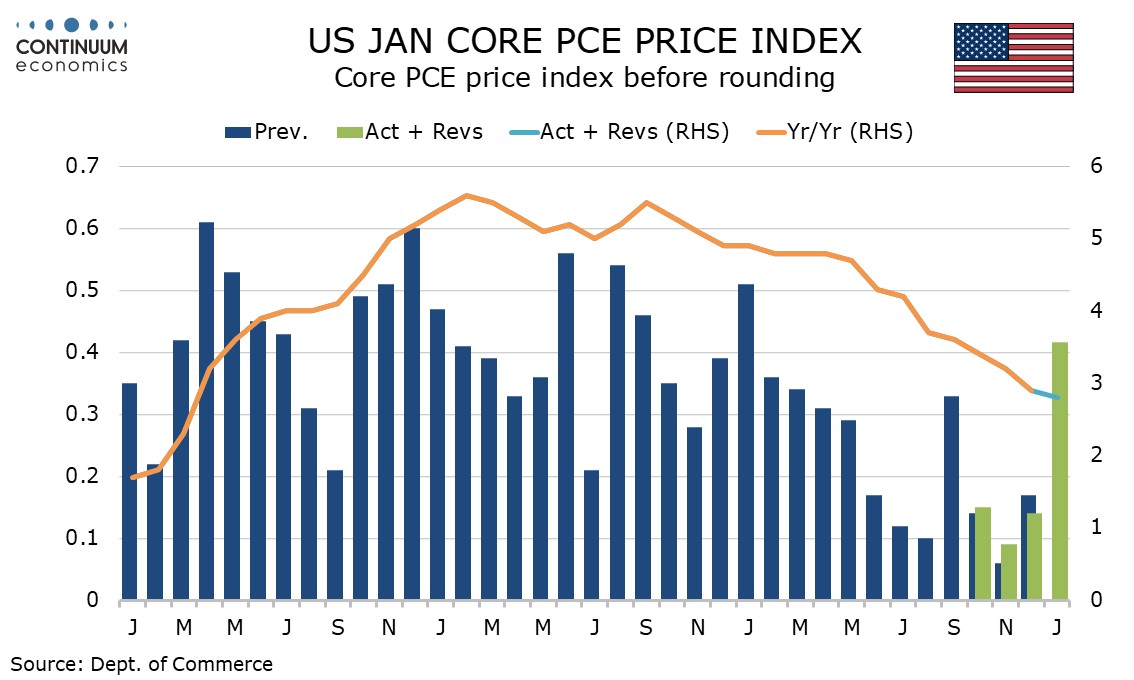

January’s PCE price data has matched the strength of the CPI, rising 0.3% overall and 0.4% in the core rate, and while as expected is a break from a string of encouraging inflation data in late 2023. Personal spending saw a weak 0.2% rise as expected but personal income saw a stronger than expected 1.0% increase on government benefits, though this was offset by a sharp rise in tax payments. The core PCE price index actually increased by 0.416% before rounding, marginally exceeding a 0.392% core CPI and contrasting a recent tendency of core PCE prices to underperform. Like the CPI PCE price data was subdued for goods, falling by 0.2%, but saw a strong 0.6% increase in services.

December core PCE price data was revised lower, to 0.1% from 0.2%, but we already knew from the GDP revisions that Q4 had been revised marginally higher, to 2.1% annualized from 2.0%. Yr/yr core PCE prices slipped marginally to 2.8% from 2.9% while overall PCE prices fell to 2.4% from 2.6%. The strength of the January data probably reflects one-time price gains brought in for the new year, and few will expect a string of 0.4% core PCE price gains to follow. However the price gains are likely to stick, with the above tend month followed by an on trend month rather than a correction below trend, and the fact prices were raised in the new year shows that pricing power persists.

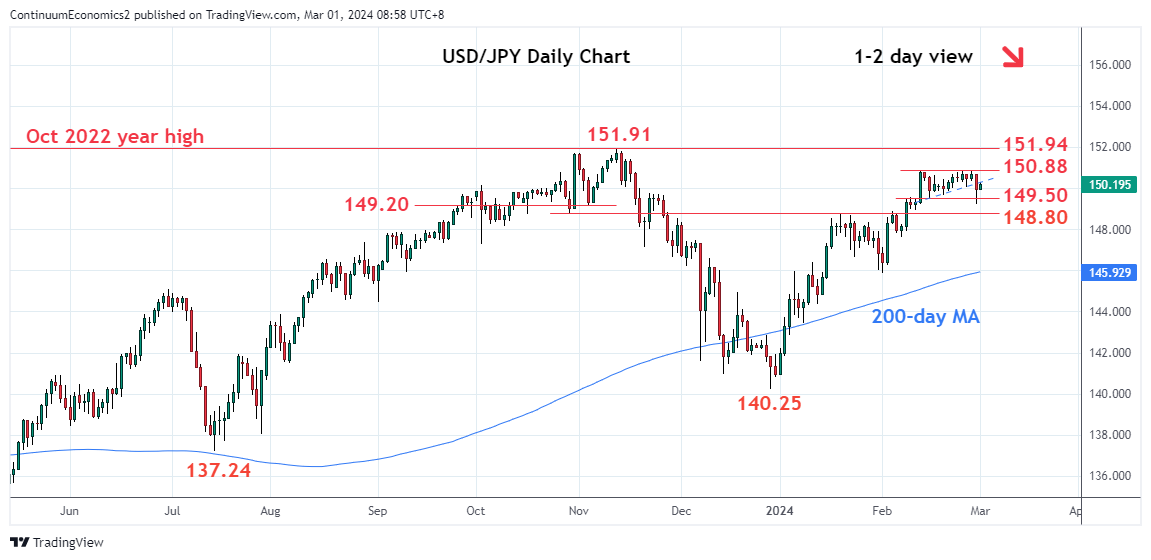

The moment of truth seems to be coming for USD/JPY. BoJ's Takata led the charge with saying spring wage negotiation seems to be going good and trend inflation target is in sight, which implies monetary policy could be changed to accommodate current inflation picture. USD/JPY saw a quick dip of half a percent as it is the first time a BoJ official saying trend inflation target to be so close, along with expected strong wage growth. And on Friday, we heard from Ueda speaking in Brasil with a copy and paste speech, which sees USD/JPY recovering some lost grounds. However, once it is set in motion, it will be unlikely to reverse as we suspect the correction in USD/JPY may be beginning for market participants realize the monetary policy changes are coming.

On the chart, the break of the 150.00 level saw sharp dive through the 149.50 support to reach the strong support at 149.20/148.80 area. Subsequent bounce from the 149.20 low see prices unwind the stretched intraday studies and lower high sought to further pressure the downside later. Clear break of the 149.50 support will expose the 149.20/148.80 area to retest and where break will see room for extension to the 148.00 level. Meanwhile, resistance is lowered to 150.50 congestion ahead of the 150.88 high, which expected to cap.

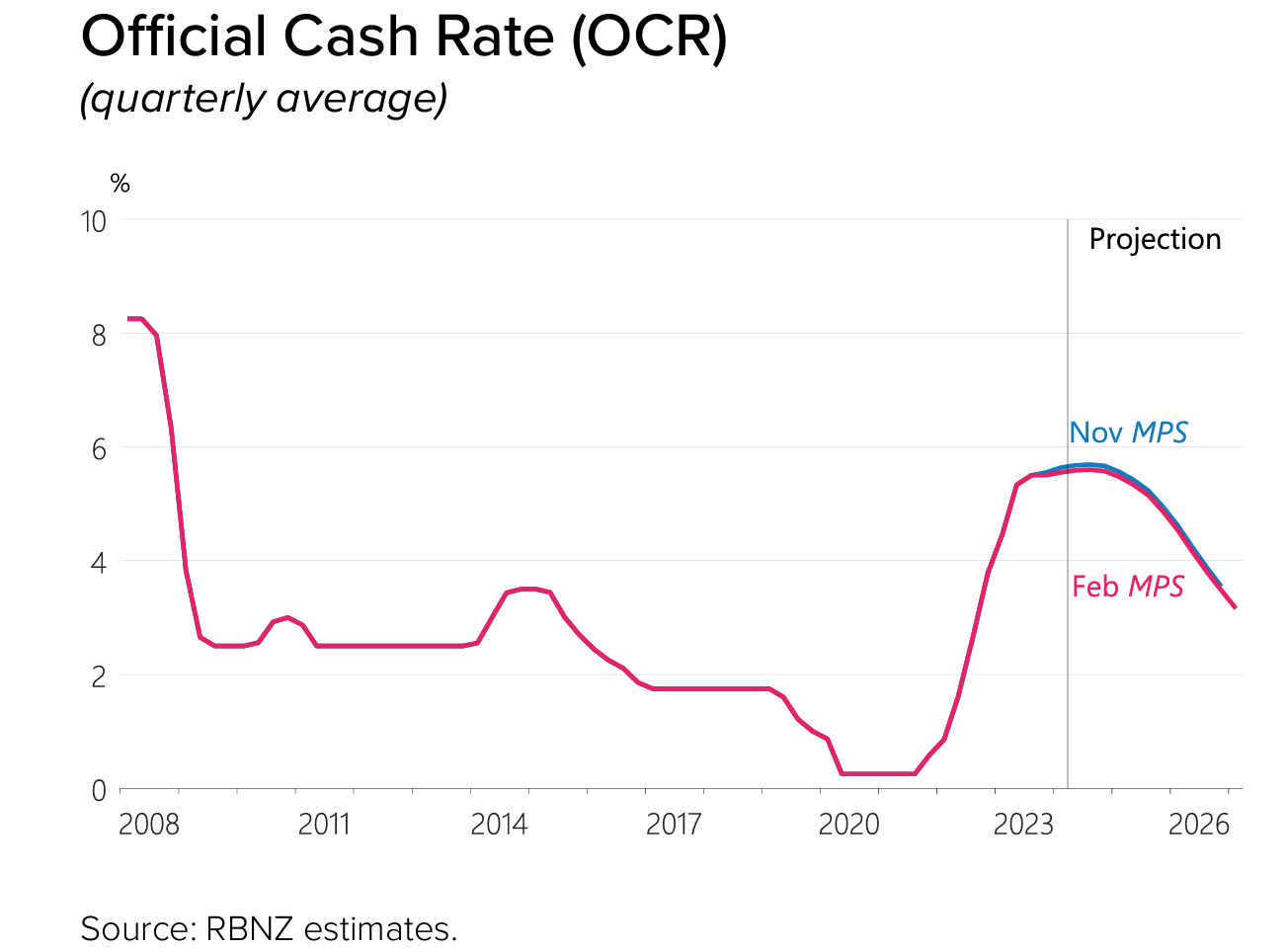

The key to the February meeting from the RBNZ is that while they recognize inflation will be higher than forecast in 2024, there will be no more rate hike as the RBNZ is confident current restrictive rates is sufficient in bring inflation back to target range. To the contrary, the RBNZ has revised the OCR forecast marginally lower from the November forecast, which is essentially a reversal of previous upward revision. Neither revision ig enough to call for a rate hike or cut. The RBNZ forecast inflation to be higher in 2024 with no change to forecast in 2025. They highlighted population growth to support spending,global economic growth to be below trend and weak Chinese economic outlook, all catching the eye of the RBNZ in assess future inflation dynamic.

We believe there will unlikely be more upward revision in the coming meeting as the RBNZ has made it clear the higher 2024 headline inflation will not see a change in OCR.

Figure 1: CPI Headline Drops Further?

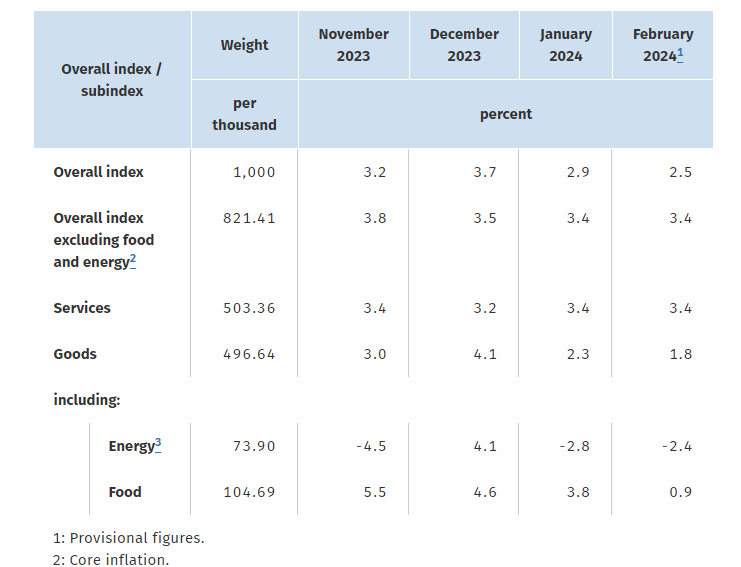

Base effects continue to distort the German HICP/CPI readings, but the January data came in a notch below expectations, and reversed half of the surge in the y/y rate seen in December. And February data continued the downtrend, as the HICP rate fell from 3.1% to 2.7%, but with no further drop in the CPI core.

Instead, the drop was purely based around lower food inflation while energy prices in February moved the other way while despite favourable base effects, there was seemingly continued momentum in services inflation, very probably a result of higher VAT being levied on restaurant meals in January still being passed on to consumers. Regardless, the disinflation backdrop is underlined by what may be still-soft core seasonally adjusted trend which may be running just around 0.1% in m/m terms and where this very creaky waning price momentum should see headline HICP below 2% by May, albeit with some swings possibly accentuated by the early Easter this year.

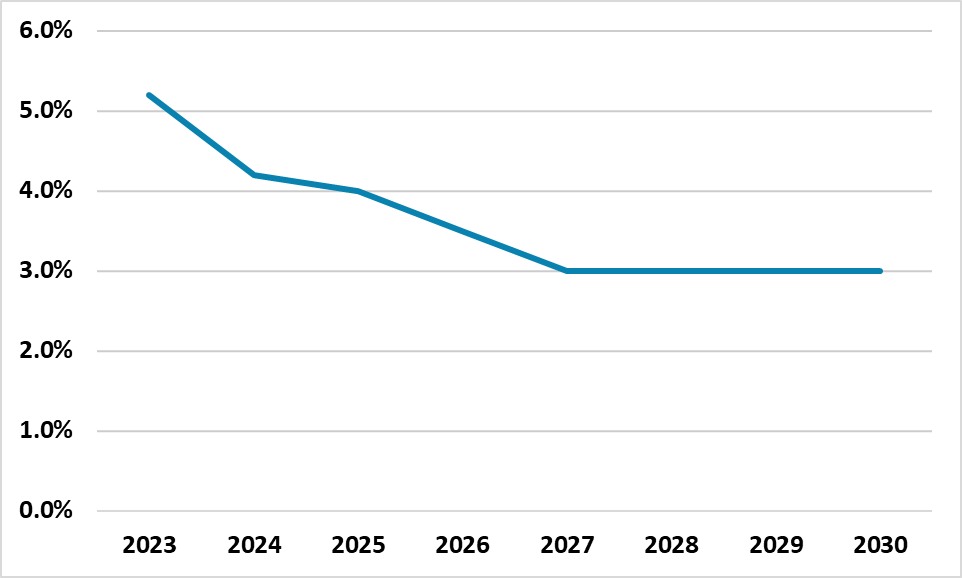

Figure: Continuum Economics GDP Forecasts (%)

China authorities leave the impression that further policy stimulus will likely be measured rather than aggressive. We feel that they are not pessimistic enough on the medium-term hangover from the residential property sector and this is why we are downbeat on 2024 GDP growth and beyond. China authorities view on 2024 GDP growth is for continued economic recovery, with a further recovery of consumption and a stabilisation of the residential property sector. The rotation to high quality growth sectors (high tech manufacturing and electric vehicles) was also seen supporting growth. The authorities were most concerned about the external sector, due to slower global growth; rising protectionism and fragmentation of globalisation. Net exports were seen to be a drag on growth.

However, China authorities are not ready to do anything about the weakness in net exports (here). We have previously noted that a significant Yuan deprecation is unlikely as it could cause domestic capital flight, with associated political tensions. Alternatively, signalling no desire for military invasion of Taiwan would help slow the speed of supply chain shifts out of China, but such a policy would be politically impossible for Beijing. On the domestic front, we fear that that hangover from the residential property sector will be a negative drag on GDP in the coming years, as the lagged effects of the construction slump feedthrough the economy. Home sales data suggest that the sector has also not stabilised yet. Even so, China authorities appears reluctant to accelerate resolving non-viable property developers or allowing quicker house price falls to clear the market and the preference is to muddle through.