Brazil GDP Review: Economy Continues Resilient

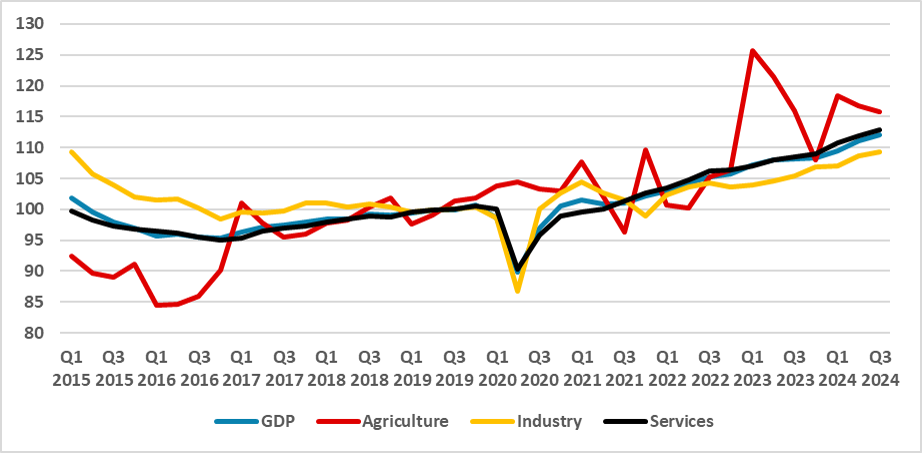

Brazil’s Q3 GDP grew by 0.9% (q/q) and 4.0% year-over-year, driven by gains in Services (+0.9%) and Industry (+0.6%), which offset a 1.4% drop in Agriculture. Household Consumption (+1.5%) and Investments (+2.1%) were key growth drivers, supported by domestic demand. Despite an unemployment rate of 6.9%, sustaining this growth may challenge inflation control. With the Central Bank raising rates and fiscal support waning, GDP is expected to slow in the next quarters. GDP is now 11% above pre-pandemic levels.

Figure 1: Brazil GDP (Seasonally Adjusted, Y/Y)

Source: IBGE

The Brazilian National Statistics Institute (IBGE) has released the GDP data for Q3. The data shows that the Brazilian economy grew by 0.9% (q/q) during Q3, more or less aligned with market expectations (0.8%) according to the Bloomberg Survey. On a yearly basis, Brazilian GDP is 4.0% higher than in the same quarter of 2023. Services grew by 0.9% in the quarter, while Industry grew by 0.6%, more than compensating for the 1.4% contraction in Agriculture.

Within the Services sector, the biggest rises occurred in Communication and IT Services (+2.1%), Other Services (+1.7%), Banking and Financing (+1.5%), and Trade (+0.8%). In the Industry sector, Manufacturing showed the highest growth, expanding by 1.3%, which offset the 1.4% decline in the Construction sector and the 0.3% drop in Mining Activities.

From a demand perspective, Household Consumption grew by 1.5%, while Government Consumption increased by 0.8%. Investments rose sharply, by 2.1% in the quarter, whereas Exports declined by 0.6% and Imports rose by 1.0%. Therefore, much of the growth in the quarter was likely driven by domestic demand, although we believe some of the growth in investment may have been generated by foreign companies producing in Brazil.

As a result, the Brazilian economy is certain to grow above 3.0% in 2024, and we believe most of this growth has been sustained by labor absorption and the fiscal push generated at the beginning of the year. The output gap is now likely entering positive territory, and the tightening of monetary policy is having little impact on economic activity. We believe the Brazilian economy has limited capacity to sustain this level of growth for much longer. Although the unemployment rate is at 6.9%, leaving some room for additional labor absorption, stronger growth will likely make it more challenging to cool inflation.

With the Central Bank of Brazil (BCB) resuming rate hikes and the likely end of the fiscal push, we believe the Brazilian economy will cool down somewhat in the next quarter, with q/q growth expected to be below 0.6%. At this moment, the Brazilian economy is 11% higher than its pre-pandemic level and is registering its highest level in the historical series.