GBP flows: Still scope for rerating despite more dovish BoE

GBP unlikely to benefit from any further rise in yields, but could still gain if there is a positive reaction to the first budget from the new government.

GBP continues to trade on the soft side today. BoE governor Bailey is due to speak at 14:30BST, and his speech should have been published by now but the BoE have yet to release it. EUR/GBP continues to find support at 0.83, after a brief break below this level on Friday. A rate cut in November is already fully priced in after recent dovish comments from Bailey, so the market will be looking more at whether he indicates a further rate cut in December, which at this stage is priced as a 75% chance.

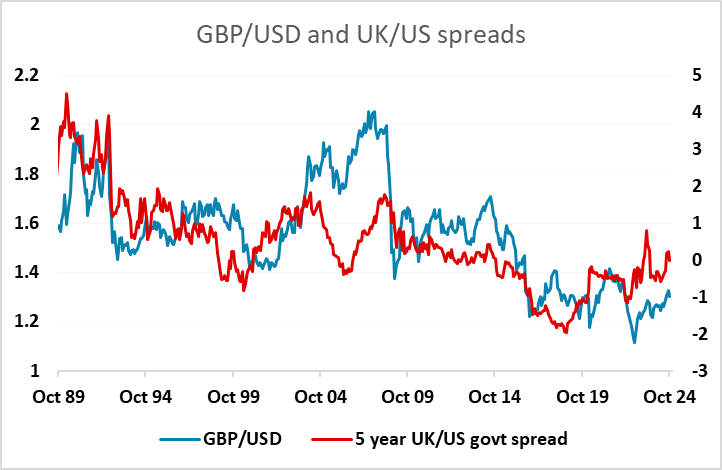

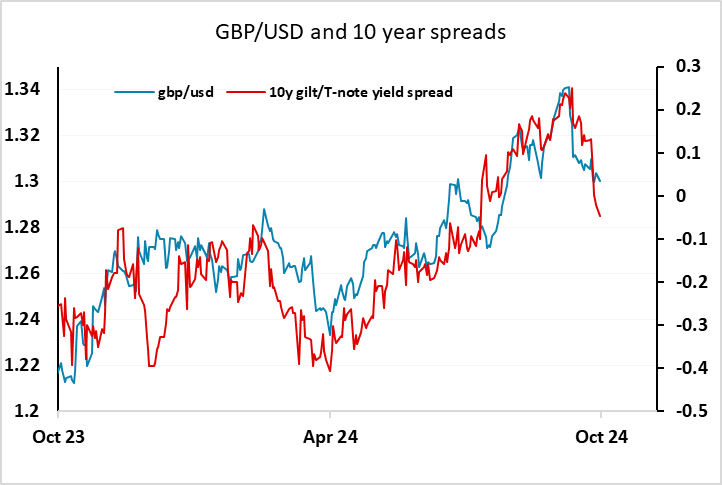

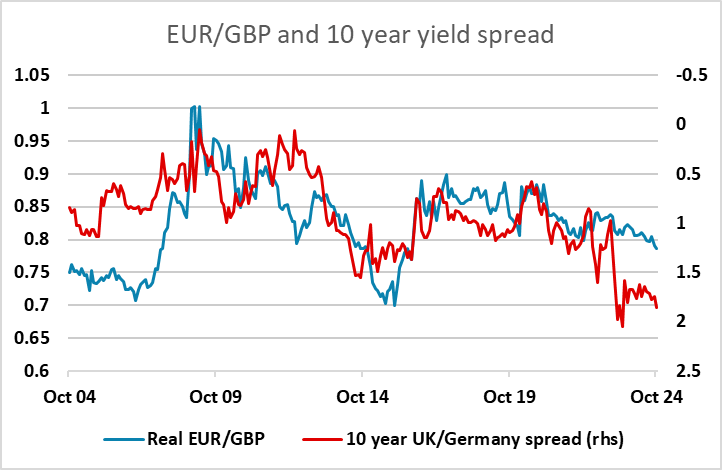

However, there is a bigger picture story for GBP related to the rise in UK yields that we saw under the short-lived Truss government. The Truss budget that triggered the rise in UK yields also triggered a sharp decline in GBP. While most of these moves have been reversed, GBP still appears to carry something of a risk premium from that period, with both EUR/GBP and GBP/USD trading somewhat lower than might be expected based on yield spreads. The first budget from the new Labour government on October 30 might therefore be significant if it is seen as setting the agenda for better fiscal management going forward. So while there is quite limited scope for GBP to benefit from rising short end yield spreads – if anything, spreads might move against the pound as there is potential for more BoE easing to be priced in – there is some potential for GBP to benefit from a reduction in risk premia. GBP is still expensive here against the EUR from a long term perspective, but with current yields could still rise further if there is a smaller (or no) risk premium attached to GBP.