This week's five highlights

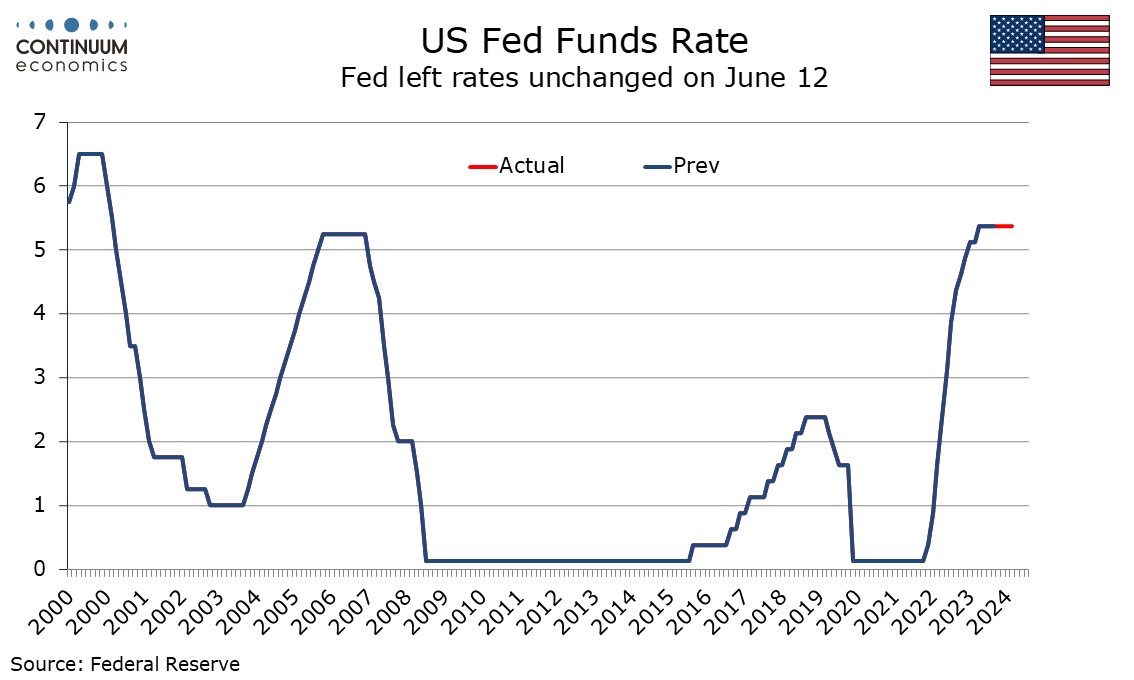

FOMC delivers hawkish 2024 dots

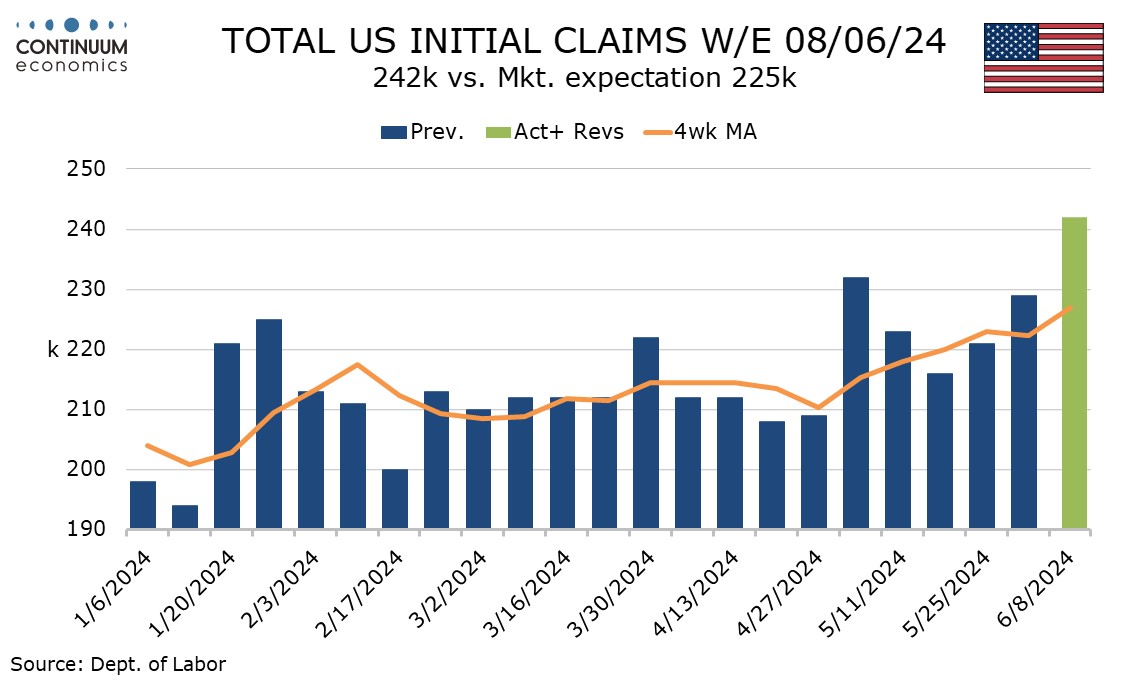

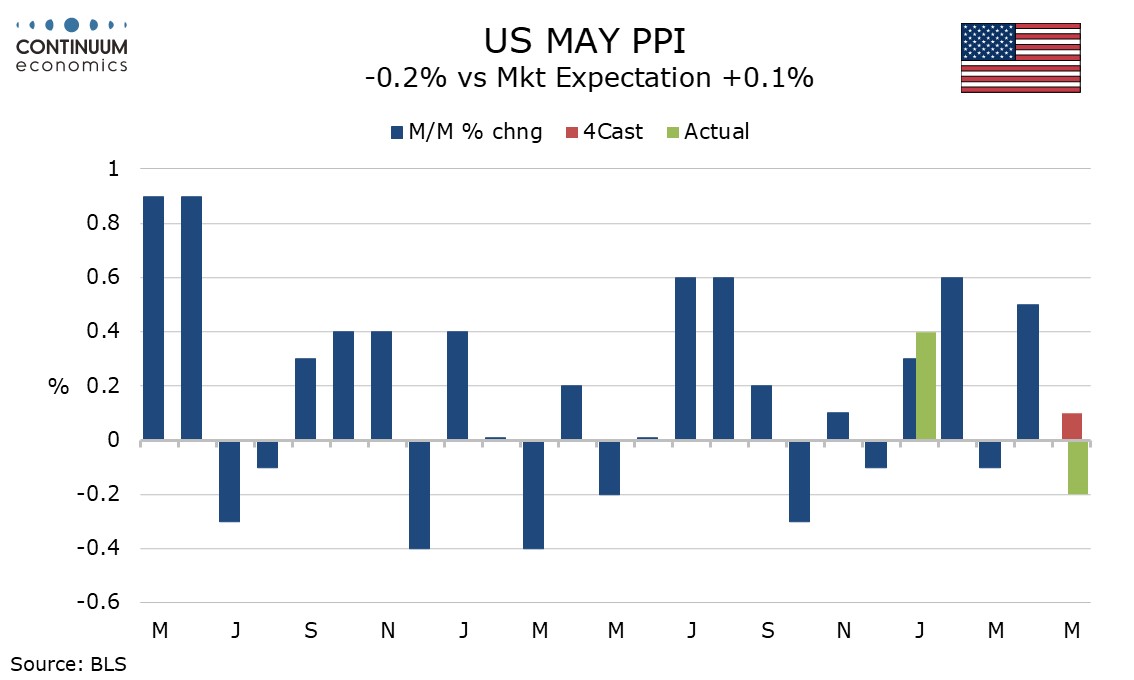

U.S. Initial Claims up sharply, May PPI corrects April strength

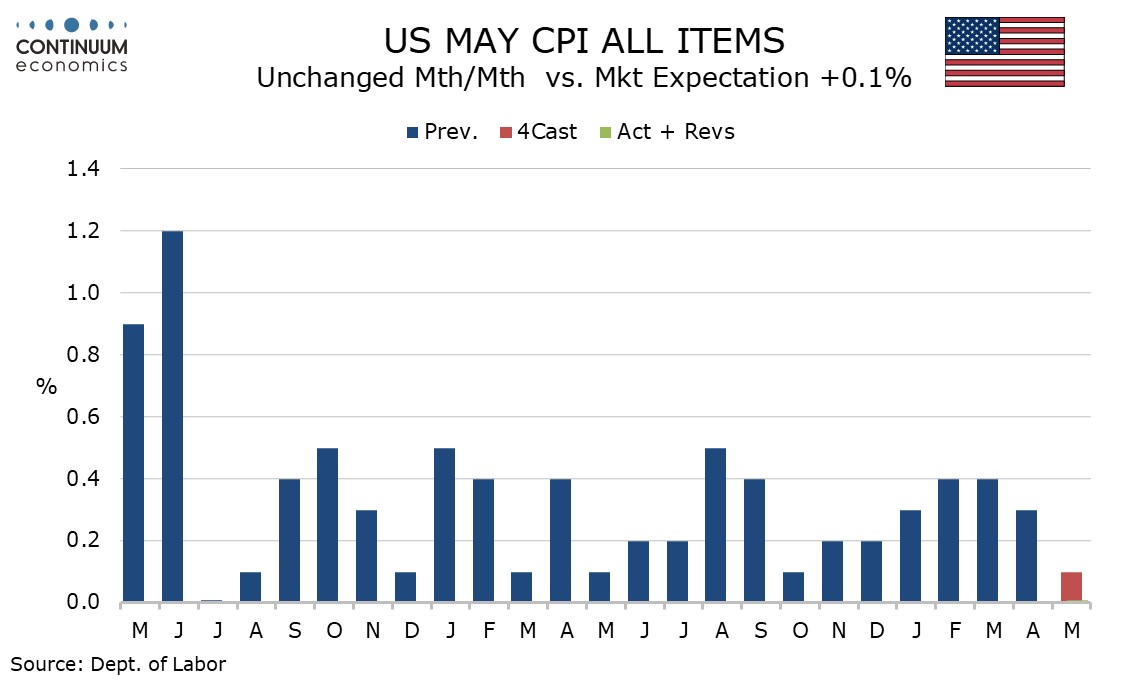

U.S. May CPI Loses Momentum

BoJ Surprise Again

Flat April UK GDP

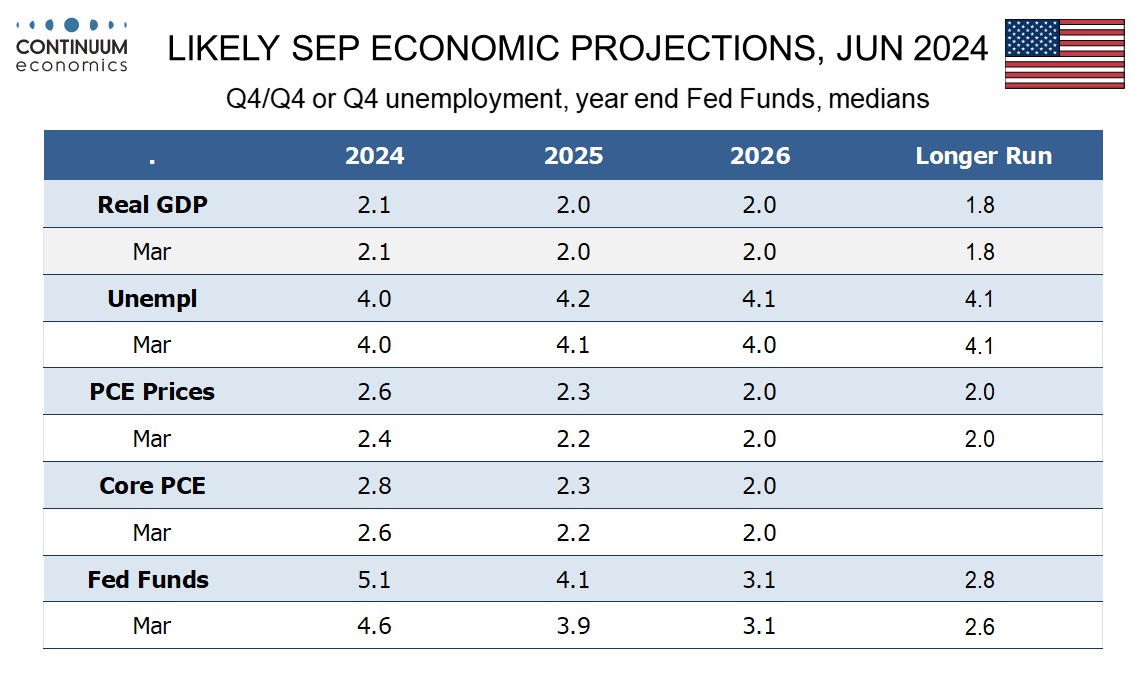

The Fed’s statement is slightly more optimistic on inflation on June than in May, tough continues to require greater confidence that it is moving towards target before easing. The dots are significantly more hawkish than in March, with a median of only one 25bps easing in 2024 rather than three, though 100bps rather than 75bps are now seen in both 2025 and 2026. The details of the dot plot show seven on the median for one move in 2024, with four seeing no moves and eight seeing two, meaning only a modest negative skew and none on the March median which saw three moves. This is more hawkish than expected. The 2025 and 2025 dot plots are reasonably balanced with the median clearly the most popular option in both, though there is a marginal upside skew. This leaves the end 2026 median as it was in March though the neutral rate has been nudged up to 2.8% from 2.6%.

GDP views have not been changed at all despite a weaker Q1 outcome but unemployment has been nudged marginally higher in 2025 and 2026. The 2024 inflation view has been lifted by 0.2%, the 2025 view lifted by 0.1%, and the 2026 view, when inflation is seen returning to the 2.0% target, is left as it was.

The main change to the statement has been that they now see modest further progress on inflation in recent months rather than a lack of further progress, and this may reflect the May CPI data released today. It is unclear whether May CPI was fully taken into account in the production of the dots. The statement continues to state that the Committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2%. There was no dissent from the decision to leave rates unchanged.

May PPI with a 0.2% decline, and flat core rates ex food and energy and ex food, energy and trade, surprised on the downside and offsets the disappointment on a stronger than expected April increase. More significant however is a sharp increase in initial claims to 242k from 229k, hinting that the labor market’s continued momentum in May is fading in early June. The latest initial claims level is the highest since August 2023. Last week’s 229k outcome, up from 221k, was seen as surprisingly high but easily downplayed given the fact before seasonal adjustment claims were unchanged and the week contained the Memorial Day holiday. This week saw unadjusted claims also increase, to 235k from 196k, making the rise harder to downplay. Next week is the survey week for June’s non-farm payroll.

Overall PPI was restrained by a 4.8% decline in energy that more than fully reversed an April increase while food fell by a marginal 0.1%. Goods PPI ex food and energy was actually on the firm side of trend with a 0.3% increase but services were flat, restrained by a sharp 1.4% fall in transportation and warehousing. Yr/yr PPI slipped to 2.2% from 2.3% and ex food and energy fell to 2.3% from 2.5%, but ex food, energy and trade still looks quite firm, unchanged at 3.2% and the highest since April 2023. Intermediate PPI was mixed on the goods side, processed goods falling by 1.5% with a 0.1% increase ex food and energy, and unprocessed goods falling by 1.8% with a 1.8% increase ex food and energy. Intermediate services were soft with a rise of only 0.1%.

May CPI has come in softer than expected, unchanged overall with a 0.2% increase ex food and energy, with the latter up only 0.163% before rounding, which is the softest since August 2021. If sustained this would be consistent with inflation returning to target though the Fed will treat one soft month cautiously. Looking into the detail, a 0.5% decline in transportation services stands out, this following gains of 1.0% or above in each month of Q1 and 0.9% in April. Services less energy services rose by 0.2%, well below recent trend. Commodities less food and energy were unchanged, slightly stronger than two preceding marginal declines with used autos showing their first rise in three months. Gasoline corrected lower after three straight gains while food increased by a marginal 0.1%. Transportation services were led lower by a sharp 3.6% fall in air fares which looks like feed through from lower energy prices. Motor vehicle services however were near flat after rising strongly in recent months, particularly in March.

At the June 13-14 meeting, the BoJ has surprised the market again with no change to rates nor bond purchase program despite Ueda's hints and multiple "source" reports. However, they do suggest the planning for bond purchase cut will be decided in July. Labor cash earning has risen above 2%, along with the latest rebound in CPI should be enough to support BoJ's decision to hike or cut bond purchase. Indeed, the statement recognized CPI is above target range and would continue to be higher in 2025 but the weak Q1 GDP, indicating a weaker Japanese economy, seems to be dragging the BoJ from faster tightening. Our central forecast continue to see inflation to be lower than BoJ's forecast for we suspect Japanese residents will be unwilling to accept higher prices even when real wage approaches positive. Given the current inflation dynamics and BoJ's attitude, we forecast there will be only be 10bps hike in July 2024.

While the move could be rationalized by BoJ's assessment towards trend inflation and wages, it does not fare well with their outlook. Labor cash earning y/y rose above 2% to 2.1% in April as wage growth began to accelerate after the historic results from March's wage negotiation. Even if the average wage hike does not meet the historic sub five percent negotiate for large firms employees, a three to four percent wage growth would be sufficient to bring real wage to positive and stimulates consumption. However, Japanese residents are showing resistance to consume at higher prices and thus we believe the impact of wage growth towards inflation will be less than BoJ's expectation. Moreover, PPI continue to stay below 1% four months in a row, further reducing the impetus for business to raise prices. All of these factors points towards a tight window for the BoJ to tighten for the BoJ sees CPI to tread below 2% in 2025.

In the latest comment from Ueda, he mentioned that "If underlying inflation moves as we project, we will adjust degree of monetary support" and "As we move towards exit from massive monetary stimulus, it would be appropriate to reduce bond purchases: It made the market believed that rate hikes and bond purchase reduction are in BoJ's consideration after being echoed by Nakamura, a known dove. Forward guidance from the BoJ has its credibility significantly tarnished after multiple surprises and could have negative impact in the future.

Our central forecast sees inflation to flare up from wage hikes by a smaller magnitude than BoJ's own forecast and thus expects only one hike of 0.1% in July 2024. Although further tightening cannot be ruled out if wage-inflation translation turns up, the probability is low on consumers' reluctance in higher price and business inability to sustainably hike wages leading to lower inflation in the coming year.

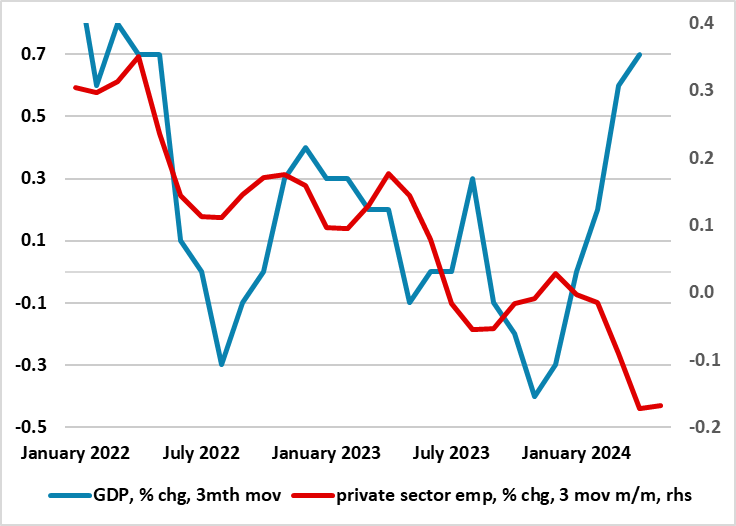

Figure: Clearer Recovery But Contrast with Jobs Weakness?

The economy may have been in only mild recession in H2 last year, but the ‘recovery’ now evident is much clearer than any expected with GDP growth notably positive, albeit with some continued volatility. Indeed, coming in more than expected, and despite industrial action, GDP rose by 0.4% m/m in March accentuating the upgraded bounce in the two previous months, with the fresh April numbers showing no change, also better than the small drop widely expected, despite the adverse impact of yet more unseasonable weather. This projection would be consistent with a circa-0.1 Q2 q/q outcome, a clear contrast to the strong but possibly misleading Q1 jump and would also be below BoE thinking for the current quarter. But the apparent resilience, if not strength, in the GDP data contrasts increasingly with employment weakness (Figure 1) and is partly a result of public sector gains.

The March data resulted in a very clear end to the modest recession seen in H2 last year and also exceeded BoE thinking as Q1 growth jumped by 0.6%, an outcome dominated by a boost from net trade, mainly a sharp fall in imports, hardly indicative if firmer demand. Regardless, there are still areas of concern, with the latest BoE Agents survey pointing to weakness in consumer spending on goods and services in Q1 and as a result revising down their expectations of growth for 2024.

As for the last set of monthly GDP numbers, Real gross domestic product (GDP) is estimated to have grown by 0.7% in the three months to April 2024, compared with the three months to January 2024. Services output was the main contributor with a growth of 0.9% in this period, while production output rose by 0.7% and construction fell by 2.2%. Monthly real gross domestic product (GDP) is estimated to have shown no growth in April 2024, following a growth of 0.4% in March 2024. Construction and manufacturing saw clear m/m falls, the former possible a result of poor weather.