Published: 2025-02-04T13:39:02.000Z

Preview: Due February 5 - U.S. January ISM Services - Bad weather may deliver a hit

1

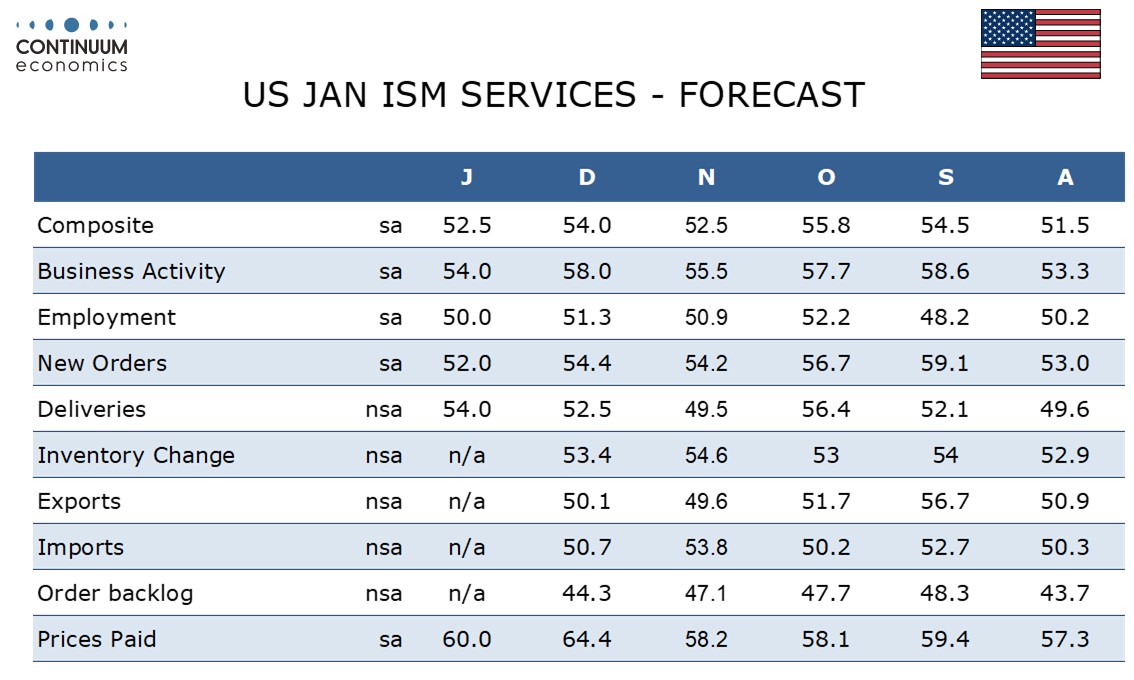

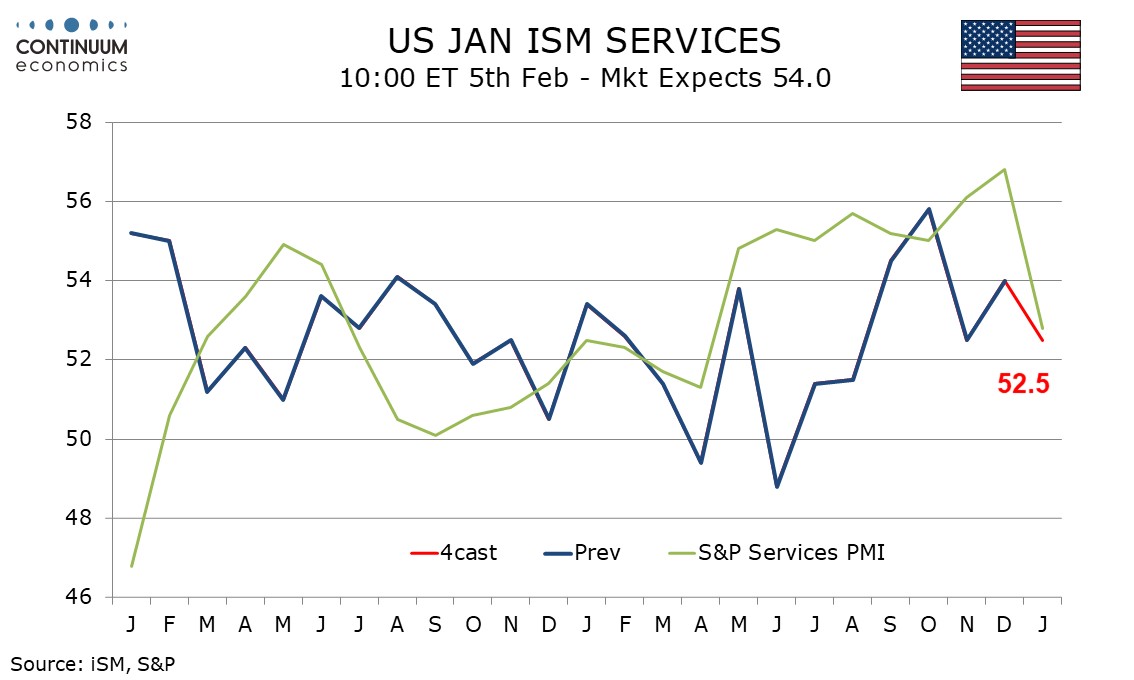

We expect January’s ISM services index to slip to 52.5 from 54.0 in December, returning the index to November’s level. Unusually cold weather in much of the country and to a lesser extent the Los Angeles fires provide downside risk.

January’s S and P services index slipped significantly from consistently strong readings in late 2024, and while not a reliable guide to the ISM data, most regional service sector surveys slipped in January, if not dramatically.

We expect slippage in three of the four components that make up the ISM services composite, most significantly in business activity after a strong December, but also from new orders and employment. The final component, delivery times, may get a lift from bad weather. Prices paid do not contribute to the composite. Here we expect a correction lower to 60.0 after December’s 64.4 reading bounced to the highest level since February 2023.