EUR, GBP flows: PMIs unremarkable but GBP may gain some support

EUR a tad softer after PMIs, GBP may make more gains

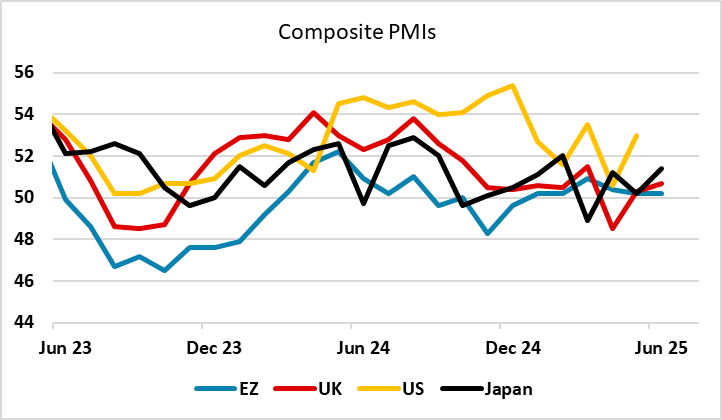

European PMIs are fairly unremarkable, with the Eurozone composite PMI unchanged in June from May, slightly disappointing expectations, while the UK PMI was marginally up on the month and slightly ahead of consensus. The UK PMI showed a marked easing in services inflation, which the MPC doves will see as supportive of their vote. However, none of the indices are far enough away from consensus or the previous month to justify any significant change in policy expectations.

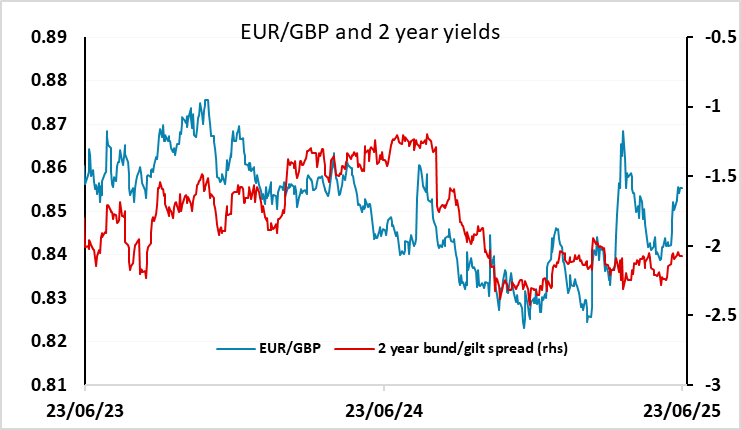

EUR/USD and EUR/GBP are both a tad lower, and GBP can be expected to get some support from the higher oil price, especially since EUR/GBP has exceeded the gains suggested by yield spreads in the last few weeks. There is still a focus on geopolitics, but equities have started the morning a little firmer and in the absence of escalation the riskier currencies may regain some ground against the USD.