USD flows: USD gains on stronger US data

US GDP above consensus, but H1 still quite soft. USD modestly firmer

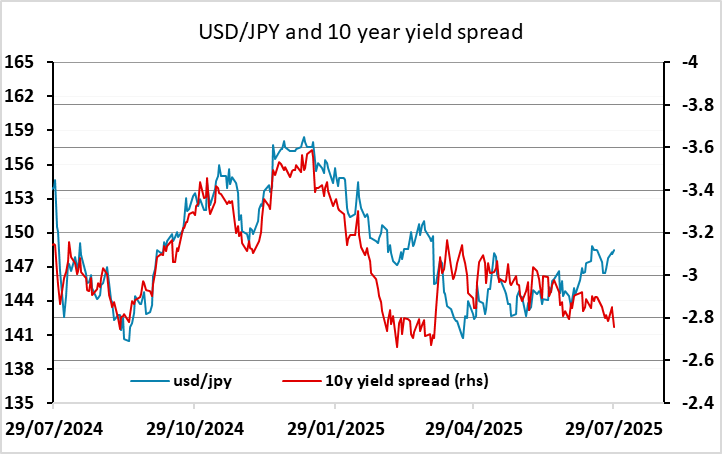

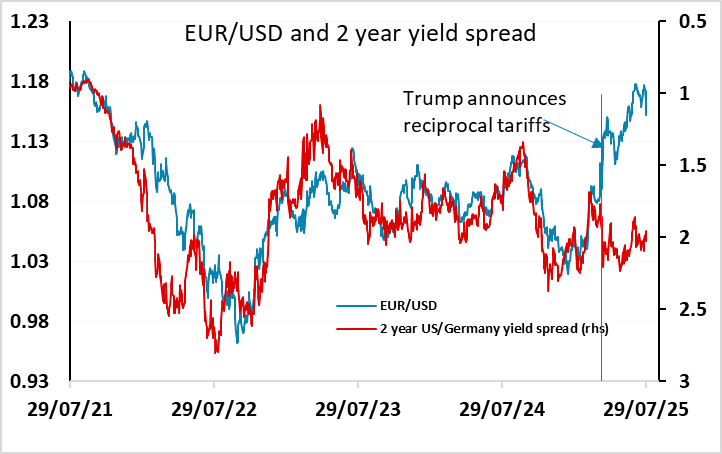

US data coming in stronger than expected with Q2 GDP at 3.0% annualised and ADP employment for July at 104k. The Q2 GDP data is stronger than expected, but follows a 0.5% Q1 decline so H1 is still not a strong performance. Annualised H1 growth is only 1.1%. The number was also perhaps less unexpected after the better than expected June trade numbers released yesterday. Consumer spending rose 1.4% after a 0.5% gain in Q1, so also fairly modest. Nevertheless, the data was stronger than expected and the USD is consequently benefiting across the board with US yields modestly higher. Equities are also marginally stronger. From a yield spread perspective, there is much more scope for gains against the EUR than gains against the JPY, but as long as equity markets are fairly neutral JPY crosses are unlikely to move too much.