Preview: Due June 24 - Canada May CPI - BoC core rates to correct April's acceleration

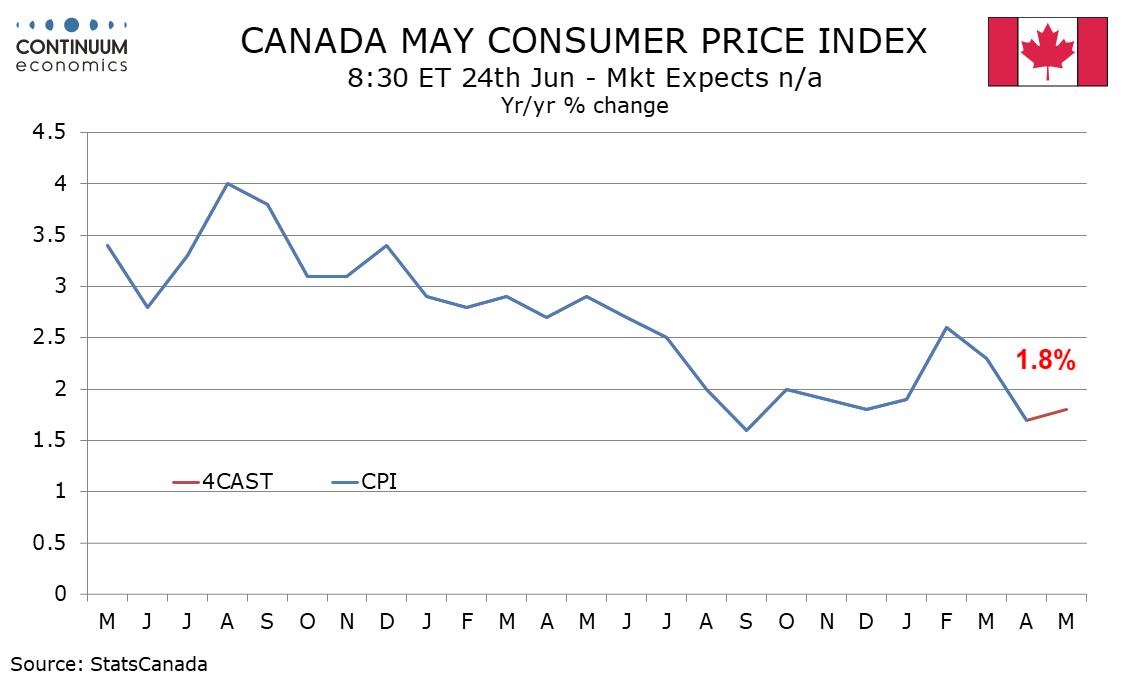

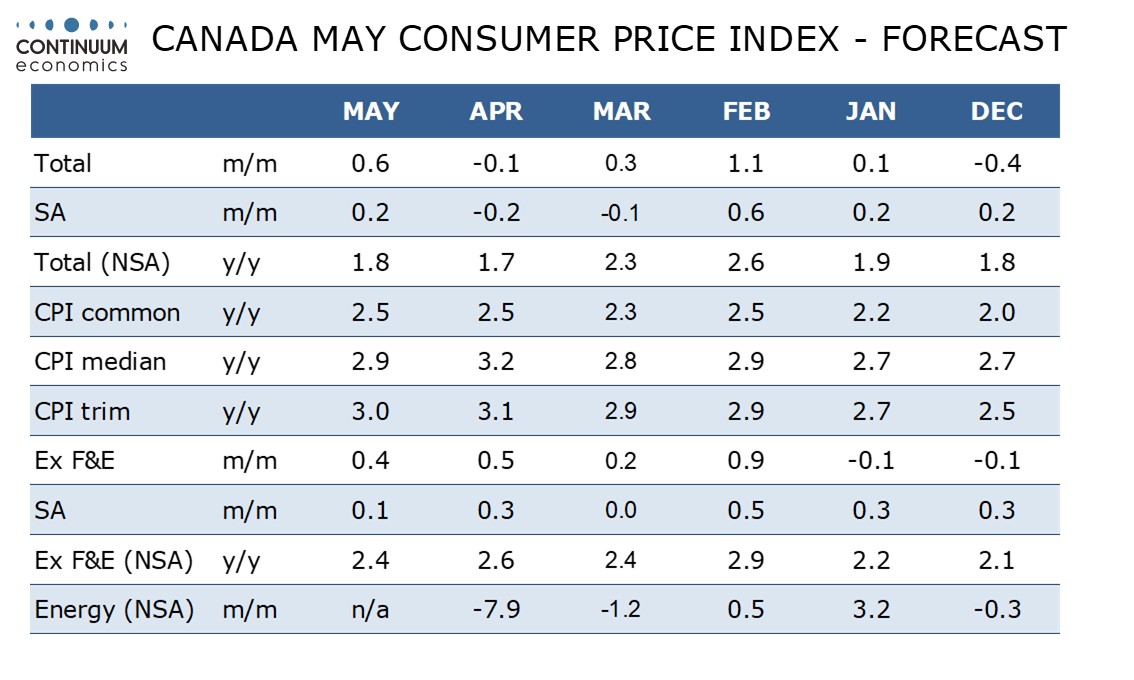

We expect May Canadian CPI to see a marginal rise to 1.8% yr/yr from 1.7% in April, correcting a fall from 2.3% in March that was fully explained by the abolition of the consumer carbon tax. However, after an acceleration in April, we expect some slowing in the Bank of Canada’s core rates in May.

On the month we expect a 0.1% seasonally adjusted increase ex food and energy to follow a 0.3% increase in April, with a stronger CAD providing some restraint. We expect gasoline to lift overall CPI to a 0.2% seasonally adjusted increase.

Before seasonal adjustment we expect seasonal increases to lift overall CPI to a 0.6% rise on the month with ex food and energy CPI rising by 0.4% unadjusted. This would see yr/yr ex food and energy slipping to 2.4% from 2.6%, reversing an April acceleration.

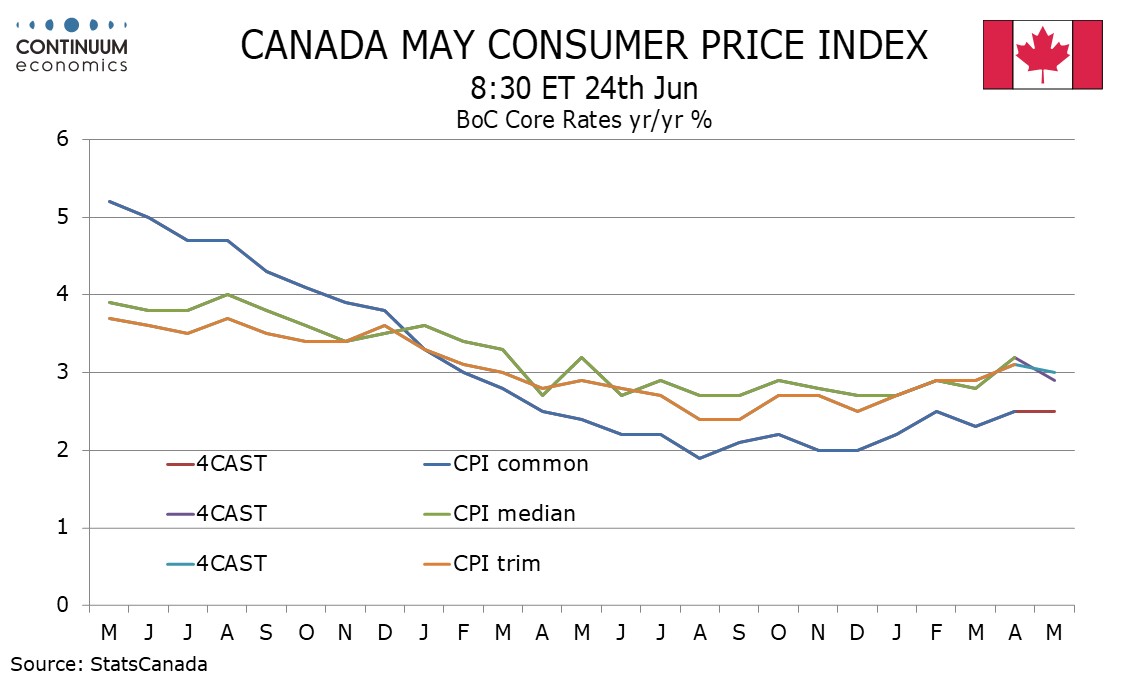

The ex food and energy rate is not one of the BoC’s three core rates. Here we expect an unchanged 2.5% for CPI-Common, a dip to 3.0% from 3.1% in CPI-Trim and a drop to 2.9% from 3.2% in CPI-Median. April saw the BoC core rates accelerate as soft year ago data dropped out. In May stronger year ago data is dropping out for CPI-Trim and particularly CPI-Median, and this should see yr/yr growth correct lower.