JPY, NOK flows: USD/JPY under pressure, NOK has scope to recover

BoJ squeezing out JPY shorts. Norges Bank could provide NOK support

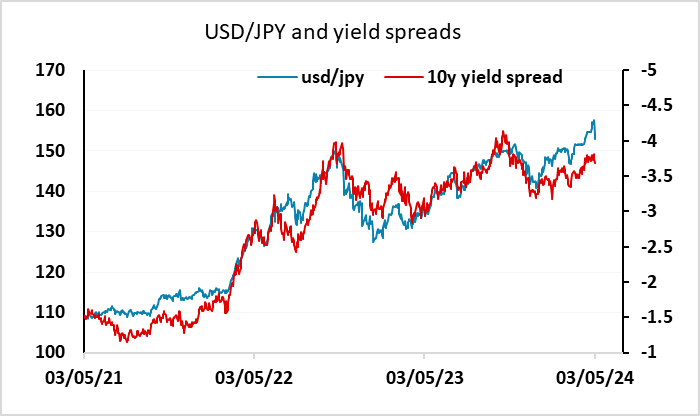

The JPY has stayed strong overnight, making its highest since April 12 against the USD and since April 19 against the EUR. The BoJ intervention in NZ time seems to have got the message home to JPY shorts. Short positions are at risk of being cleaned out in illiquid markets, and few will now want to hold short term short positions as a result. Longer term short positions make little sense at these levels, which still represent a very weak JPY, so it’s hard to see who will want to take the short JPY side as long as the BoJ threat remains. Yield spreads still suggest scope down to the mid 140s in USD/JPY, and there are now likely to be sellers on any bounce.

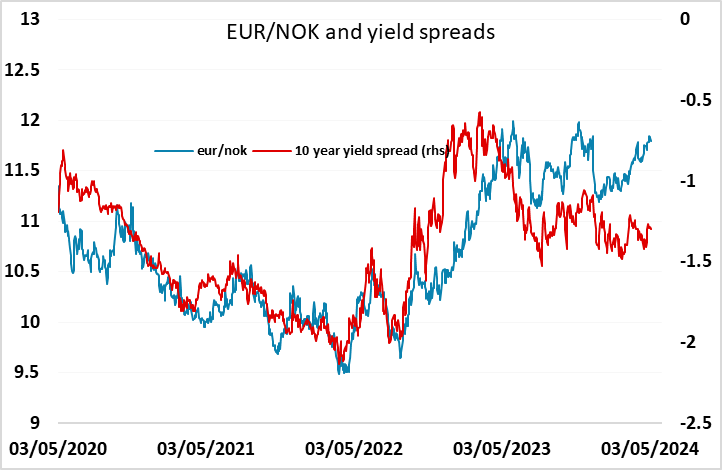

For today the US employment report looms large, and the European morning is consequently unlikely to see a lot of action. However, there is the Norges Bank meeting at 09:00 UK time, with then NOK having potential to recover from very depressed levels if Norges Bank retains the stance that “policy to stay on hold for some time ahead” first aired at the December meeting.