U.S. January PPI - Trend remains firm, Initial Claims fall

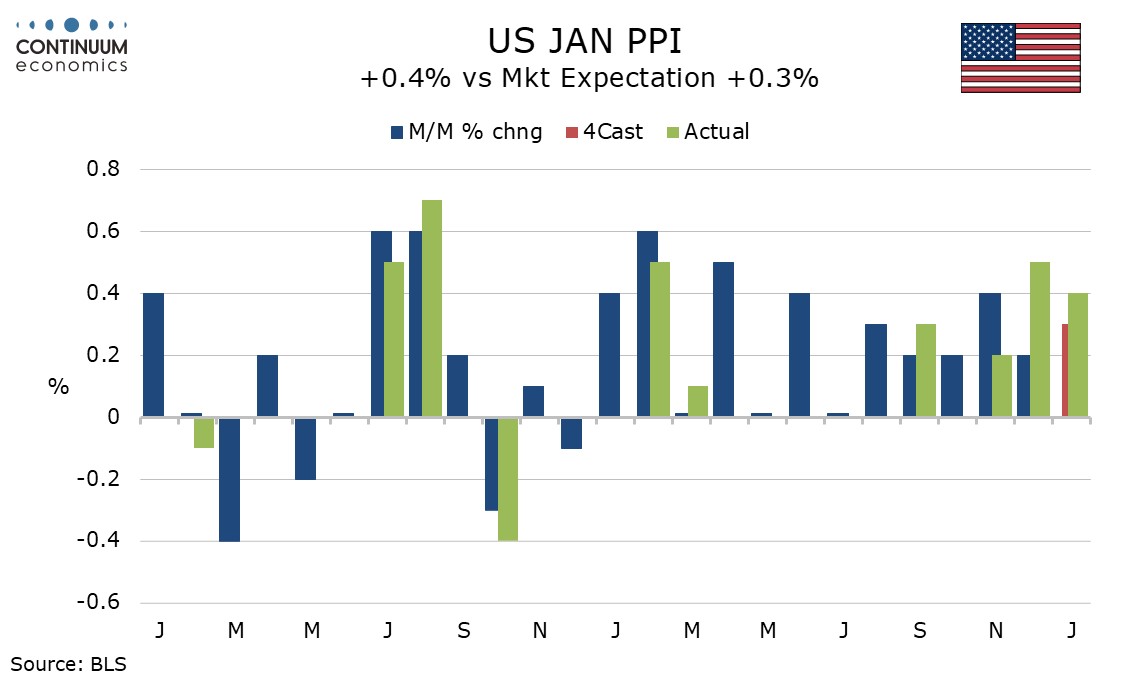

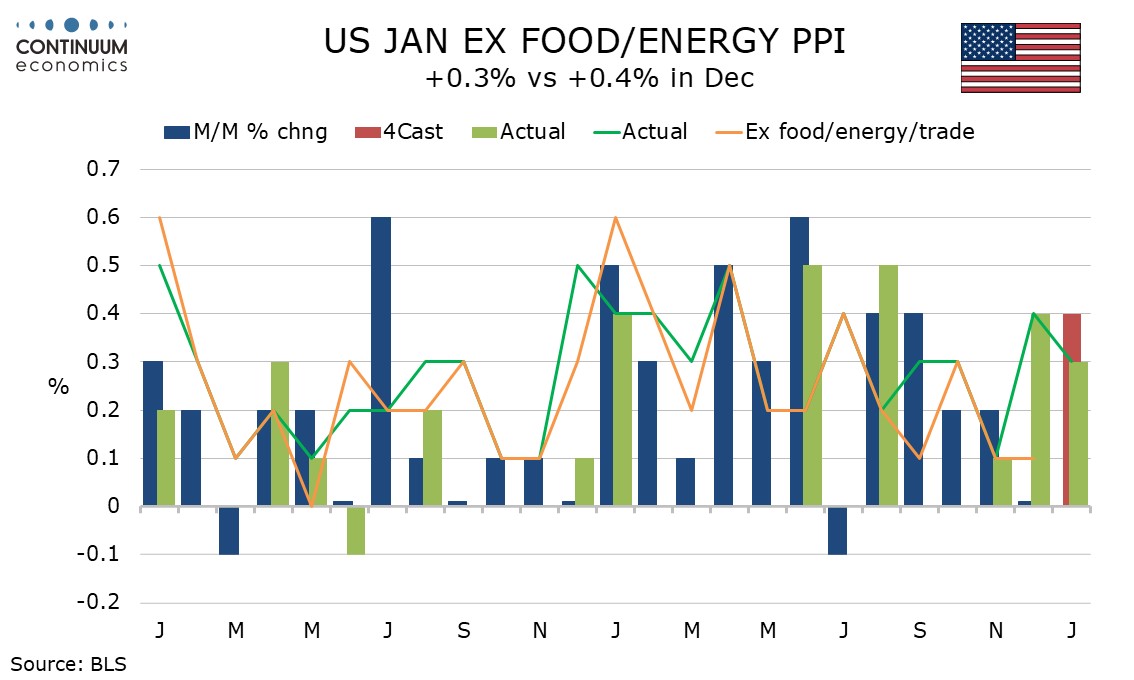

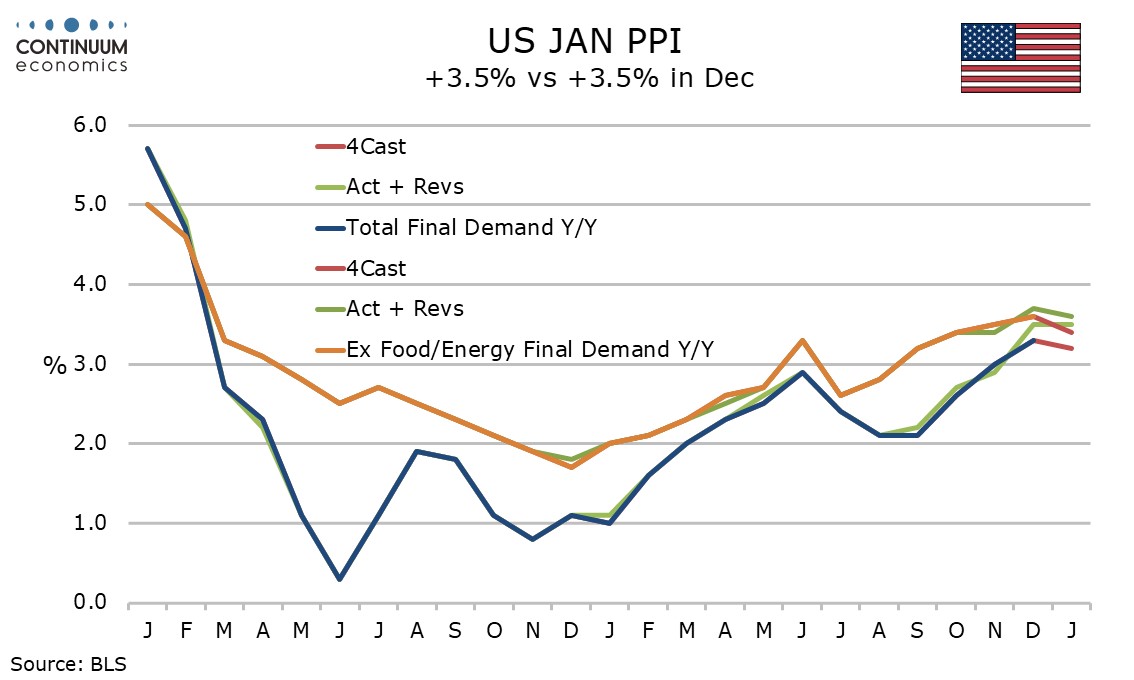

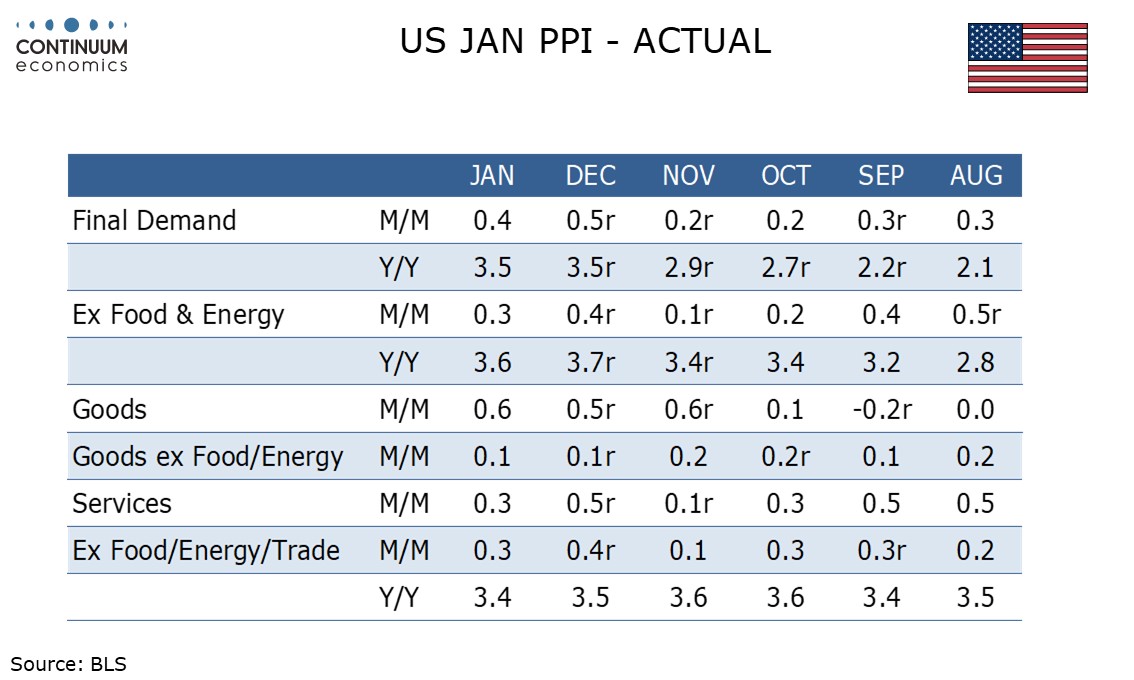

January PPI is slightly stronger than expected overall at 0.4%, but on consensus at 0.3% in both of the core rates, ex food and energy and ex food, energy and trade. December revisions however mean that yr/yr rates are higher than expected, overall PPI at 3.5%, ex food and energy at 3.6% and ex food, energy and trade at 3.4%, with December’s respective gains of 3.5%, 3.7% and 3.5% all revised up by 0.2%.

Food was up by 1.1% led by a massive 44.0% monthly surge in the price of eggs, while energy rose by 1.7%, led by gas, with gasoline up only marginally by 0.2%.

Goods less food and energy rise by only 0.1% for a second straight month, but services rose by 0.3% after a 0.5% December gain. Trade was subdued at 0.1% but transportation and warehousing rose by 0.6% and other services rose by 0.4%.

The latest report contains annual historical revisions on updated seasonal adjustments, though the revisions to the seasonal adjustments were fairly modest. December PPI was however revised up significantly on fresh source data, overall to 0.5% from 0.3%, ex food and energy to 0.4% from unchanged, and ex food, energy and trade to 0.4% from 0.1%.

Strong year ago data mean that the yr/yr rates for January were stable overall and lower in the core rates, but with all close to 3.5% they are too high to be consistent with the FOMC target. Yr/yr rates have also been trending higher through 2024.

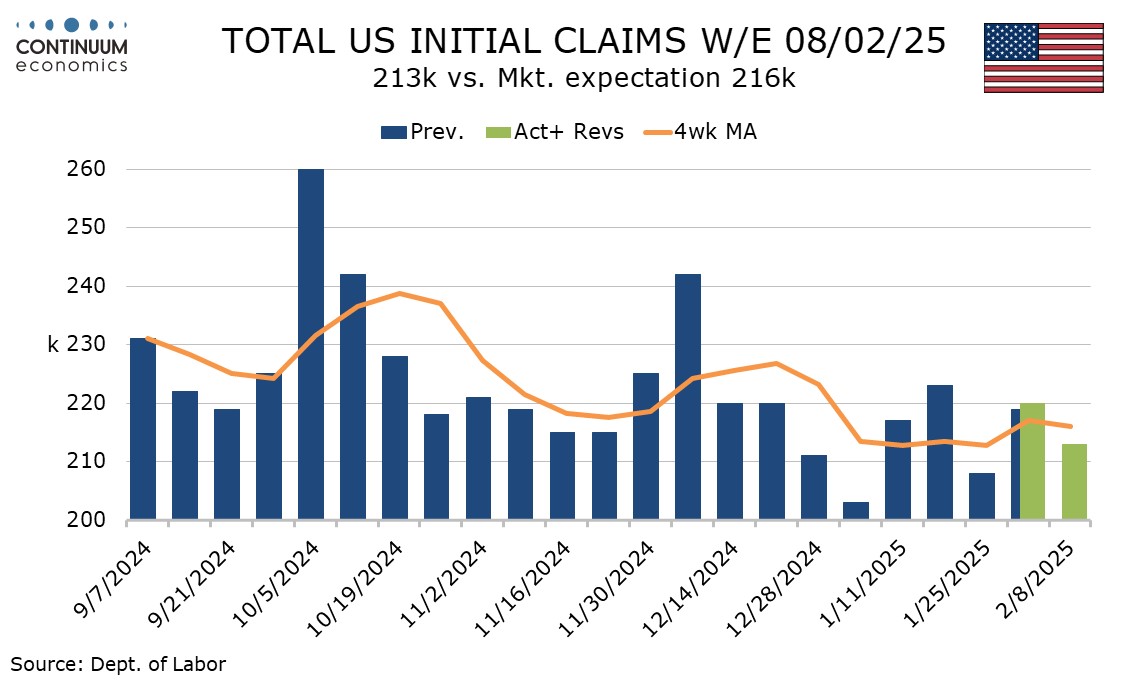

Initial claims are consistent with a continued healthy labor market, down to 213k from 220k, while continued claims also slipped, to 1.850m from 1.886m. Next week’s initial claims release will cover the survey week for February’s non-farm payroll.