USD flows: USD recovery extends after PMI

US composite PMI below consensus but manufacturing rises. USD correction can extend but underlying picture still negative

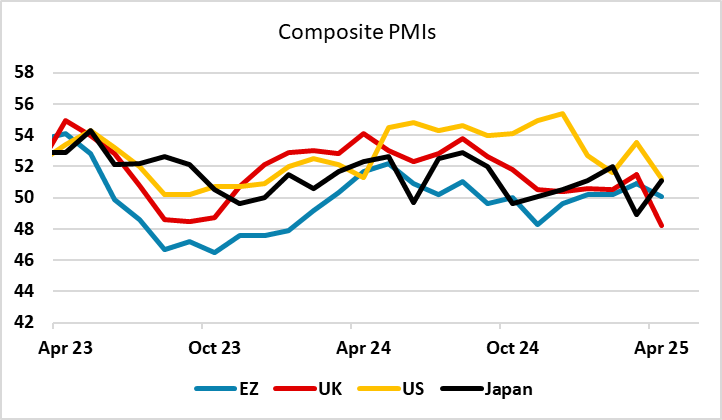

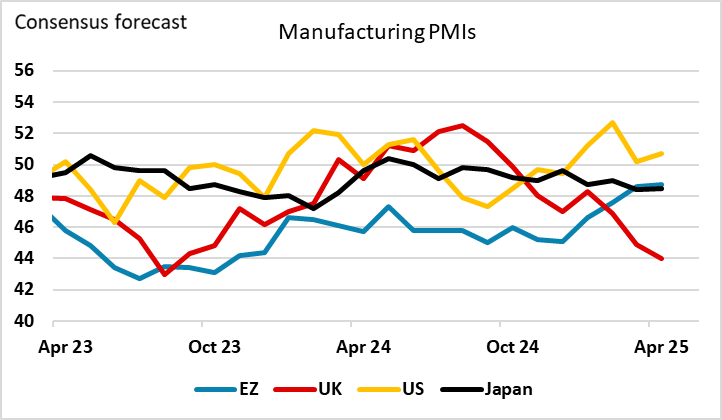

As with the European PMIs, the weakness in the US PMIs is in services rather than manufacturing, and the market has taken this as a mildly USD positive story, although the USD was already well bid on the back of a strong open to the cash equity market. However, the PMIs may just be a question of timing, with the service sector feeling the impact on confidence more rapidly than the manufacturing sector, which maybe seeing some influences from attempts to beat the tariff deadlines as well as longer supply chains. The weakness of the services PMI means the US composite PMI is below consensus, even though the manufacturing PMI rose slightly.

From here, the USD recovery may have scope to extend with concerns about the potential sacking of Fed chair Powell now eliminated. A correction to the EUR/USD rally from 1.0733 on March 26 would suggest a move to the mid-1.12s, while USD/JPY could see a move back above 144. But we would see such moves as corrective as long as the tariff policy essentially remains in place.