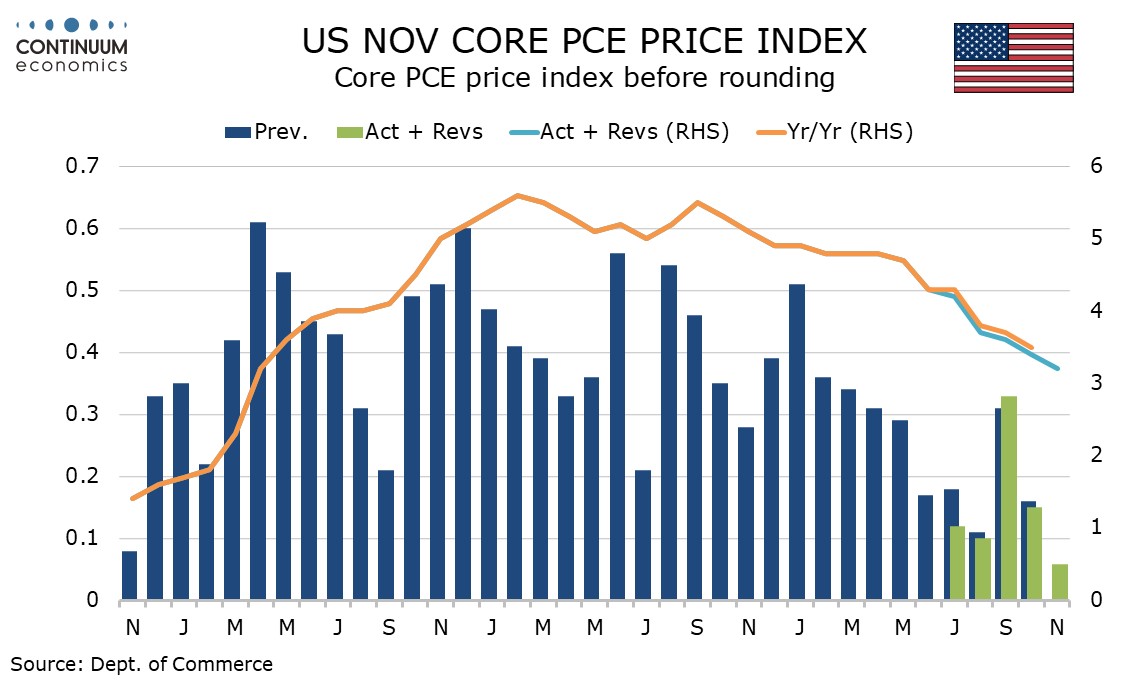

US November Core PCE Prices extend the recent loss of momentum

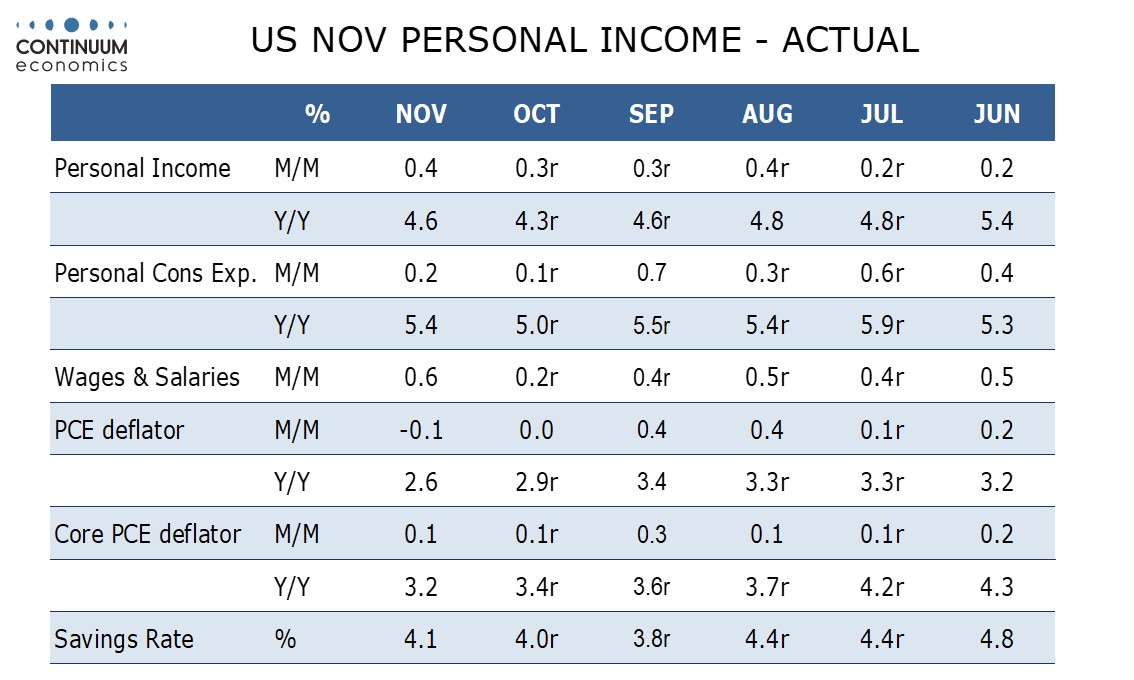

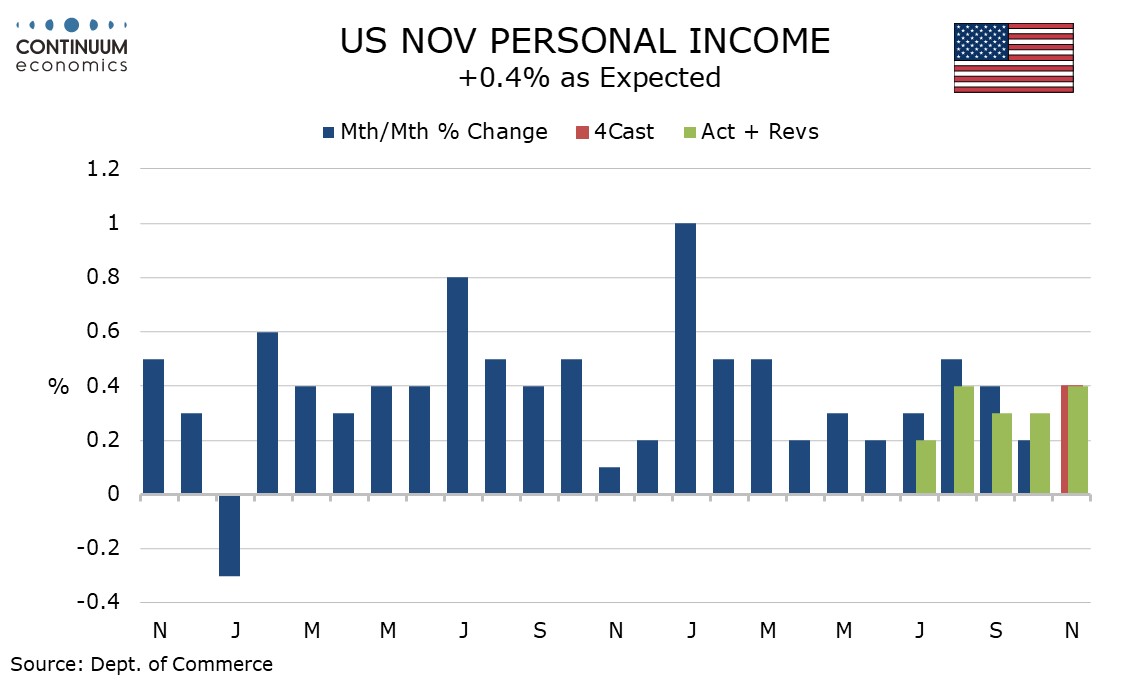

November’s core PCE price data with a 0.1% increase (and only 0.058% before rounding) is softer than expected and significantly softer than the 0.3% core CPI, and provides further evidence of easing inflationary pressures. Personal income data was in line with consensus spending softer but durable goods orders were stronger than expected.

Four of the last five months have now seen gains of 0.1% in core PCE prices given negative back month revisions in October and Q3 (the exception being a 0.3% rise in September).

Overall PCE prices fell by 0.1% in November seeing yr/yr growth fall to 2.6% from 2.9% while the core rate fell to 3.2% yr/yr from 3.4%. This is still well above the 2.0% Fed target but recent months are consistent with near target inflation on an annualized basis.

Personal income with a 0.4% increase was in line with expectations with a stronger 0.6% rise in wages and salaries consistent with positive non-farm payroll details. A correction in social security benefits from an above trend October restrained the overall data.

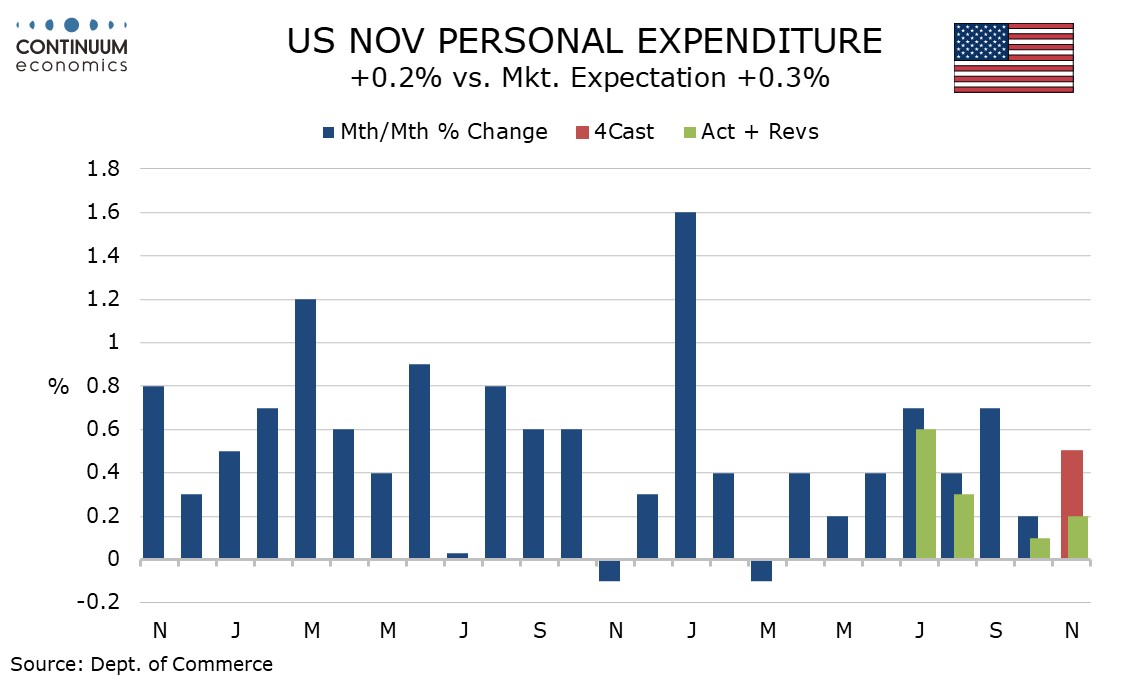

Personal spending’s 0.2% increase was weaker than expected but up by 0.3% in real terms. Services underperformed rising by 0.5% in nominal terms but with a third straight 0.2% rise in real terms.

If December data is unchanged in real terms both real disposable income and spending would be up by 2.1% annualized in Q4. The outcomes are likely to be a little stronger than that.

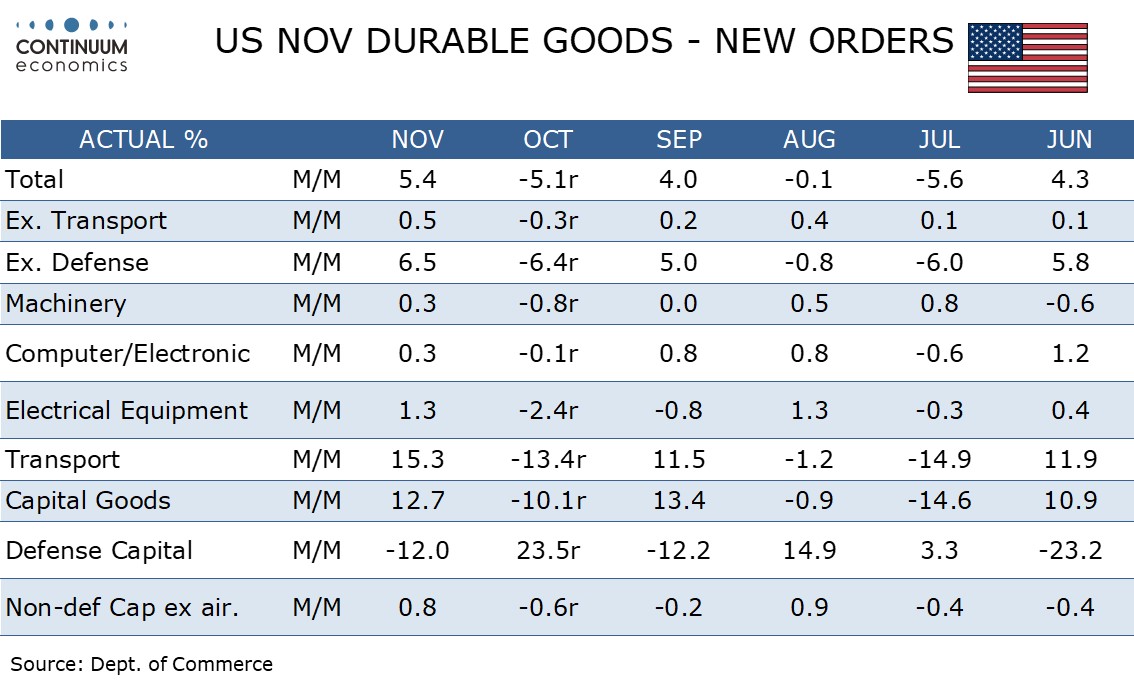

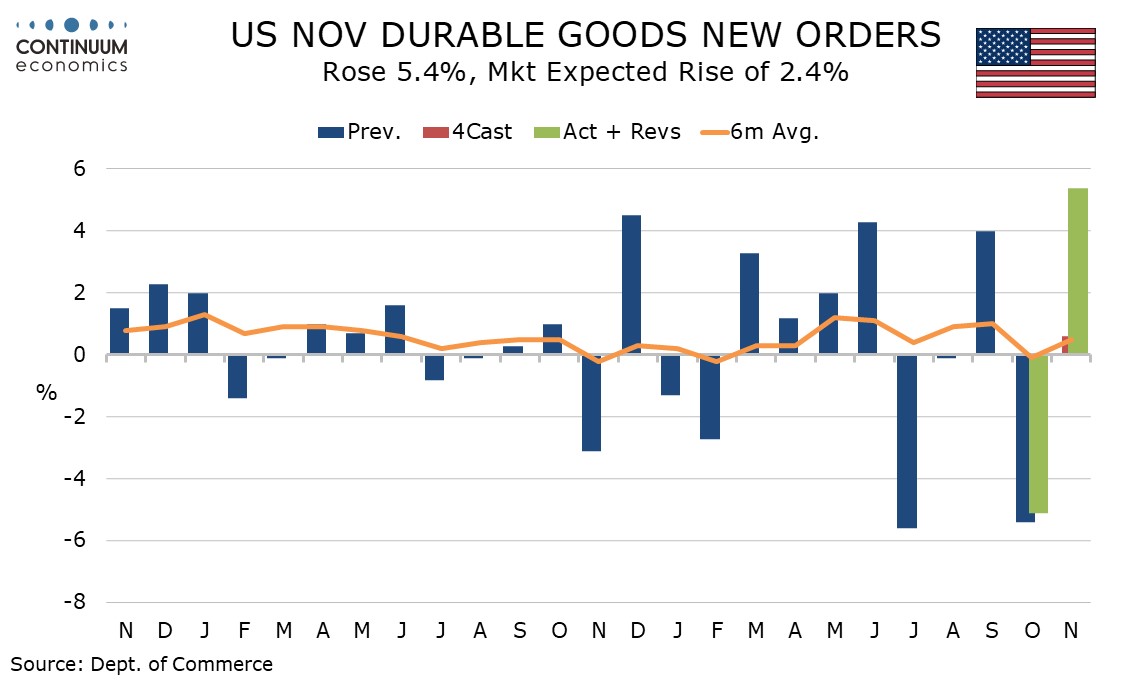

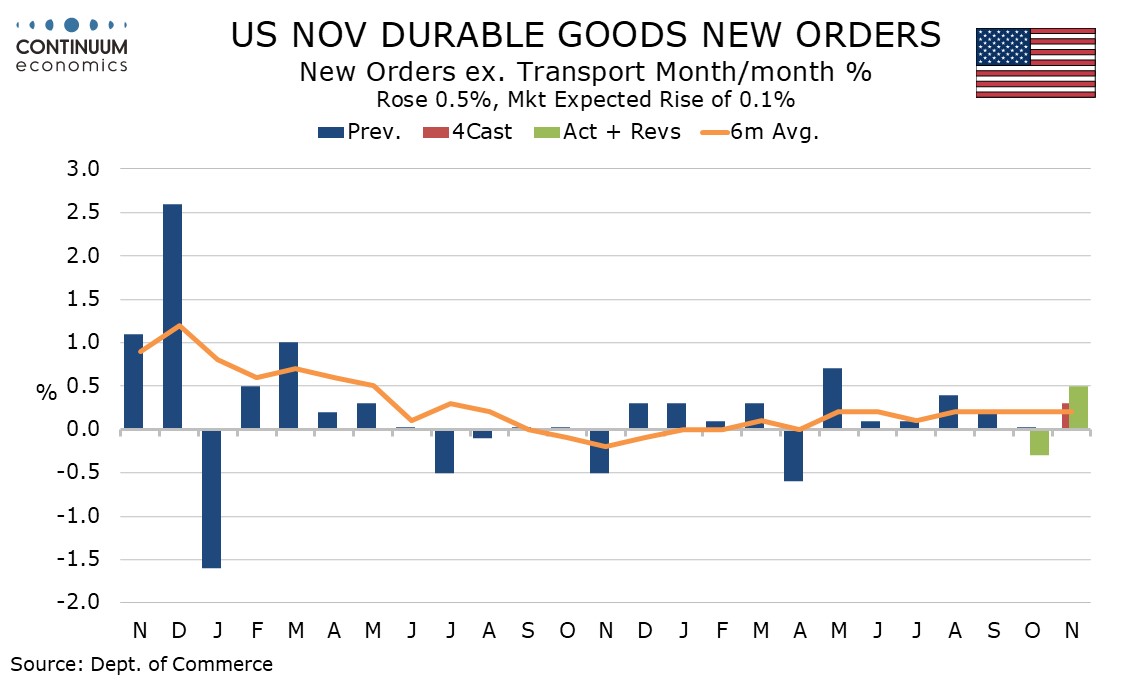

A 5.4% rise in November durable goods orders follows a 5.1% October decline and was led by transport, though a 0.5% increase ex transport was stronger than expected, bouncing from a 0.3% October decline to keep trend marginally positive.

The transport rise was led by civil aircraft with autos also positive but defense was weaker. Ex-defense orders rose by 6.5% after a 6.4% October decline. Non-defense capital orders ex aircraft, a key indicator for business investment, rose by 0.8% after a 0.6% October decline.