EUR, GBP flows: EUR should gains support from German data, GBP firmer on trade deal hopes

German production data suggetss rising trend. Talk of US/UK trade deal should offset any concerns about weaker growth in the BoE MPR

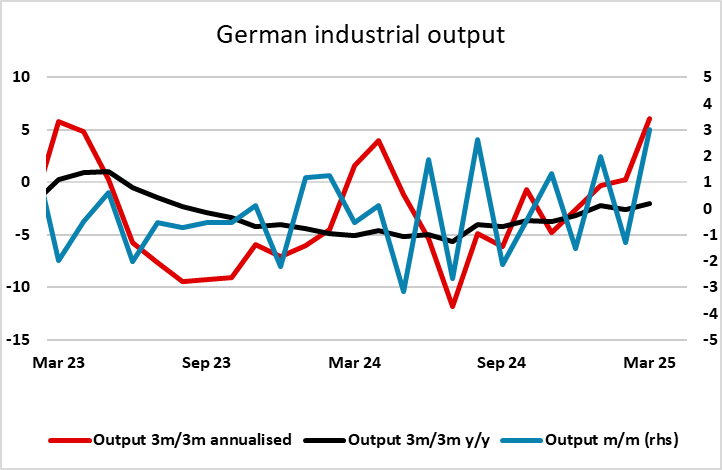

Thursday kicks off with much stronger than expected German industrial production data for March, showing a 3.0% m/m rise. While the data can be choppy, it is typically less volatile than the orders data and the underlying trend seems to be improving. This should provide some mild support for the EUR after the USD made gains overnight following a slightly hawkish presentation from Powell following the unchanged rate decision at the FOMC, although EUR/USD has dipped below 1.13 in early trade.

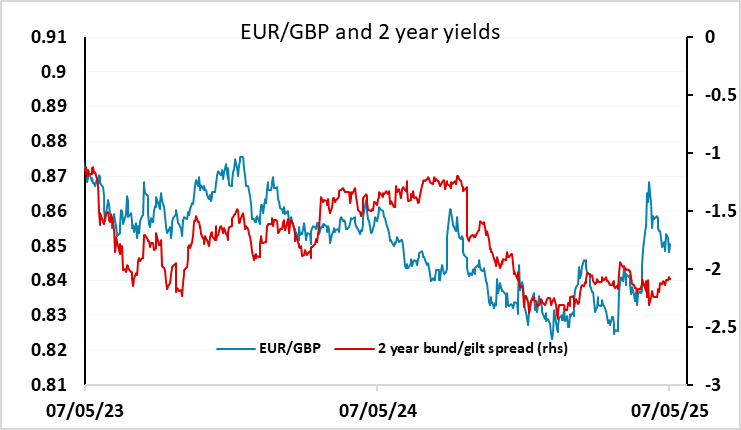

Ahead of the BoE meeting later GBP is showing a positive tone helped by the reports of a US/UK trade deal being announced later today. Given the general concerns about the impact of tariffs, this should be supportive for GBP against the EUR and any other currencies where trade deals are less likely. A UK rate cut is fully priced in today, so should have no negative impact, and the FX focus in any case is shifting more to growth prospects. While the BoE may be downbeat on this score in the May Monetary Policy Report, a trade deal with the US could be expected to offset such concerns and push the pound higher, especially if the more positive tone to equity markets persists.