EUR, USD, JPY flows: EUR focus on IFO, USD strength dependent on equities

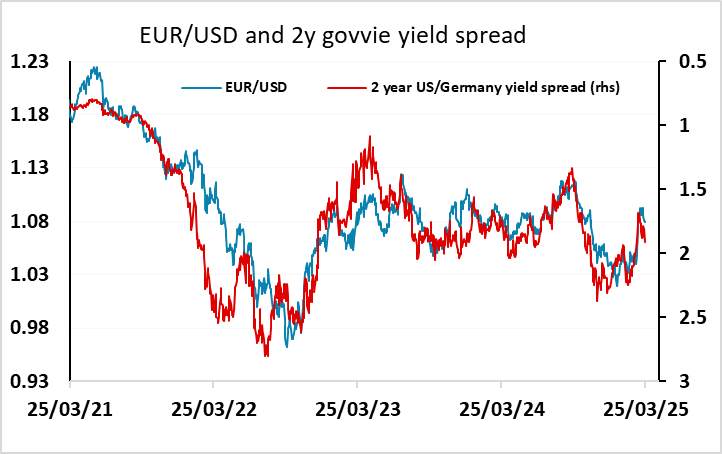

EUR may continue to drift lower unless IFO surprises on the upside. JPY weakness dependent on continued US equity gains

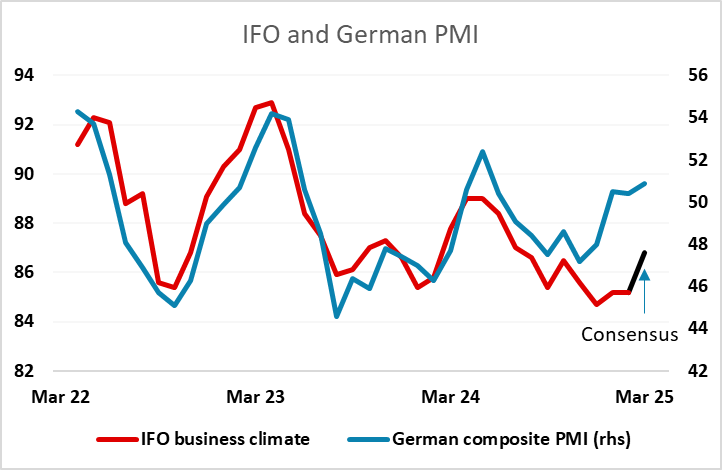

The German IFO survey will be the main focus this morning. The last couple of months have seen the IFO index lag behind the S&P PMI survey, after broadly matching it over the last few years. There is consequently some potential for an upside surprise, but the market is already anticipating some recovery, so the recovery will have to be large if the EUR is to benefit.

As it stands, the rise in US front end yields in the last few days, helped by some apparent softening of Trump’s tariff stance as well as a strong ISM services number yesterday, has taken yield spreads to a level that suggests some further downside scope for EUR/USD. So EUR yields will likely need to rise on the IFO survey if EUR/USD isn’t to continue to drift lower.

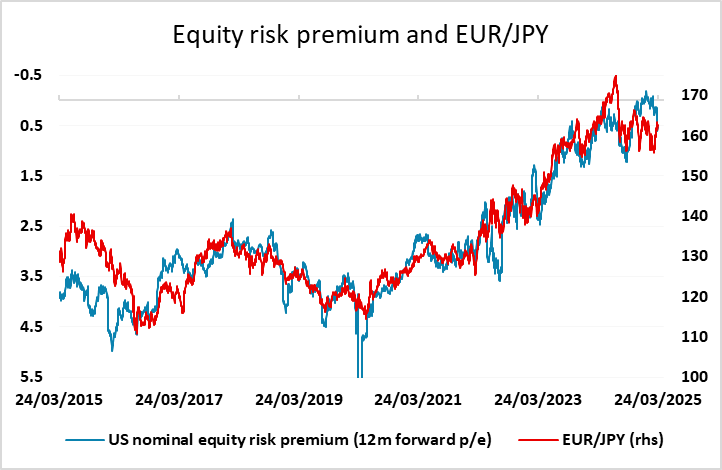

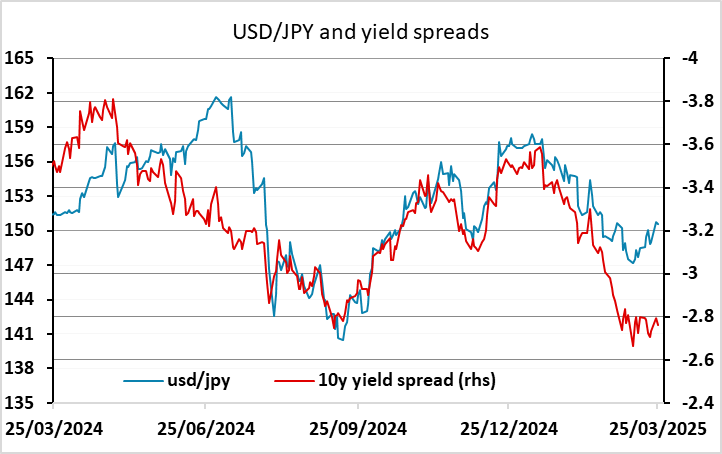

The USD has made general gains on the back of the better US equity market performance yesterday, with USD/JPY the most notable gainer. This has come without any widening of US/Japan yield spreads in favour of the USD, with JGB yields staying firm helped by indications from the BoJ Minutes that most members agreed the likelihood of hitting 2% inflation target had been rising. The JPY will likely remain under pressure as long as equity markets continue to perform well, but the recent rise opens up risks of a sharp fall on any setback in sentiment.