Published: 2024-07-31T14:23:14.000Z

Preview: Due August 1 - U.S. July ISM Manufacturing - A little firmer but still below neutral

7

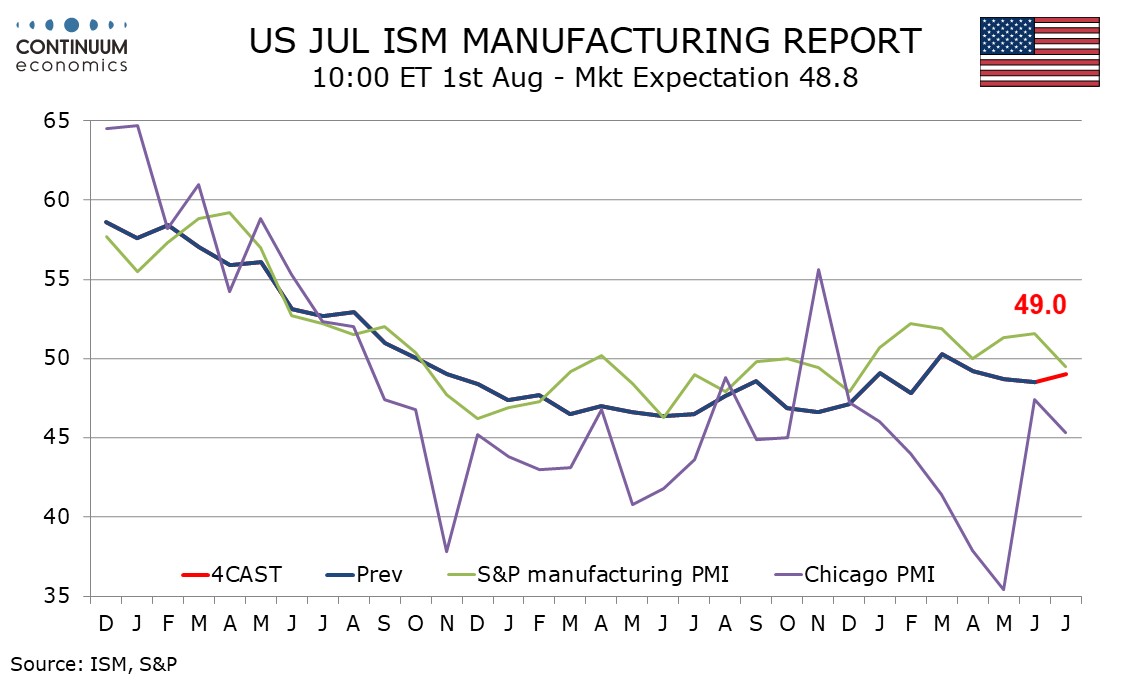

We expect a July ISM manufacturing index of 49.0, slightly improved from 48.5 in June though still short of neutral. March’s 50.3 was the only reading to reach neutral since October 2022.

A correction lower in the S and P manufacturing PMI is not a reason to look for a weaker ISM manufacturing index which could have scope to catch up with strength in June’s S and P index.

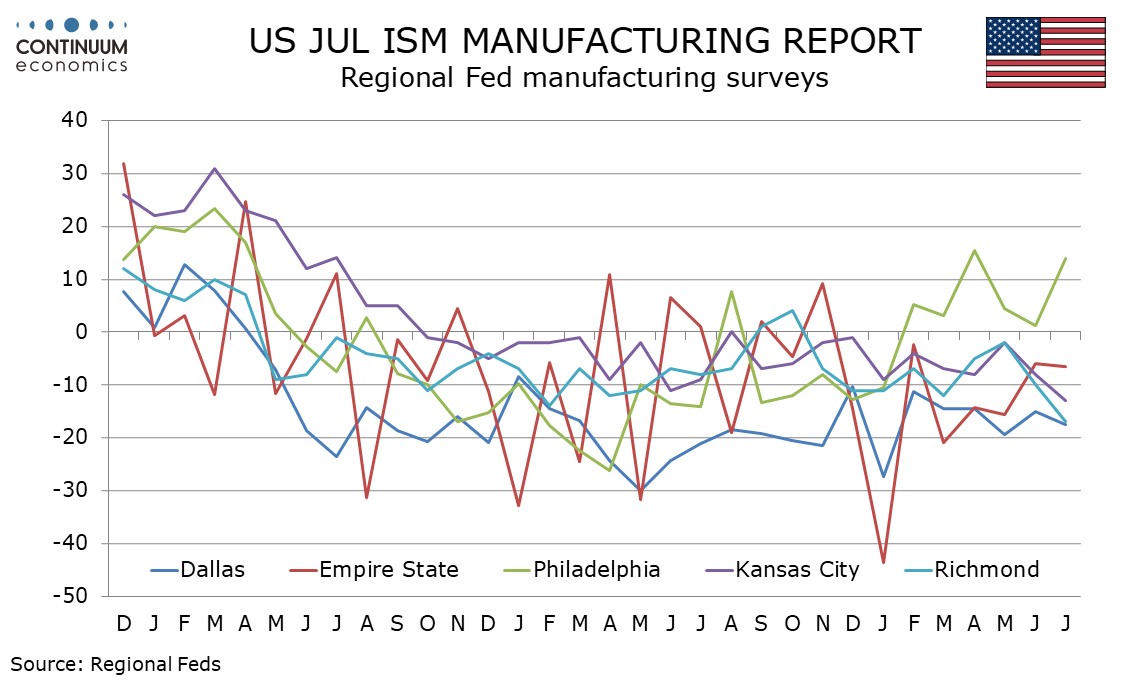

The Philly Fed’s manufacturing survey was increasingly positive in July but most other regional Fed surveys were unimpressive, generally slightly weaker and remaining below neutral, as was the Chicago PMI.

We expect the ISM detail to show improvements in production, employment and inventories, after June slowings, outweighing corrections lower in new orders and deliveries after June improvements. Prices paid do not contribute to the composite. Here we expect the index to correct marginally higher to 52.5 after June’s 52.1 produced the weakest reading since December.