GBP flows: GBP steady after UK labour market data

UK labour market data much as expected. GBP steady but risks still to the GBP downside

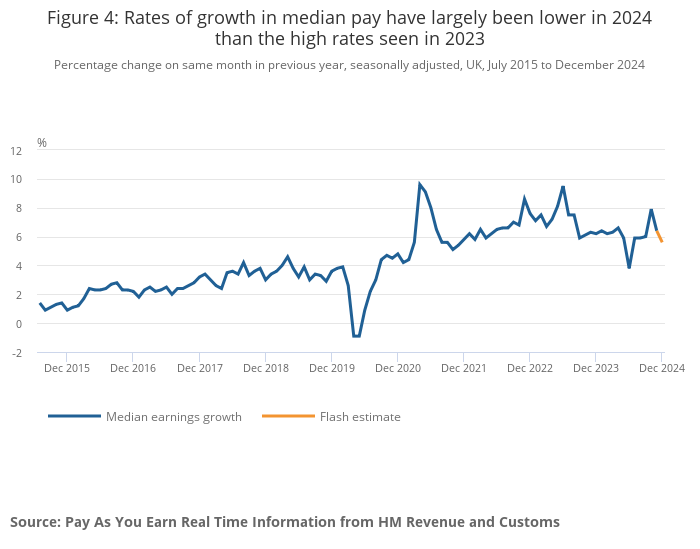

UK labour market data is broadly as expected. The ONS data showed average earnings growth rose to 5.6% y/y in the 3 months to November, from 5.2% in October, but the rise was in line with expectations and due to base effects rather than particular strength in November. The more up to data HMRC data on payrolled earning showed a decline in December to 5.6% y/y from 6.4% in November. Employment data was also as expected, showing a 35k rise in the 3 months to November, but the HMRC data are showing a weaker trend, with a December showing a 47k decline from November following a 32k decline in November.

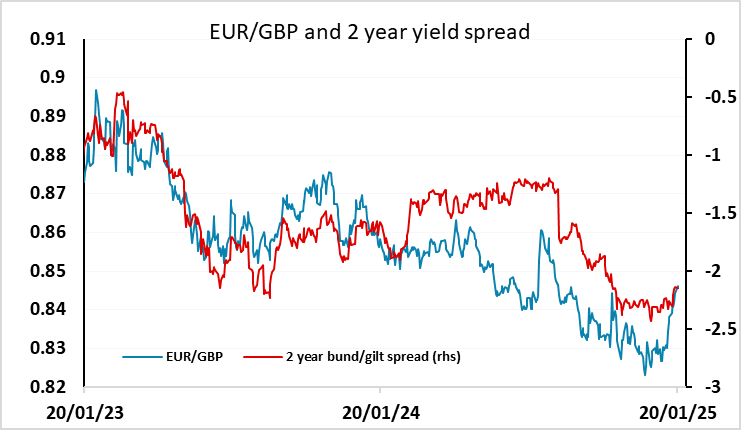

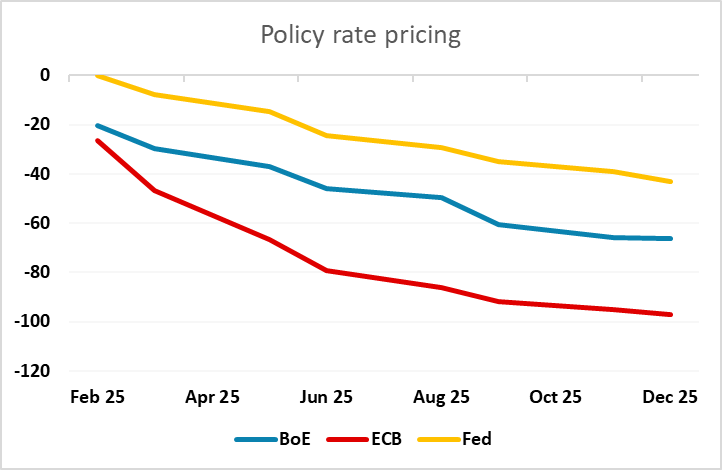

The data is unlikely to have much impact on market expectations for the February BoE decision, and GBP is not much changed in response to the data. A 25bp rate cut is currently priced as an 80% chance. There is still scope for the current pricing of the path of rate cuts over the year to change, as this only shows 66bps of cuts against the 97bps for the ECB (who are starting at a lower level). But this will likely have to wait for the MPC statement and Monetary Policy Report at the February meeting, which seems likely to suggests a steeper pace of rate cuts. In the meantime, EUR/GBP should hold in the mid-to-high 0.84s, but we still see upside risks over the medium term.