Preview: Due February 21 - U.S. February S&P PMIs - Manufacturing to rise further, Services to correct higher

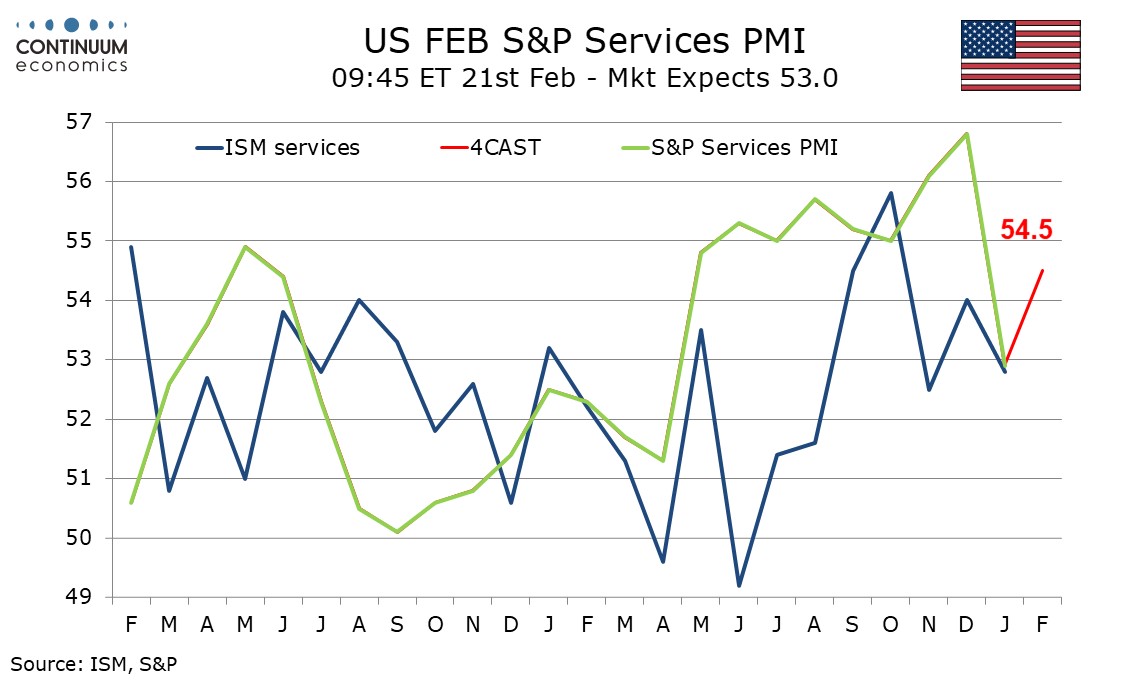

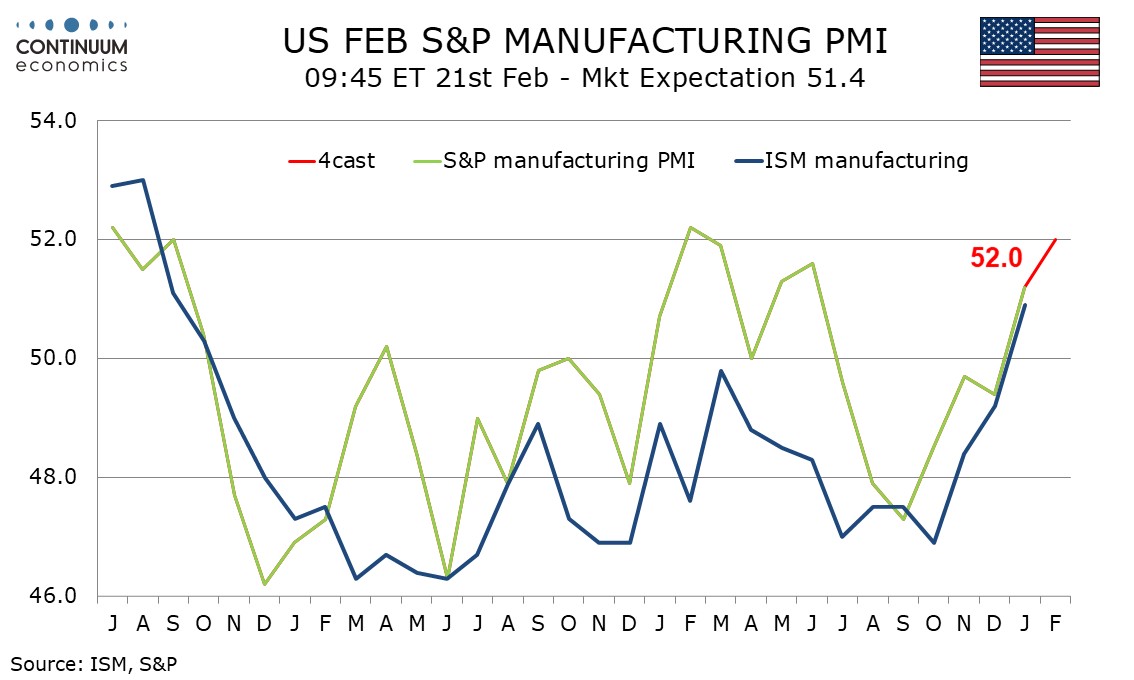

We expect February’s S and P PMIs to show a further rise in manufacturing, to a 12-month high of 52.0 from 51.2, and a correction higher in services to 54.5 from a 9-month low of 52.9.

The S and P manufacturing index moved above the neutral 50 in January for the first time since June 2024, a move that was backed by the ISM manufacturing index. Trade policy uncertainty is a potential negative, but a reprieve for Canada and Mexico from tariffs until March 1 will have come as a relief, for autos in particular. We note an upturn in early 2024 peaked in February. Early 2025 may prove similar. February's Empire Sate and Philly Fed surveys were both modestly positive, even if the former was up and the latter down from January.

The S and P service index saw a significant move below the positive preceding trend in January, which was backed by the ISM services index, but we believe most of the decline was due to bad weather. However, we do not expect a full reversal. Weather may still be a negative in February, if less so than January. More importantly, a pick-up in trend in mid-2024 was probably assisted by growing expectations for Fed easing. Fading expectations for Fed easing may act as a weight in upcoming data.