Preview: Due November 5 - U.S. October ISM Services - Seasonal adjustments to provide support

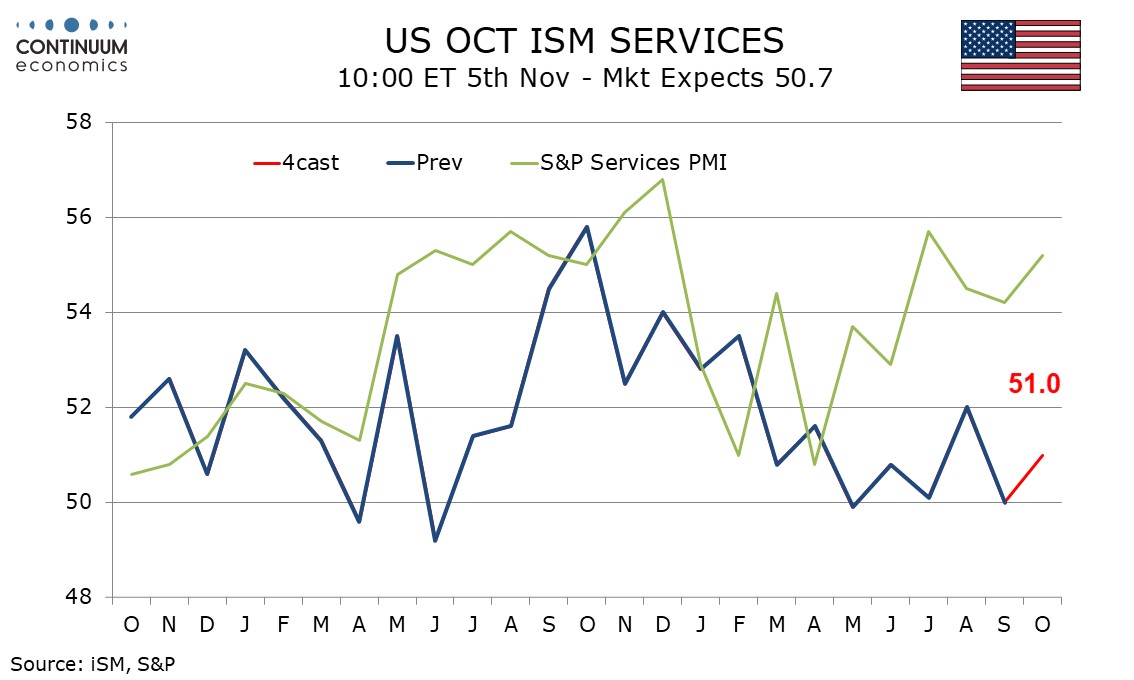

We expect October’s ISM services index to rise to 51.0 from 50.0, supported by seasonal adjustments. This would be in line with the Q3 average of 50.7 and the Q2 average of 50.8.

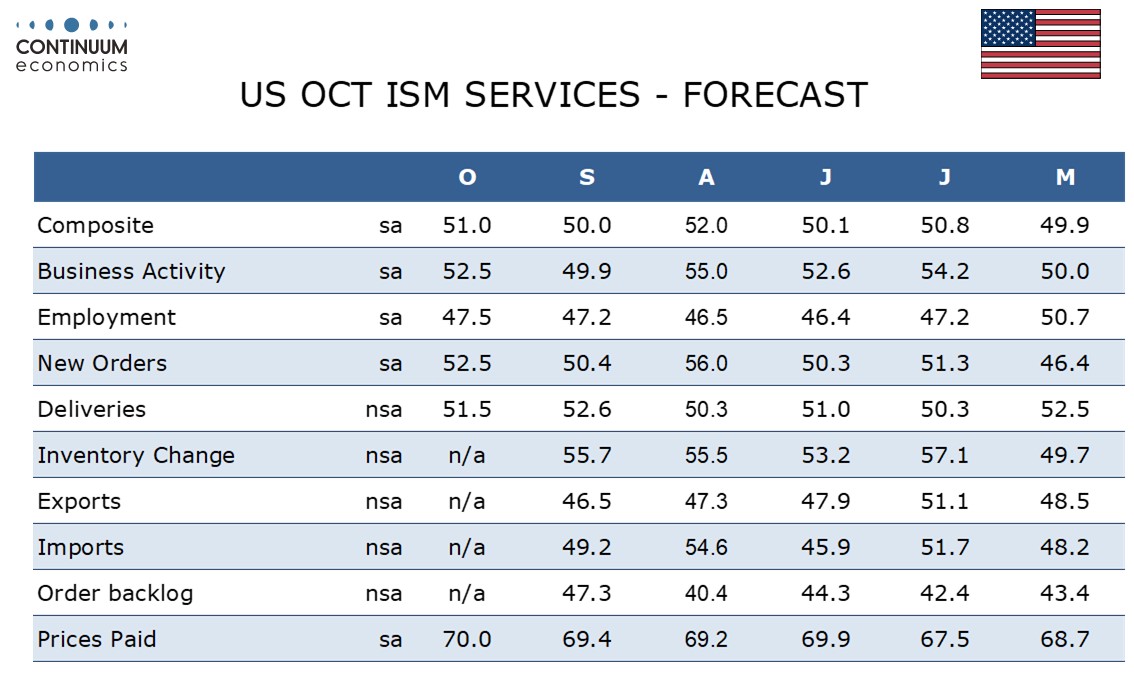

An August improvement to 52.0 from July’s near neutral 50.1 was assisted by more supportive seasonal adjustments and September’s dip to 50.0 was restrained by tougher seasonal adjustments. October’s seasonal adjustments are more supportive, particularly for new orders and business activity, where we expect October indices of 52.5 for each, up from 50.4 and 49.9 respectively. We expect employment t0 edge up to 47.5 from 47.2 but slippage in deliveries, which are not seasonally adjusted, to 51.5 from a stronger September reading of 52.6, completing the breakdown of the composite.

Prices paid do not contribute to the composite and here we expect a rise to 70.0 from 69.4, marginally exceeding the recent high of 69.9 set in July to reach the highest level since October 2022.

The ISM services index is not well correlated with the S and P services PMI which was quite strong at 55.2. Regional Fed service sector surveys are mostly soft, with the Empire State, Philly and Dallas Fed surveys increasingly negative, though the Kansas City Fed’s was less negative and the Richmond Fed’s slightly more positive.