JPY flows: JPY weaker on Takaichi appointment

JPY weaker on Takaichi PM appointment, but short JPY positioning is risky.

USD/JPY has gained strongly in early Europe in reaction to the appointment of Takaichi as the new Japanese PM. This should have been fairly well expected after the announcement of the link-up of the LDP and the Innovation Party yesterday, but USD/JPY has nevertheless risen half a figure in the official announcement.

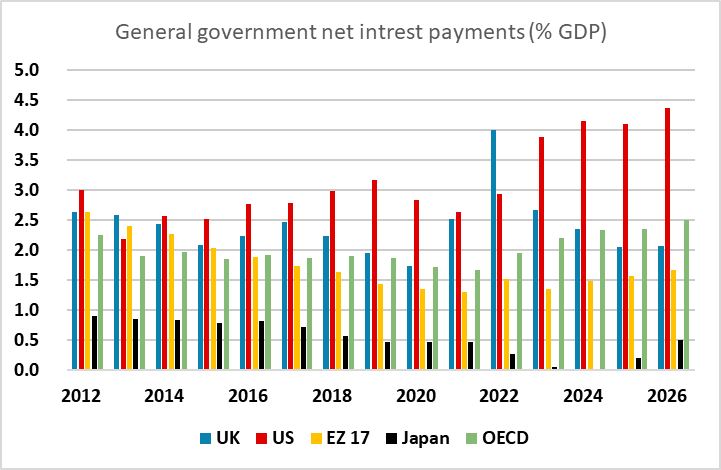

From a fundamental perspective, the case for a weaker JPY due to Takaichi becoming PM looks pretty flimsy. She is an adherent of Abenomics, which has led some to expect she will try for both easier fiscal and monetary policy. But whatever some believe, the BoJ is independent and an expansionary fiscal policy will likely lead to higher rather than lower Japanese yields. The other argument put forward for a weaker JPY is that the Japanese fiscal position will become unsustainable if fiscal policy is eased further. But while the level of government debt is very high, interest payments on the debt are very low, and are dwarfed by US and UK levels, so it will take a long time before these will become a problem, especially since Japan runs a big current account surplus and the debt is 88% domestically funded, with almost half owned by the BoJ.

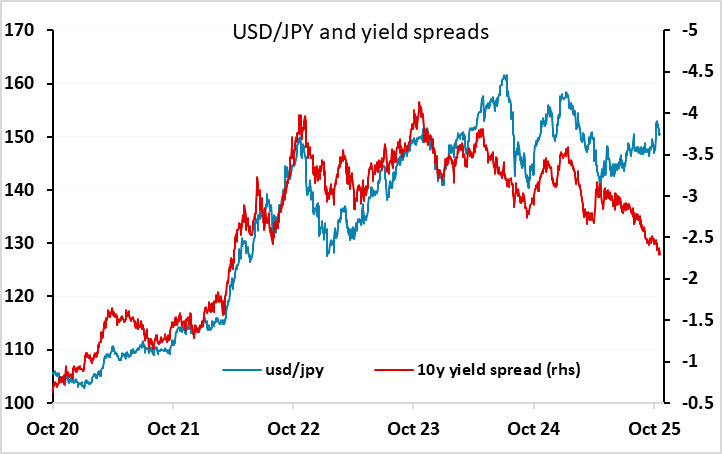

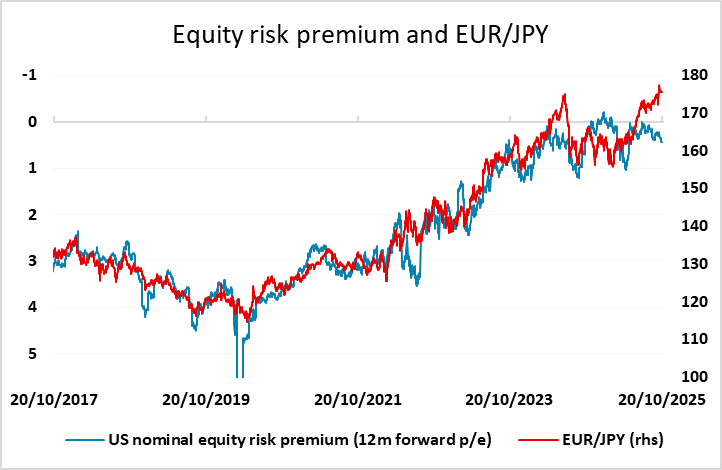

There have been some hawkish BoJ comments in recent days, and we would not rule out an October rate hike at the meeting on the 29th, even though this is only 20% priced in, so caution is required from JPY bears. Certainly, traditional relationships with yield spreads and risk premia suggest there is substantial upside risk for the JPY.