U.S. April ISM Manufacturing - Headlines provide some relief, but picture remains worrying

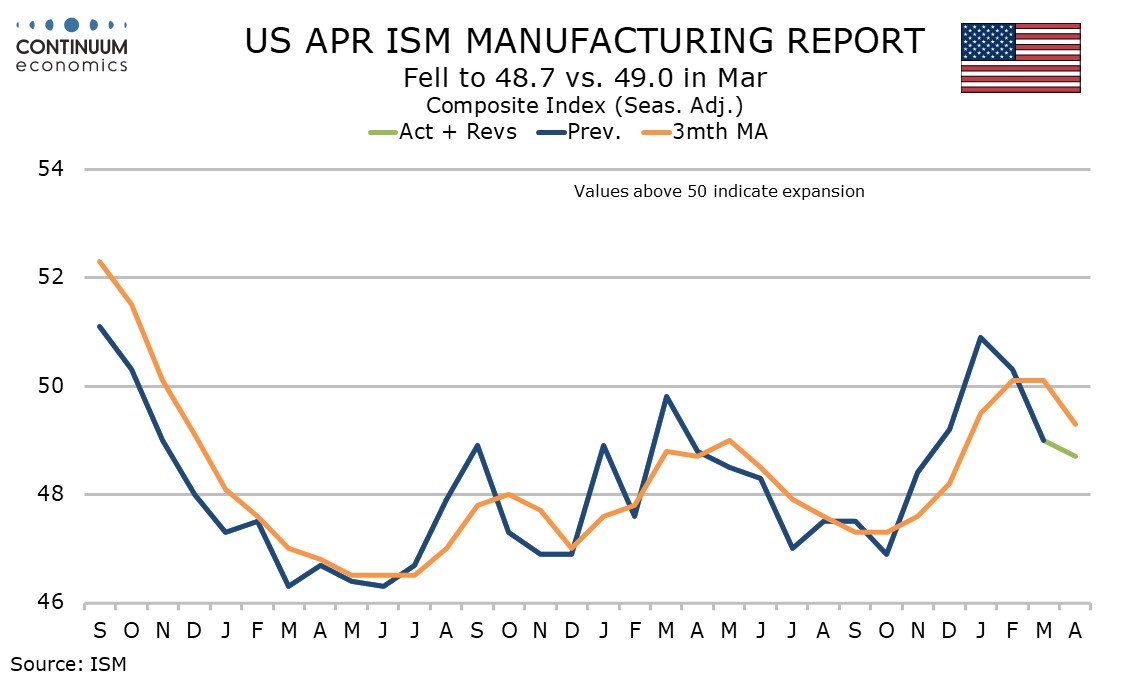

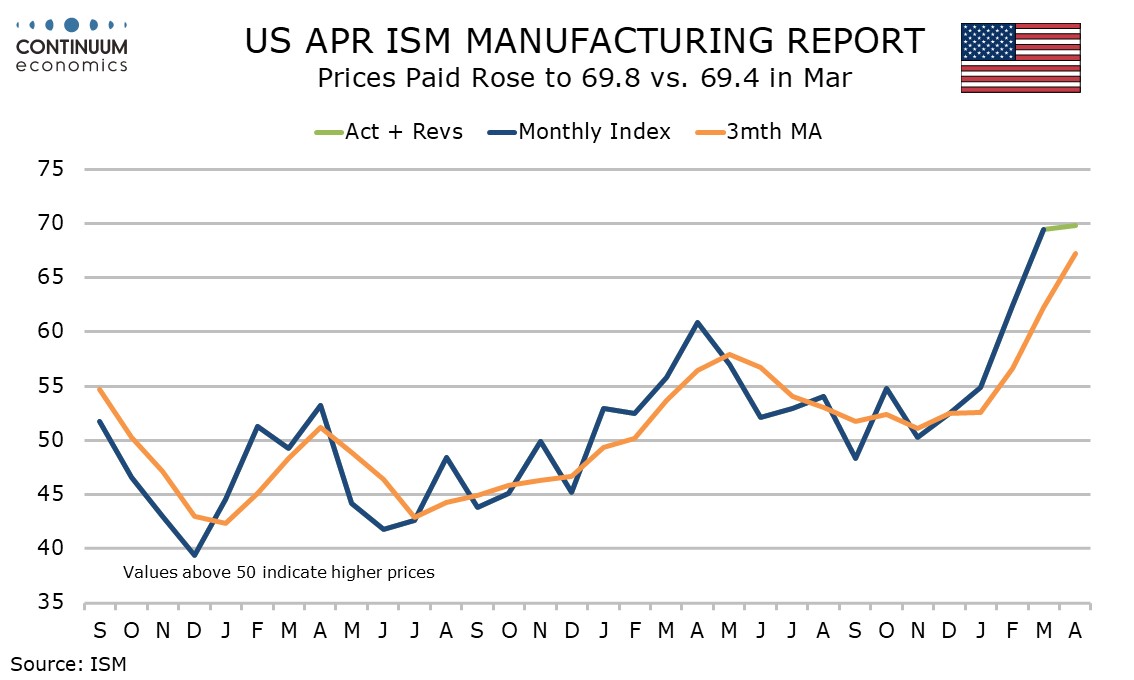

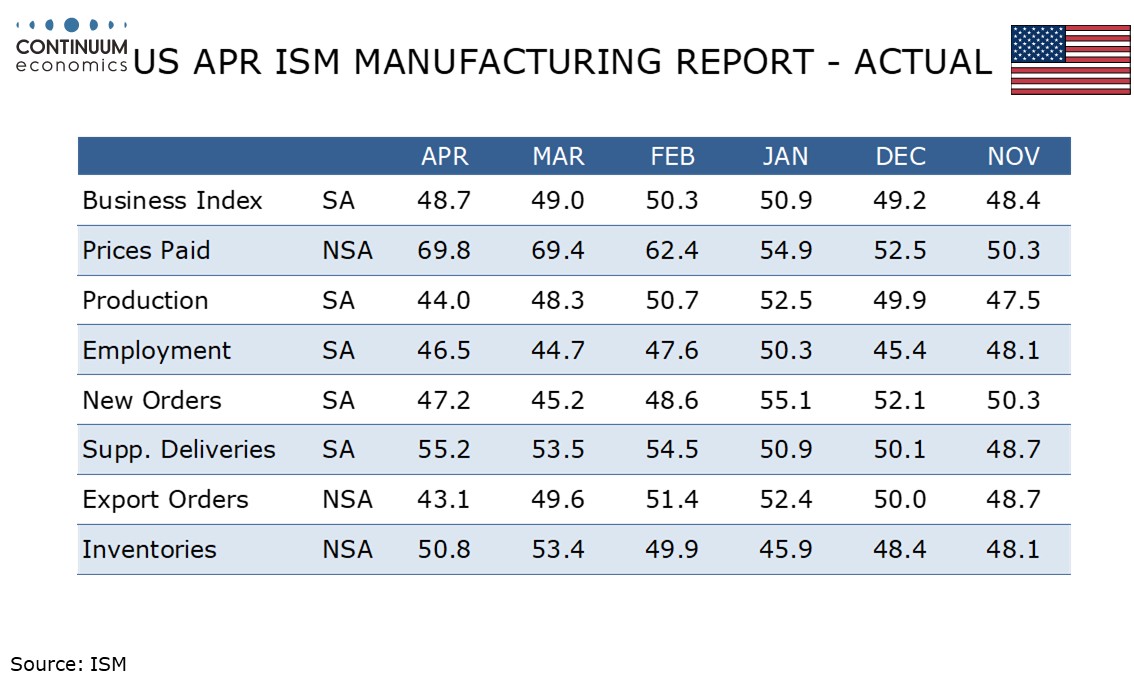

April’s ISM manufacturing index of 48.7 has held up better than expected, and most regional Fed surveys, falling only marginally from March’s 49.0. Prices paid have also shown less response to the increased tariffs than generally feared, with only a marginal gain to 69.8 from 69.4.

There has still been a slowing in activity and an acceleration of prices since January, when the overall index stood at 50.9 and prices paid stood at 54.9. Prices paid do not contribute to the composite. Weaker energy prices probably kept the April increase in prices paid modest.

Of the five components that make up the composite, three were improved while two were softer. New orders corrected to 47.2 from March’s very weak 45.2, and employment similarly corrected higher to 45.5 from 44.7. A rise in delivery times to 55.2 from 53.5 may however signal supply shortages and potential inflationary pressure.

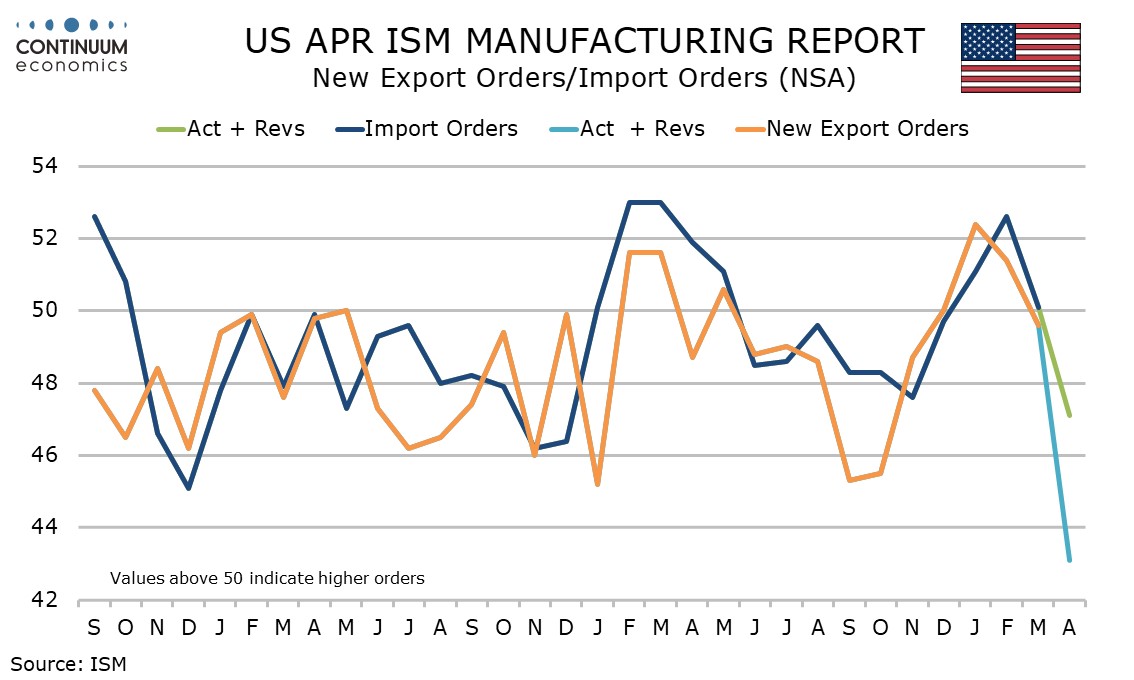

The production index of 44.0 from 48.3 is worryingly weak. The final components of the composite, inventories, slowed to 50.8 from 53.4 and may correspond to imports slowing to 47.1 after three straight months above 50.

While imports are correcting from what was clearly a temporary Q1 build, exports are looking even weaker, falling to a 43.1 from 49.6. Neither imports nor exports contribute to the composite. While there is some relief in the headlines, there are some causes for concern in the detail.