Some evidence of a subdued US labor market picture in October

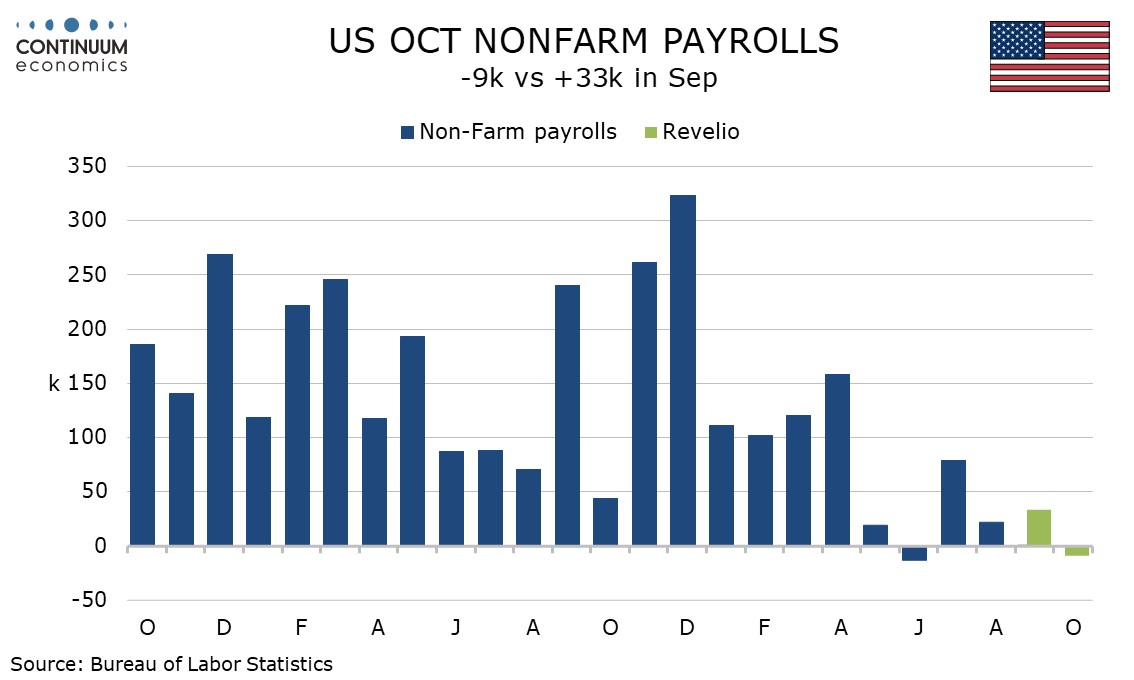

While October’s non-farm payroll will not be released as scheduled tomorrow with September’s still absent, we are seeing some labor market signals today. A non-farm payroll estimate from Reveilo Labs shows payrolls down by 9.1k in October after a 33k rise in September (revised down from 60.1k). Challenger, Gray and Christmas are reporting a rise in layoffs in October but the Chicago Fed is seeing only a marginal rise in unemployment.

Details in the Revelio Labs report show the largest negative coming from government at 22.2k, meaning private payrolls rate are seen up by 13.1k. The largest positive comes from education and health at 22k. This sector has tended to lead recent non-farm payroll gains. All other sectors moved by less than 10k in either direction, suggesting a picture of little change in the labor market. ADP data released yesterday is for private payrolls only, and rose by 42k after a 29k September loss. With Revelio Labs showing private payrolls up by 53.9k in September, it is outperforming ADP over the two months.

Monthly layoffs data from Challenger, Gray and Christmas shows 153,074 in October, up sharply from 55,727 in October 2024 and the highest for an October since 2003. Warehousing at 48k and tech at 33k led the way. Hiring announcements at 48,808 are well below the 266,743 seen in October 2024. Hiring announcements are usually high in September and October as the holiday season approaches but this year appears low by historical standards, suggesting a subdued holiday season is expected.

The Chicago Fed has estimated October unemployment at 4.36% from 4.35% in September. August’s official figure from the Labor Dep’t was 4.32%. This suggests the slowdown in hiring is slightly steeper than what can be explained solely by reduced labor supply as immigration falls.