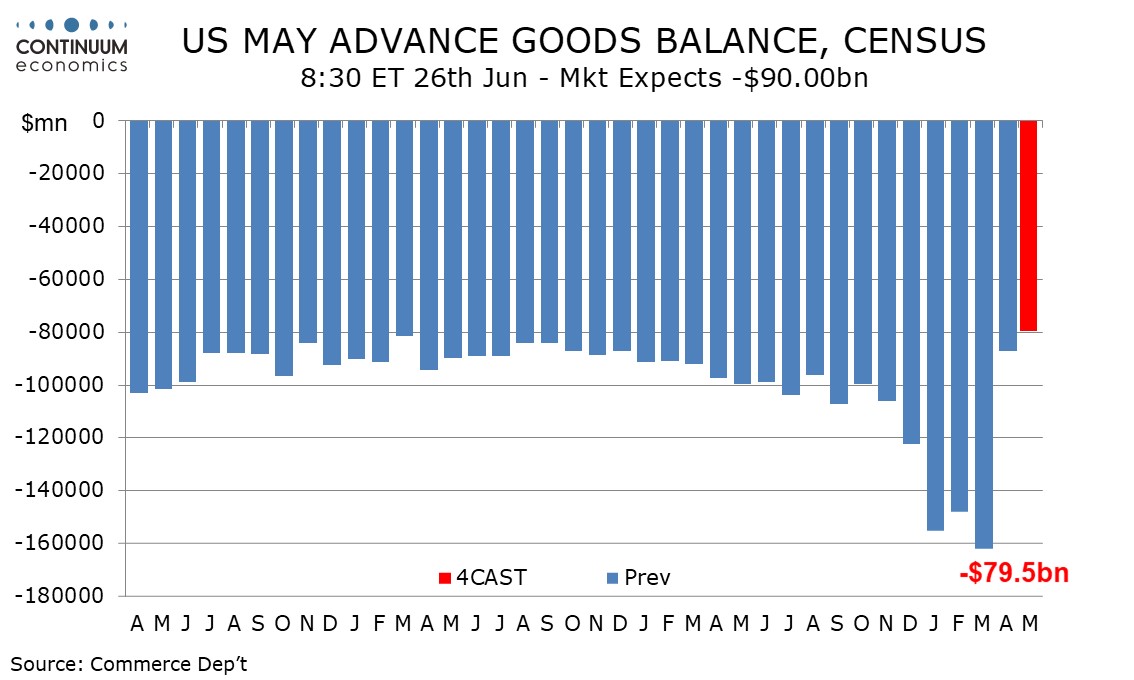

Preview: Due June 26 - U.S. May Advance Goods Trade Balance - Deficit to extend correction from March record

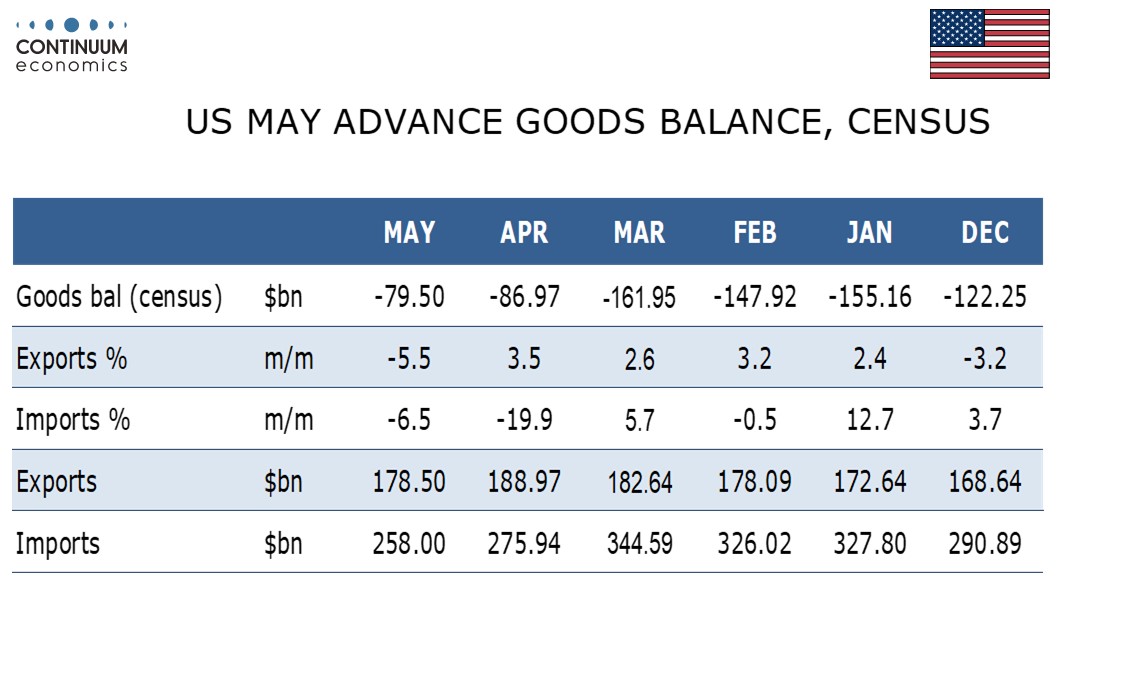

We expect May’s advance goods trade deficit to fall to $79.5bn from $87.0bn in April, extending the sharp correction from the record $162.0bn deficit seen in March as imports surged ahead of the April 2 tariff announcement.

We expect a 6.5% fall in imports after a 19.9% plunge in April, with the fall coming entirely on volumes with import prices unchanged in May. Imports will be further depressed by an escalation of tariffs with China with the reduction on May 12 likely to have not seen imports from China recovering until June. Chinese data showed exports to the US falling further in May.

We expect a 5.5% decline in exports with a 0.9% fall in May export prices adding to slippage in volumes. Exports did not pick up as sharply as imports ahead of the tariffs, but four straight gains show some acceleration ahead of potential retaliatory tariffs and a correction lower looks likely. Data from the Southern California ports shows weakness in both exports and imports in May.

A narrowing of the trade deficit will be supportive for Q2 GDP but advance retail and wholesale inventory data due at the same time should be watched for offsetting weakness.