U.S. October ISM Manufacturing - Still slightly negative, prices paid slowing

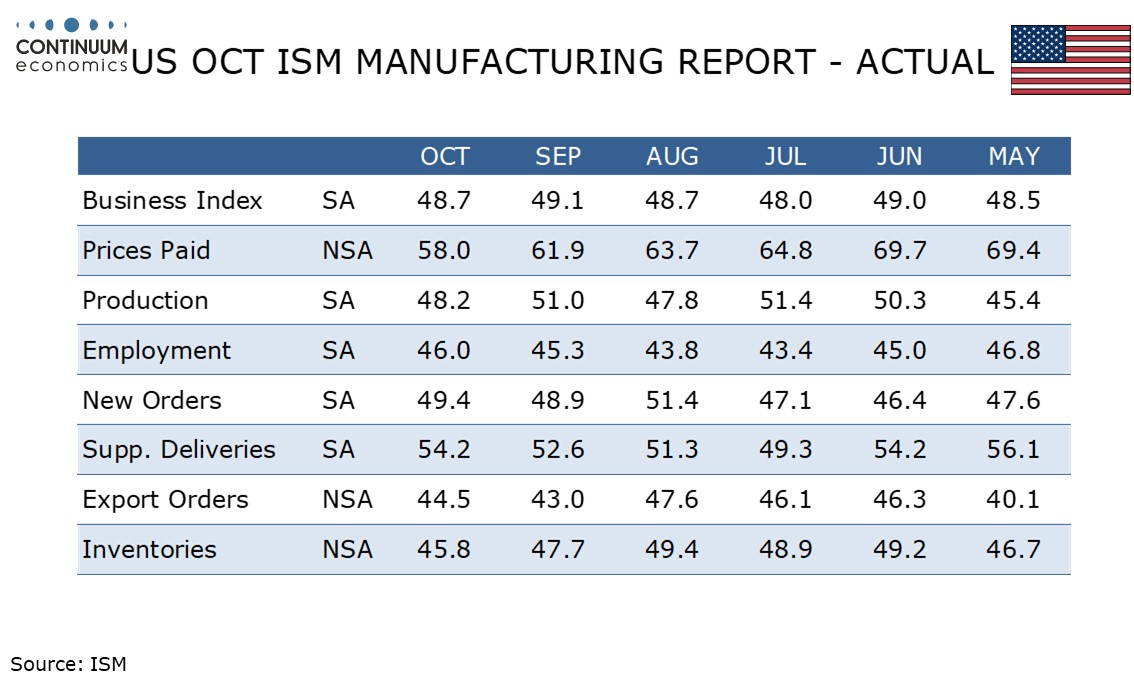

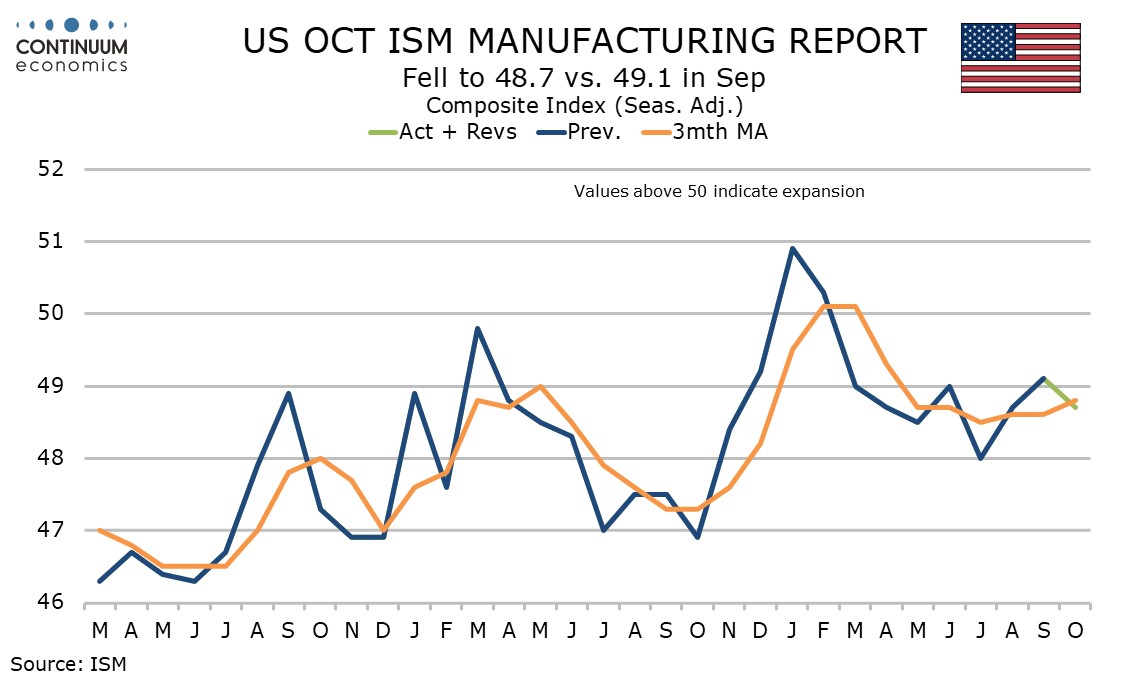

October’s ISM manufacturing index of 48.7 from 49.1 is weaker than S and P manufacturing PMI and the bulk of the reginal surveys had implied, and keeps the index is a tight range marginally short of neutral. Some of the tariff impact is fading, with prices paid and inventories slowing.

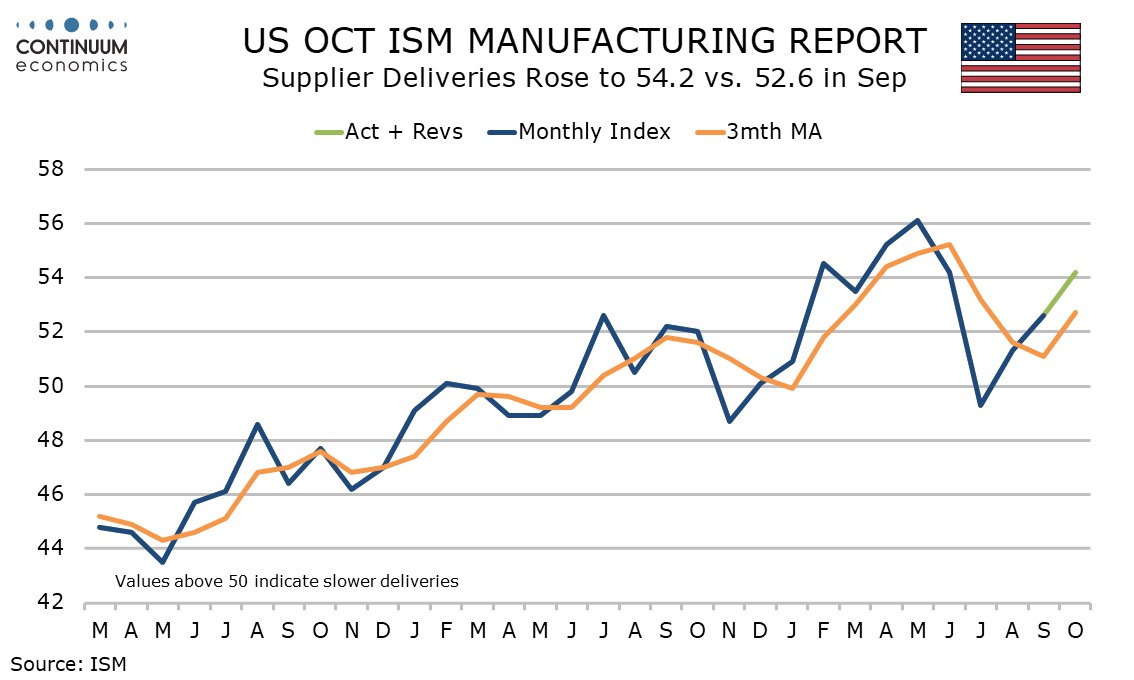

Details are generally negative, with only one of five components that make up the composite being positive, and that being delivery times at 54.2 from 52.6, which could hint at supply restraints.

New orders at 49.4 from 48.9 and employment at 46.0 from 45.3 are improved but still negative. Production was unable to sustain September’s move above neutral, falling to 48.2 from 51.0.

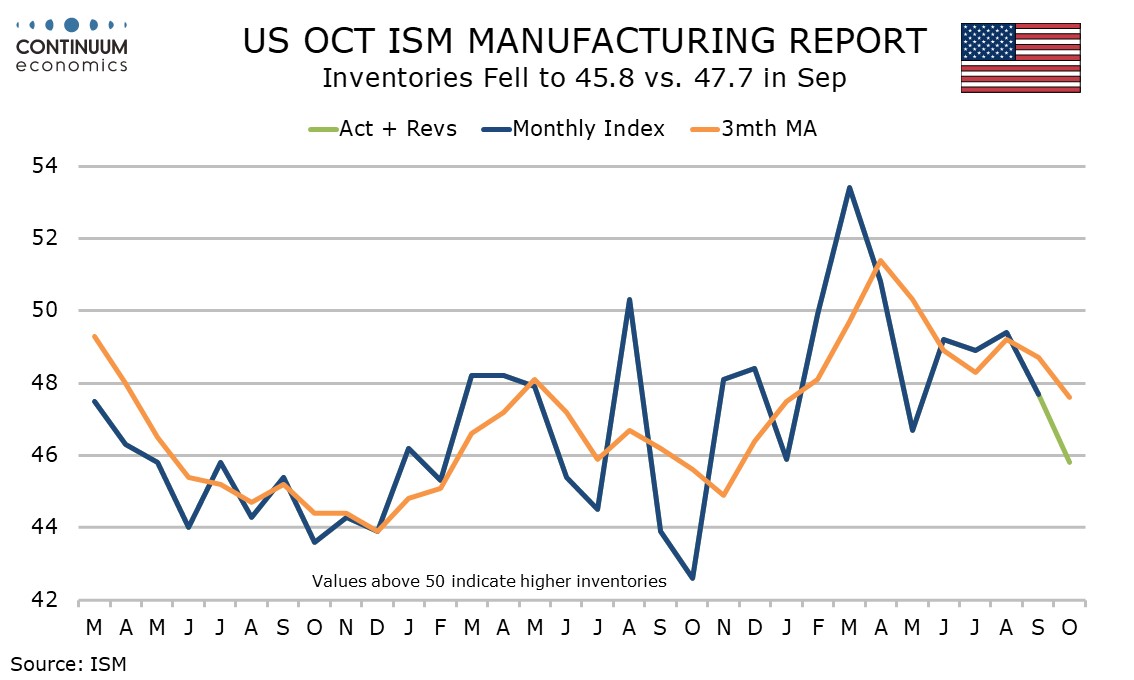

The final component of the composite is inventories, which fell to 45.8 from 48.7, reaching a 12-month low, suggesting the boost to inventories that came ahead of tariffs is now done.

Imports do not contribute to the composite but remain weak at 45.4, if up from 44.7. Exports are looking similar, at 44.5 from 43.0, weak despite the relatively moderate extent of retaliatory tariffs.

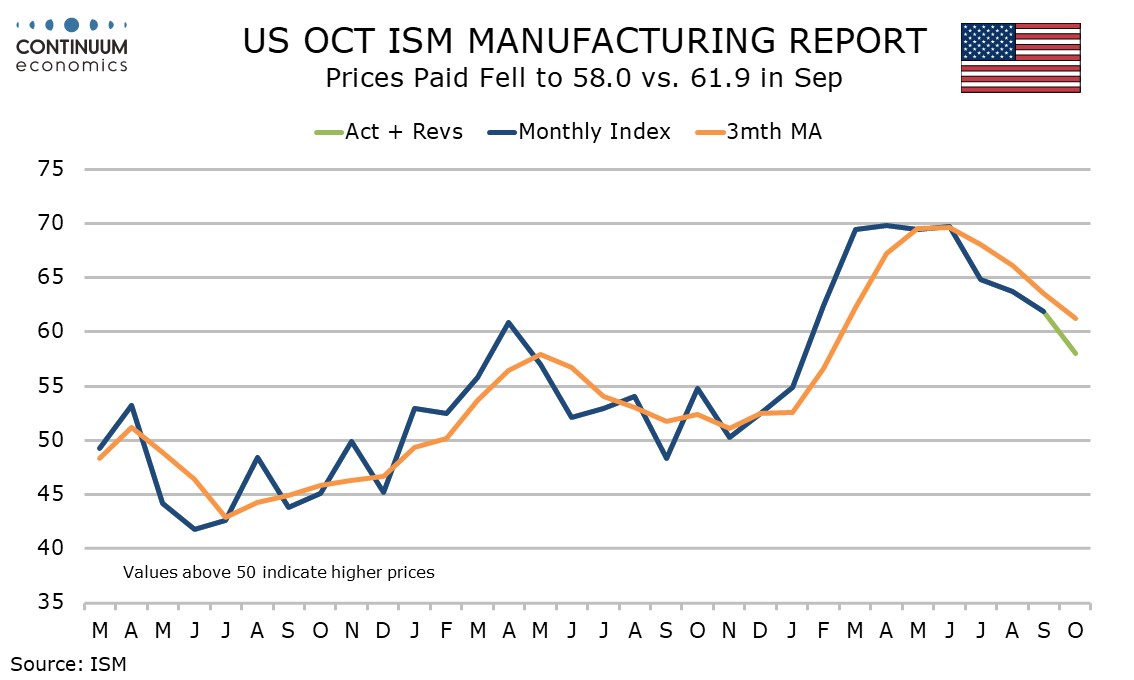

Prices paid also do not contribute to the composite but at 58.0 from 61.9 are the lowest since January, with the boost from tariffs that saw a peak of 69.8 in April now fading.