Brazil: Supply Factors Leading Export Growth

In 2023, Brazil's exports surged, initially driven by both supply and demand factors following the pandemic recovery. However, as the year progressed, demand began to overshadow supply influences. The main contributors were abundant agricultural production, particularly in soybeans, increased oil output from the Pre-salt area, and robust iron ore production. Looking ahead to 2024, sustaining this growth may be challenging due to diminished agricultural incentives, potential productivity constraints, and the need for new investments in oil and mining.

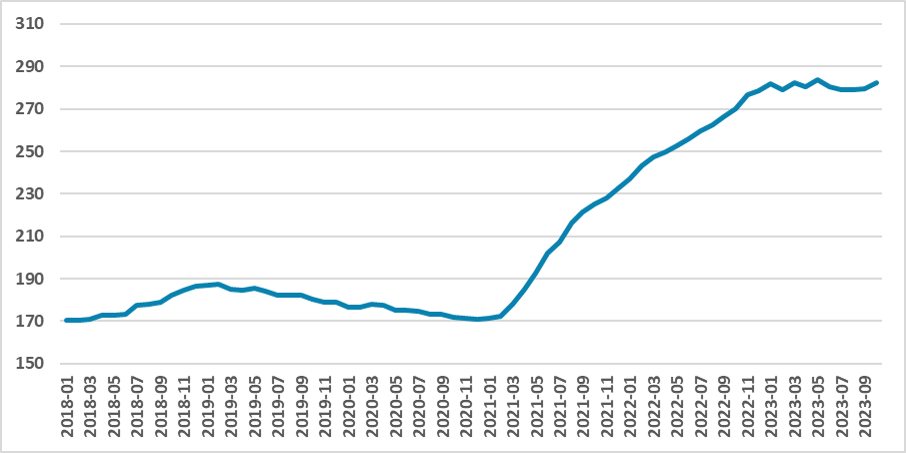

Figure 1: Brazil Exports (USD Bn)

Source: MDIC

Brazilian exports continued to grow robustly during 2023, despite a deceleration from 2022. The main reason for this slowdown is related to the effects of the pandemic. While 2021 still faced headwinds from the coronavirus, 2022 was the first year in which the economy started to be fully in motion, leading exports to grow around 50% at certain moments of the year. Once this effect passed, Brazilian exports started to grow on their own, leading to a new dynamic. We analyze what is behind the recent export growth in Brazil: demand or supply. To analyze that, we turn to ECO101. In case both prices and quantity are growing, demand effects are dominating supply ones, and in case prices grow while quantity diminishes, supply effects dominate demand.

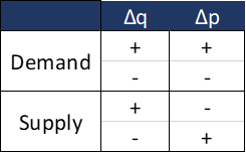

Figure 2: Supply and Demand

Source: Continuum Economics

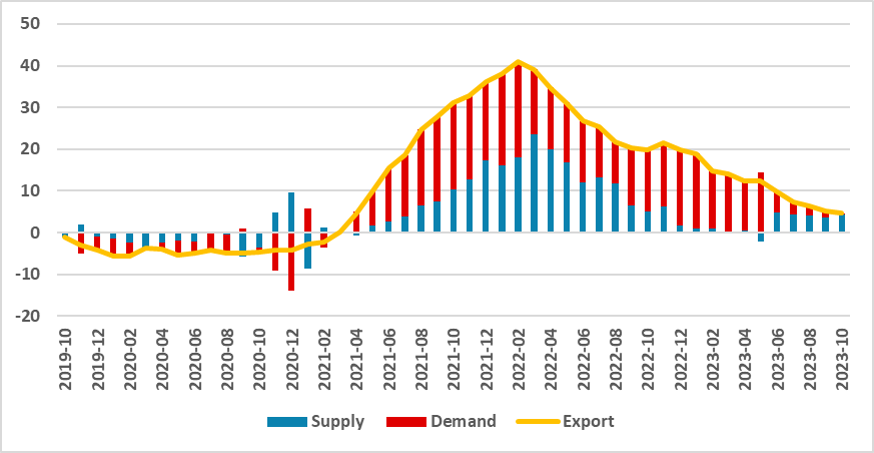

By looking at our results, it is interesting to note that during the recovery of 2022, supply and demand factors contributed to the strong rise of Brazilian exports. This is logical, as coronavirus restrictions waned, and both supply and demand grew during this period. However, once this recovery phase passed as we moved towards 2023, demand factors started to dominate supply ones.

Figure 3: Exports Growth Decomposition (%)

Source: Continuum Economics

Most of the Brazilian exports are concentrated in commodities, such as agricultural goods like soybeans, mining, such as iron ore, and oil. In all these classes, what predominated during 2023 were supply factors. First, on Agricultural goods, Brazil's soybean production reached one of the biggest harvests during 2023, contributing to this export growth. Also, lower soybean production by Argentina during this year contributed, although we see the big harvest as the main contributor. On oil, increased oil production from the Pre-salt area was determinant for this growth, while iron ore benefited from the strong production in the North of Brazil.

Moving forward, it is difficult to see this movement repeating in 2024. First, agricultural production will not have the same incentive to increase production again, as agricultural goods prices are not as high as in 2022, and the El Niño phenomenon could curtail grain productivity. On oil and mining, there is some indication that the country is reaching the maximum of its capacity, meaning new investments would be needed. Overall export growth is likely dependent on increasing demand in 2024.