Published: 2026-02-04T12:47:44.000Z

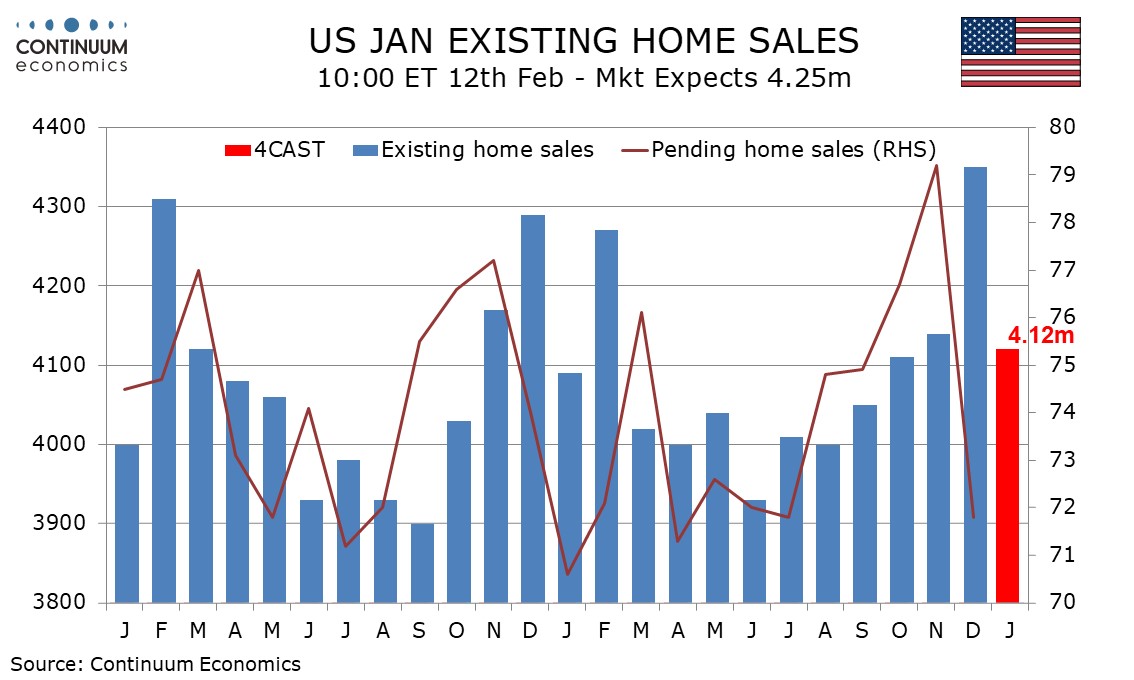

Preview: Due February 12 - U.S. January Existing Home Sales - Reversing a strong December gain

5

We expect January existing home sales to fall by 5.3% to 4.12m, more than fully erasing a 5.1% December increase. Pending home sales are signaling a sharp decline and bad weather late in the month is a further downside risk.

The most powerful signal for a sharp decline in existing home sales come from December pending home sales, which fully erased four straight gains. If matched by existing home sales that would imply a level similar to August’s 4.00m. However January’s NAHB index, while weaker, suggests a more moderate decline, and weekly MBA house purchase indices have generally held up well.

We expect sharper declines in the Northeast and South than the Midwest, which has seen less strength in recent months, and the West, which has been less impacted by bad weather. We expect a 1.5% decline in the median price on the month, though that will be largely seasonal. Yr/yr growth would then pick up to 1.5%, from 0.4% in December and 1.4% in November.