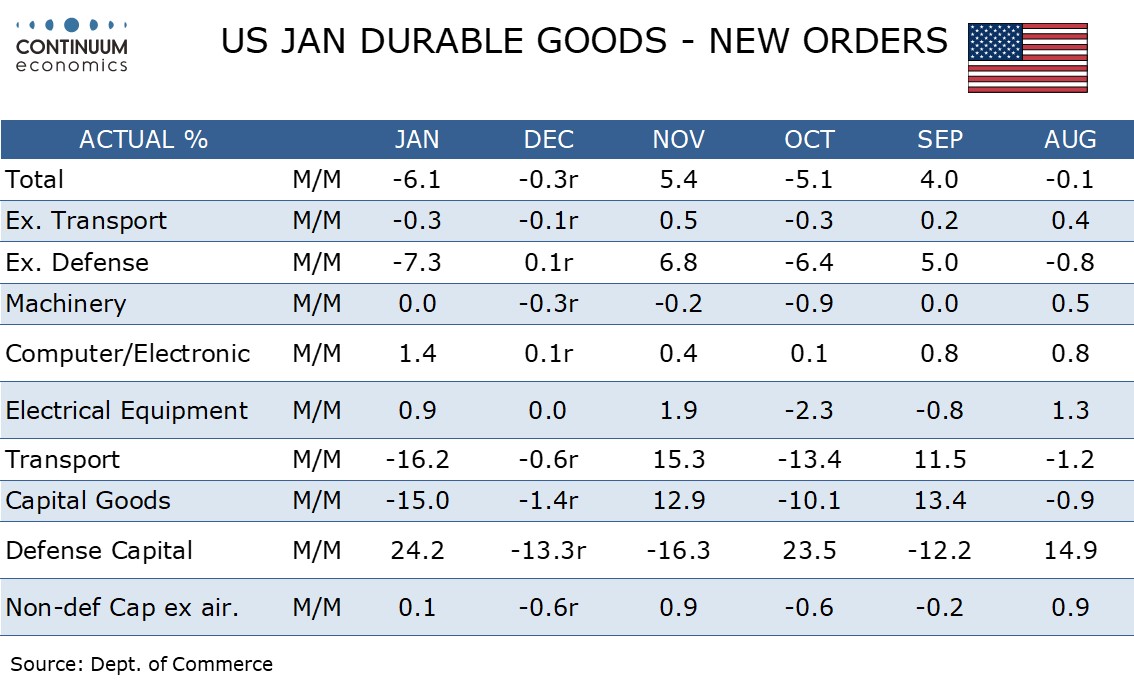

U.S. January Durable Goods Orders - Aircraft plunge, underlying trend near flat

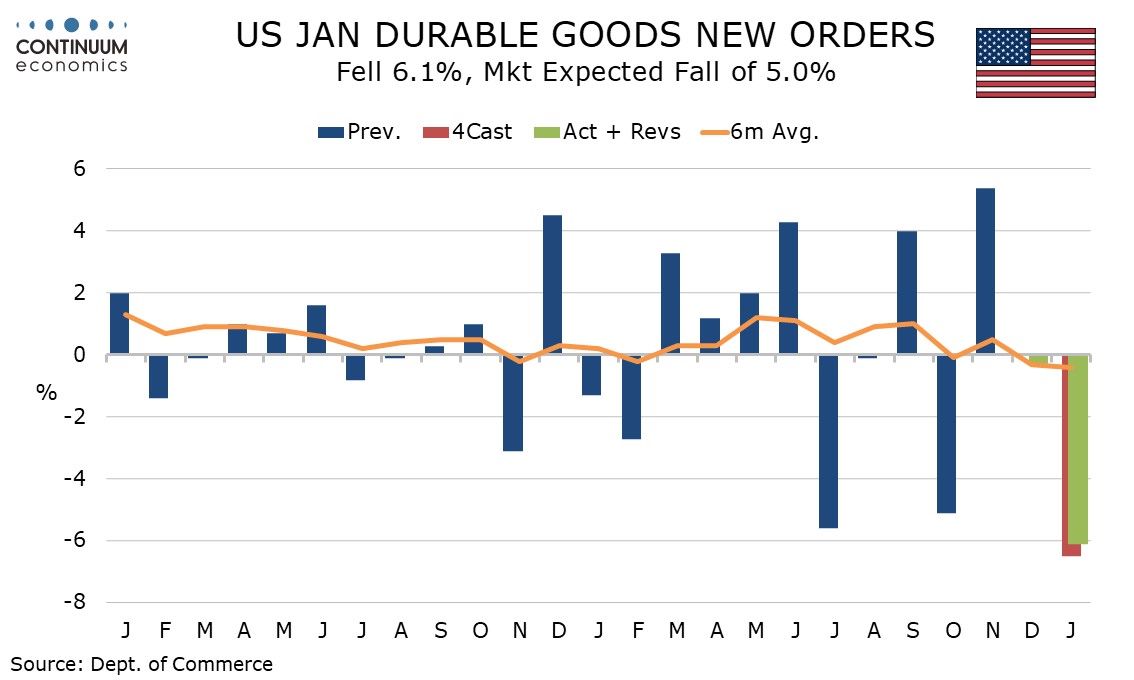

January durable goods orders have plunged by an even steeper than expected 6.1% with the fall fully explained by a plunge in aircraft from a strong December level, as had been signaled by Boeing data. Ex transport data is however on the weak side of expectations, with a fall of 0.3%, and with December now reporting a 0.1% decline rather than a 0.5% increase.

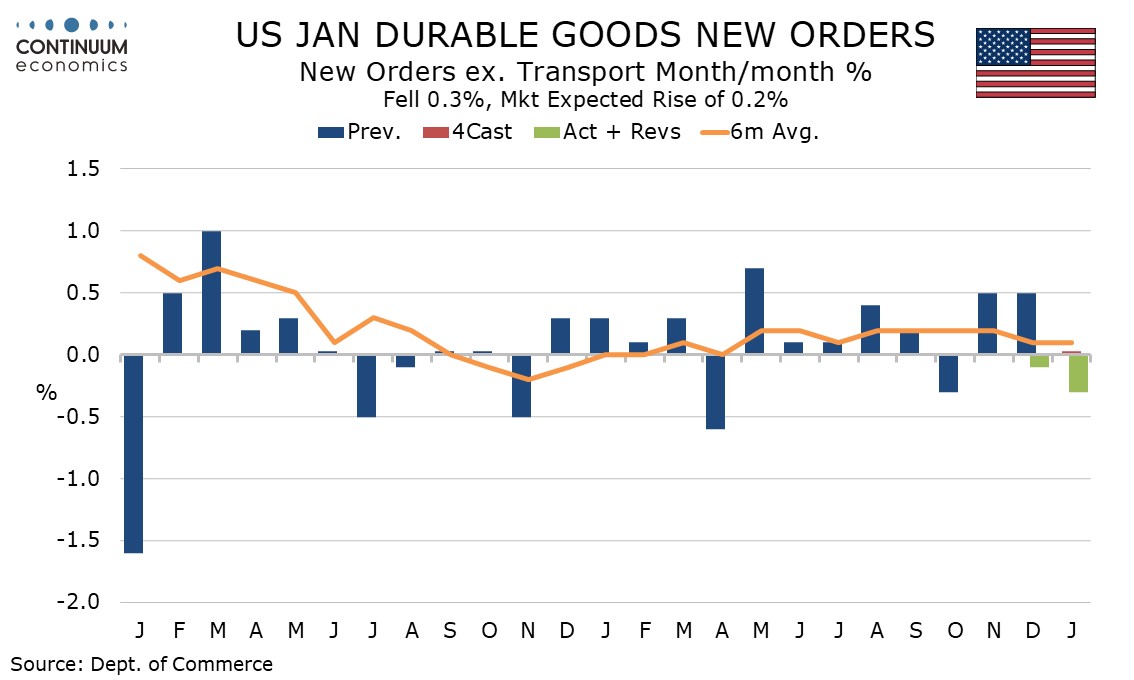

The ex-transport data comes as a contrast to improvement in January’s ISM new orders index, but is consistent with weak manufacturing data in January’s industrial production report. Trend ex transport is fairly flat if marginally positive with no moves reaching 1.0% in either direction since March 2022.

Problems at Boeing may keep aircraft weak for a few months. Auto orders saw a modest 0.4% decline but defense capital which has a strong overlap with transport saw a 24.2% increase to correct two straight declines. Orders ex defense plunged by 7.3%.

Non-defense capital orders ex aircraft, a key signal for business investment, increased by a marginal 0.1% but shipments in the sector rise by 0.8% and that is supportive for GDP. Inventories rose by 0.2%, which is fairly neutral for GDP.