EUR flows: Mild recovery after ECB

ECB statement slightly more upbeat after leaving rates unchanged but little EUR reaction

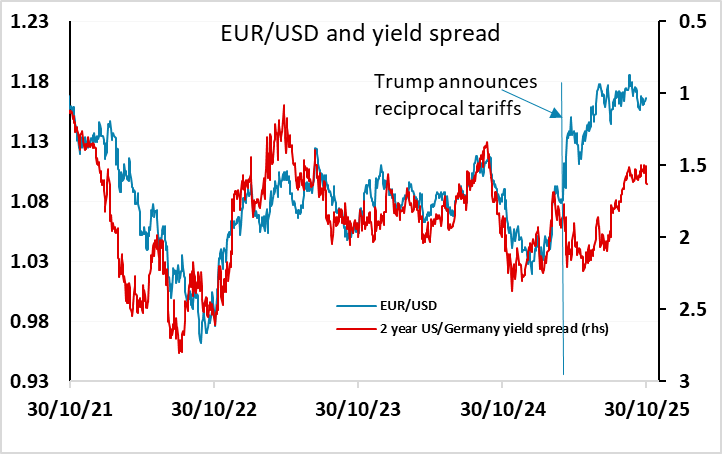

The EUR is modestly firmer after a slightly more upbeat ECB statement following their unchanged policy decision, although it remains lower on the day with the USD generally firming in early North American trading. Indeed, the EUR/USD recovery looks more like a USD correction, as the EUR isn’t much changed on the European crosses. The ECB said “The robust labour market, solid private sector balance sheets and the Governing Council’s past interest rate cuts remain important sources of resilience. However, the outlook is still uncertain, owing particularly to ongoing global trade disputes and geopolitical tensions”. There is no real prospect of any change in the policy rate in the next few meetings unless we see a significant shock. There is still some case for EUR/USD to fall back towards its historic relationship with yield spreads that broke back in April, as many other pairs have converged towards these yield spread indictors, and for now the pressure looks to be on the downside of the recent range in the mid-1.15s.