GBP flows: GBP extends gains after strong GDP

May GDP stronger than expected, GBP closign in on year's highs against the EUR.

Much stronger than expected UK GDP in May, rising 0.4% m/m, has pushed GBP higher across the board, with EUR/GBP threatening the lows of the year below 0.84. The stronger outcome was due to services, which rose 0.3% against a market consensus of 0.2%, and construction, which showed a very large rise of 1.9% m/m. However, industrial production was slightly weaker than expected at 0.2% and there were downward revisions to past data. The trade deficit was also larger than expected at GBP17.9bn.

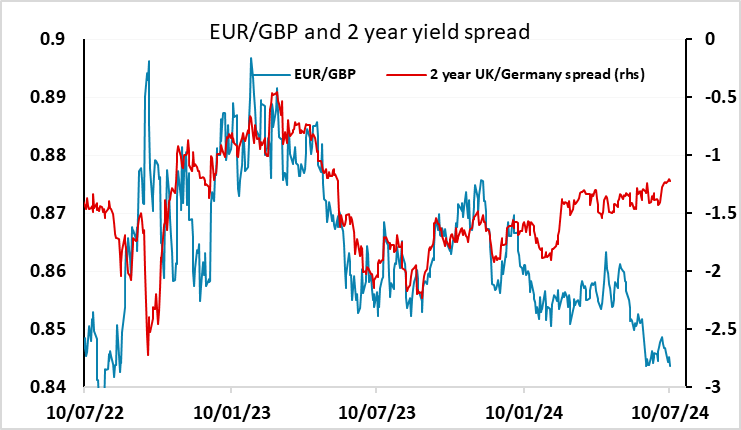

While GBP has benefited from the data, the gains have been quite modest with the big move lower in EUR/GBP coming after the Pill speech yesterday. While the FX market saw this as being on the hawkish side, there was no significant reaction in front end UK yields, and spreads are still suggesting the EUR/GB move lower is overdone. But today’s data provides some belated justification for yesterday’s move, and may see UK yields move up this morning. Even so, a break below the 0.84 level may prove difficult in the short term until or unless we have a clearer view of the prospects for the August MPC, which the market is still currently pricing as presenting a 50-50 chance of a rate cut.